Sallie Mae 2011 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

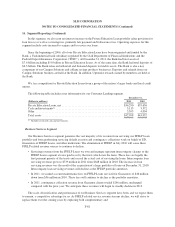

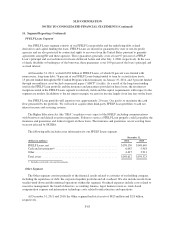

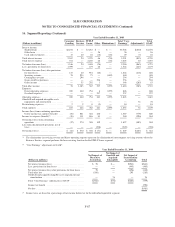

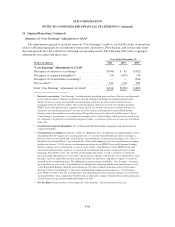

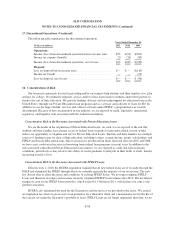

16. Segment Reporting (Continued)

Measure of Profitability

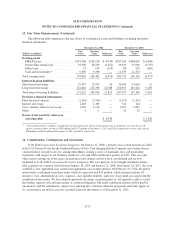

The tables below include the condensed operating results for each of our reportable segments. Management,

including the chief operating decision makers, evaluates the Company on certain performance measures that we

refer to as “Core Earnings” performance measures for each operating segment. We use “Core Earnings” to

manage each business segment because “Core Earnings” reflect adjustments to GAAP financial results for three

items, discussed below, that create significant volatility mostly due to timing factors generally beyond the control

of management. Accordingly, we believe that “Core Earnings” provide management with a useful basis from

which to better evaluate results from ongoing operations against the business plan or against results from prior

periods. Consequently, we disclose this information as we believe it provides investors with additional

information regarding the operational and performance indicators that are most closely assessed by management.

The three items adjusted for in our “Core Earnings” presentations are (1) our use of derivatives instruments to

hedge our economic risks that do not qualify for hedge accounting treatment or do qualify for hedge accounting

treatment but result in ineffectiveness and (2) the accounting for goodwill and acquired intangible assets and

(3) the off-balance sheet treatment of certain securitization transactions. The tables presented below reflect “Core

Earnings” operating measures reviewed and utilized by management to manage the business. Reconciliation of

the “Core Earnings” segment totals to our consolidated operating results in accordance with GAAP is also

included in the tables below.

Our “Core Earnings” performance measures are not defined terms within GAAP and may not be comparable

to similarly titled measures reported by other companies. Unlike financial accounting, there is no comprehensive,

authoritative guidance for management reporting. The management reporting process measures the performance

of the operating segments based on the management structure of the Company and is not necessarily comparable

with similar information for any other financial institution. Our operating segments are defined by the products

and services they offer or the types of customers they serve, and they reflect the manner in which financial

information is currently evaluated by management. Intersegment revenues and expenses are netted within the

appropriate financial statement line items consistent with the income statement presentation provided to

management. Changes in management structure or allocation methodologies and procedures may result in

changes in reported segment financial information.

F-84