Sallie Mae 2011 Annual Report Download - page 80

Download and view the complete annual report

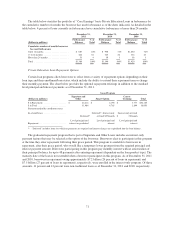

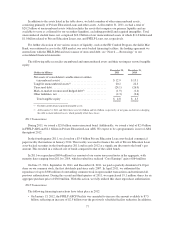

Please find page 80 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the amendment extends the final maturity date by one year to January 9, 2015 and increases the amount

available at future step-down dates.

• On January 19, 2012, we issued $765 million of FFELP ABS.

• On January 27, 2012, we issued a two-part $1.5 billion senior unsecured bond. $750 million has a five-

year term, the remaining $750 million has a ten-year term.

• On February 9, 2012, we issued $547 million of Private Education Loan ABS.

In addition, on January 26, 2012, we increased our quarterly dividend on our common stock to $0.125 per

share. The next such quarterly dividend will be paid on March 16, 2012. We also authorized the repurchase of up

to $500 million of outstanding common stock.

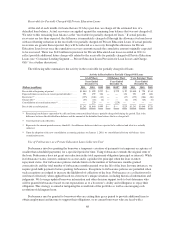

Counterparty Exposure

Counterparty exposure related to financial instruments arises from the risk that a lending, investment or

derivative counterparty will not be able to meet its obligations to us. Risks associated with our lending portfolio

are discussed in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of

Operations — Financial Condition — FFELP Loan Portfolio Performance” and “— Consumer Lending Portfolio

Performance.”

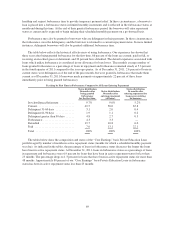

Our investment portfolio is composed of very short-term securities issued by a diversified group of highly

rated issuers limiting our counterparty exposure. Additionally, our investing activity is governed by Board

approved limits on the amount that is allowed to be invested with any one issuer based on the credit rating of the

issuer, further minimizing our counterparty exposure. Counterparty credit risk is considered when valuing

investments and considering impairment.

Related to derivative transactions, protection against counterparty risk is generally provided by International

Swaps and Derivatives Association, Inc. (“ISDA”) Credit Support Annexes (“CSAs”). CSAs require a

counterparty to post collateral if a potential default would expose the other party to a loss. All derivative

contracts entered into by SLM Corporation and the Bank are covered under such agreements and require

collateral to be exchanged based on the net fair value of derivatives with each counterparty. Our securitization

trusts require collateral in all cases if the counterparty’s credit rating is withdrawn or downgraded below a certain

level. Additionally, securitizations involving foreign currency notes issued after November 2005 also require the

counterparty to post collateral to the trust based on the fair value of the derivative, regardless of credit rating. The

trusts are not required to post collateral to the counterparties. In all cases, our exposure is limited to the value of

the derivative contracts in a gain position net of any collateral we are holding. We consider counterparties’ credit

risk when determining the fair value of derivative positions on our exposure net of collateral.

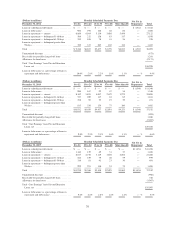

We have liquidity exposure related to collateral movements between us and our derivative counterparties.

Movements in the value of the derivatives, which are primarily affected by changes in interest rate and foreign

exchange rates, may require us to return cash collateral held or may require us to access primary liquidity to post

collateral to counterparties. If our credit ratings are downgraded from current levels, we may be required to

segregate additional unrestricted cash collateral into restricted accounts.

78