Sallie Mae 2011 Annual Report Download - page 178

Download and view the complete annual report

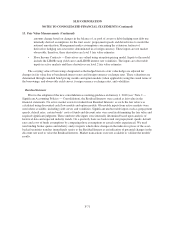

Please find page 178 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

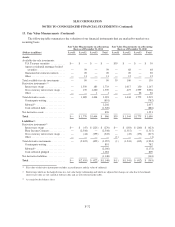

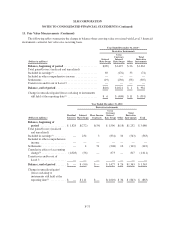

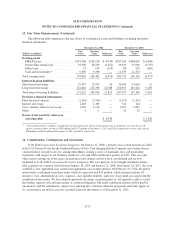

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

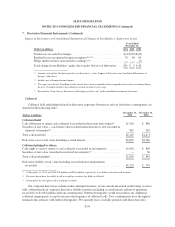

13. Fair Value Measurements

We use estimates of fair value in applying various accounting standards for our financial statements.

We categorize our fair value estimates based on a hierarchical framework associated with three levels of

price transparency utilized in measuring financial instruments at fair value. For additional information regarding

our policies for determining fair value and the hierarchical framework, see “Note 2 — Significant Accounting

Policies — Fair Value Measurement.”

During the year ended December 31, 2011, there were no significant transfers of financial instruments

between levels.

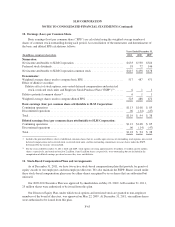

Student Loans

Our FFELP Loans and Private Education Loans are accounted for at cost or at the lower of cost or market if

the loan is held-for-sale. FFELP Loans classified as held-for-sale are those which we have the ability and intent

to sell under various ED loan purchase programs. In these instances, the FFELP Loans are valued using the

committed sales price under the programs. For all other FFELP Loans and Private Education Loans, fair values

were determined by modeling loan cash flows using stated terms of the assets and internally-developed

assumptions to determine aggregate portfolio yield, net present value and average life. The significant

assumptions used to determine fair value are prepayment speeds, default rates, cost of funds, required return on

equity, and expected Repayment Borrower Benefits to be earned. In addition, the Floor Income component of our

FFELP Loan portfolio is valued with option models using both observable market inputs and internally

developed inputs. A number of significant inputs into the models are internally derived and not observable to

market participants. Certain model assumptions were calibrated based upon pricing information related to our

acquisition of the Student Loan Corporation FFELP trusts on December 31, 2010.

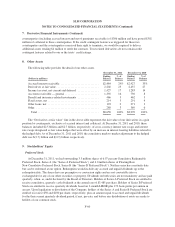

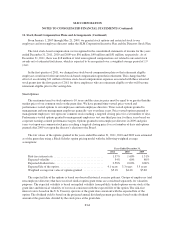

Cash and Investments (Including “Restricted Cash and Investments”)

Cash and cash equivalents are carried at cost. Carrying value approximated fair value for disclosure

purposes. Investments classified as trading or available-for-sale are carried at fair value in the financial

statements. Investments in U.S. Treasury securities consisted of Treasury bills that trade in active markets. The

fair value was determined using observable market prices. Investments in mortgage-backed securities are valued

using observable market prices. These securities are primarily collateralized by real estate properties in Utah and

are guaranteed by either a government sponsored enterprise or the U.S. government. Other investments

(primarily municipal bonds) for which observable prices from active markets are not available were valued

through standard bond pricing models using observable market yield curves adjusted for credit and liquidity

spreads. These valuations are immaterial to the overall investment portfolio. The fair value of investments in

commercial paper, asset-backed commercial paper, or demand deposits that have a remaining term of less than

90 days when purchased are estimated at cost and, when needed, adjustments for liquidity and credit spreads are

made depending on market conditions and counterparty credit risks. No additional adjustments were deemed

necessary.

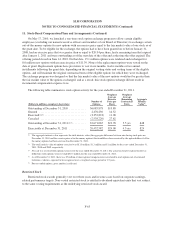

Borrowings

Borrowings are accounted for at cost in the financial statements except when denominated in a foreign

currency or when designated as the hedged item in a fair value hedge relationship. When the hedged risk is the

benchmark interest rate and not full fair value, the cost basis is adjusted for changes in value due to benchmark

interest rates only. Foreign currency-denominated borrowings are re-measured at current spot rates in the

financial statements. The full fair value of all borrowings is disclosed. Fair value was determined through

F-69