Sallie Mae 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Goodwill and Intangible Assets

In determining annually (or more frequently if required) whether goodwill is impaired, we first assess

qualitative factors to determine whether it is “more-likely-than-not” that the fair value of a reporting unit, which

is the same as or one level below a business segment, is less than its carrying amount as a basis for determining

whether it is necessary to perform additional goodwill impairment testing. The “more-likely-than-not” threshold

is defined as having a likelihood of more than 50 percent. If this “more-likely-than-not” threshold is met, then we

will complete a quantitative goodwill impairment analysis which consists of a comparison of the fair value of the

reporting unit to our carrying value, including goodwill. If the carrying value of the reporting unit exceeds the

fair value, a goodwill impairment analysis will be performed to measure the amount of impairment loss, if any. If

we determine that this event has occurred, we perform an analysis to determine the fair value of the business unit.

There are significant judgments involved in determining the fair value of a business unit, including assumptions

regarding estimates of future cash flows from existing and new business activities, customer relationships, the

value of existing customer contracts, the value of other tangible and intangible assets, as well as assumptions

regarding what we believe a third party would be willing to pay for all of the assets and liabilities of the business

unit. This calculation requires us to estimate the appropriate discount and growth rates to apply to those projected

cash flows and the appropriate control premium to apply to arrive at the final fair value. The business units for

which we must estimate the fair value are not publicly traded and often there is not comparable market data

available for that individual business to aid in its valuation. We use a third party appraisal firm to provide an

opinion on the fair values we conclude upon.

Risk Management

Our Approach

The products, services and markets in which we operate, as well as the various regulatory authorities and

regimes to which our businesses, financial condition and lending practices are subject, continue to undergo

dramatic change. We recognize that to maintain our reputation with customers and protect the interests of our

shareholders and other key constituencies we must continually refresh our understanding of each of our business

models, identify and manage the risks related to each of these businesses. Risk management, assessment and

oversight responsibilities exist and are documented, reviewed and coordinated at various levels of the Company.

Risk Oversight

Our Board of Directors and its standing committees oversee our overall strategic direction, including setting

our risk management philosophy, tolerance and parameters; and establishing procedures for assessing the risks

our businesses face as well as the risk management practices our management team develop and utilize. We

escalate to our Board of Directors any significant departures from established tolerances and parameters and

review new and emerging risks.

In 2011, our Board of Directors invested significant time and effort in continuing to consider and address

changes in our risk profile resulting from the end of FFELP in 2010. Particular attention was paid to the strategic

redirection of our businesses into consumer lending products and various strategies for expanding our business

services opportunities. The format of our strategic business plan, key performance measures and related risk

tolerances and parameters and escalation procedures were revised accordingly. Our Board of Directors also

directed our Legal, Compliance and Internal Audit groups to work with management and the Board to review and

report on the state of existing Board and management risk practices and procedures and to undertake such

improvements as the Board of Directors or its committees may direct.

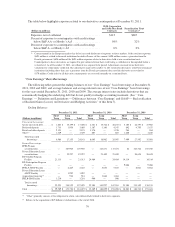

The standing committees of our Board of Directors and their current risk oversight portfolios are as follows:

Executive Committee — has full authority of our Board of Directors to take action when the Board is not

in session and includes all board committee chairs, lead outside director, Chief Executive Officer (“CEO”) and

85