Sallie Mae 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

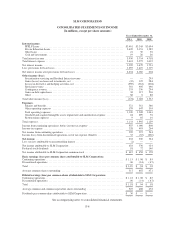

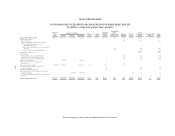

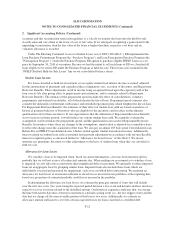

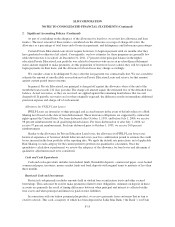

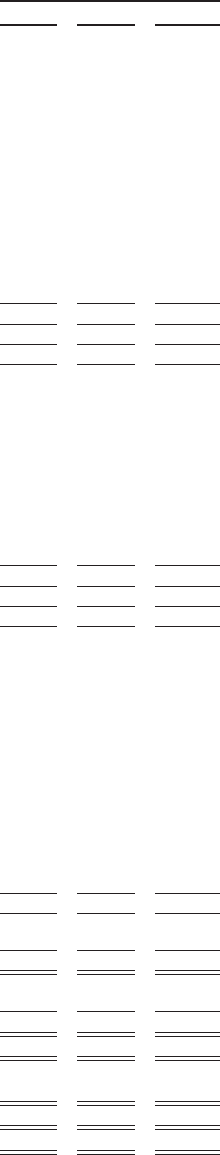

SLM CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

Years Ended December 31,

2011 2010 2009

Operating activities

Net income attributable to SLM Corporation .................................................................. $ 633 $ 530 $ 324

Adjustments to reconcile net income to net cash provided by (used in) operating activities:

(Income) loss from discontinued operations, net of tax ........................................................ (33) 67 220

(Gains) losses on loans and investments, net ................................................................ 35 (6) 1

(Gains) on debt repurchases ............................................................................. (38) (317) (536)

Goodwill and acquired intangible assets impairment and amortization expense ..................................... 24 699 76

Stock-based compensation cost .......................................................................... 56 40 51

Unrealized (gains)/losses on derivative and hedging activities .................................................. 145 (478) 324

Provisions for loan losses ............................................................................... 1,295 1,419 1,119

Student loans originated for sale, net ...................................................................... — (9,648) (19,100)

Decrease (increase) in restricted cash — other ............................................................... 15 (2) 40

Decrease (increase) in accrued interest receivable ............................................................ 463 (4) 894

Increase (decrease) in accrued interest payable .............................................................. 75 (77) (517)

Adjustment for non-cash loss related to Retained Interest ...................................................... — — 330

Decrease in other assets ................................................................................ 423 1,206 375

(Decrease) in other liabilities ............................................................................ (12) (121) (30)

Cash provided by (used in) operating activities — continuing operations ............................................ 3,081 (6,692) (16,429)

Cash provided by operating activities — discontinued operations .................................................. — — 515

Total net cash provided by (used in) operating activities ......................................................... 3,081 (6,692) (15,914)

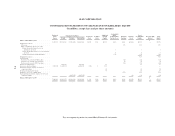

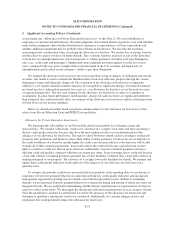

Investing activities

Student loans acquired ................................................................................. (3,888) (4,611) (5,973)

Loans purchased from securitized trusts — — (6)

Reduction of student loans:

Installment payments, claims and other .................................................................. 12,290 9,812 7,319

Proceeds from sales of student loans .................................................................... 753 588 788

Other investing activities, net ............................................................................ (210) (96) (419)

Purchases of available-for-sale securities ................................................................... (142) (38,303) (128,478)

Proceeds from maturities of available-for-sale securities ....................................................... 193 39,465 128,052

Purchases of held-to-maturity and other securities ............................................................ (277) (142) (1)

Proceeds from maturities of held-to-maturity securities and other securities ........................................ 265 136 79

Decrease (increase) in restricted cash — variable interest entities ................................................ 376 426 (1,180)

Cash provided by investing activities — continuing operations .................................................. 9,360 7,275 181

Cash provided by investing activities — discontinued operations ................................................ 114 139 130

Total net cash provided by investing activities ................................................................. 9,474 7,414 311

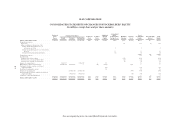

Financing activities

Borrowings collateralized by loans in trust — issued .......................................................... 4,553 5,917 12,998

Borrowings collateralized by loans in trust — repaid .......................................................... (13,408) (10,636) (5,690)

Asset-backed commercial paper conduits, net ............................................................... 887 (2,060) (16,138)

ED Participation Program, net ........................................................................... — 11,252 19,302

ED Conduit Program facility, net ......................................................................... (3,172) 664 14,314

Other short-term borrowings issued ....................................................................... 239 — 298

Other short-term borrowings repaid ....................................................................... (38) (168) (1,435)

Other long-term borrowings issued........................................................................ 2,354 1,464 4,333

Other long-term borrowings repaid ........................................................................ (6,498) (9,955) (9,504)

Other financing activities, net ............................................................................ 696 (21) (955)

Retail and other deposits, net ............................................................................ 754 1,166 204

Other ............................................................................................... 1 — (8)

Common stock repurchased ............................................................................. (300) — —

Common stock dividends paid ........................................................................... (154) — —

Preferred dividends paid ................................................................................ (18) (72) (116)

Net cash (used in) provided by financing activities ........................................................... (14,104) (2,449) 17,603

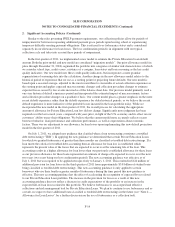

Net (decrease) increase in cash and cash equivalents ............................................................ (1,549) (1,727) 2,000

Cash and cash equivalents at beginning of year ................................................................ 4,343 6,070 4,070

Cash and cash equivalents at end of year ................................................................... $ 2,794 $ 4,343 $ 6,070

Cash disbursements made (refunds received) for:

Interest .............................................................................................. $ 2,413 $ 2,372 $ 3,657

Income taxes paid ..................................................................................... $ 559 $ 200 $ 328

Income taxes (received) ................................................................................ $ (37) $ (628) $ (30)

Noncash activity:

Investing activity — Student loans and other assets acquired ................................................... $ 783 $25,638 $ —

Operating activity — Other assets acquired and other liabilities assumed, net ...................................... $ 19 $ 376 $ —

Financing activity — Borrowings assumed in acquisition of student loans and other assets ............................ $ 802 $26,014 $ —

See accompanying notes to consolidated financial statements.

F-8