Sallie Mae 2011 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

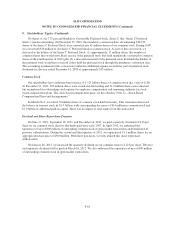

6. Borrowings (Continued)

as the Bank is generally in sound financial condition. Borrowing capacity is limited by the availability of

acceptable collateral. As of December 31, 2011, borrowing capacity was approximately $793 million and there

were no outstanding borrowings.

Senior Unsecured Debt

In 2010, we issued $1.5 billion of senior unsecured notes that bear a coupon of 8.00 percent. The notes were

swapped to LIBOR with an all-in cost of LIBOR plus 4.65 percent.

On January 14, 2011, we issued a $2 billion five-year 6.25 percent fixed rate unsecured bond. The bond was

issued to yield 6.50 percent before underwriting fees. The rate on the bond was swapped from a fixed rate to a

floating rate equal to an all-in cost of one-month LIBOR plus 4.46 percent. The proceeds of this bond were

designated for general corporate purposes.

On January 27, 2012, we issued a two-part, $1.5 billion deal featuring five-year and 10-year unsecured

bonds. The 6.00 percent fixed rate five-year bond was issued for $750 million to yield 6.25 percent before

underwriting fees. The rate on the bond was swapped from a fixed rate to a floating rate equal to an all-in cost of

one-month LIBOR plus 5.2 percent. The 7.25 percent fixed rate 10-year bond was issued for $750 million to

yield 7.50 percent before underwriting fees. The rate on the bond was swapped from a fixed rate to a floating rate

equal to an all-in cost of one-month LIBOR plus 5.4 percent. The proceeds of these bonds were designated for

general corporate purposes.

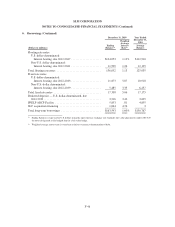

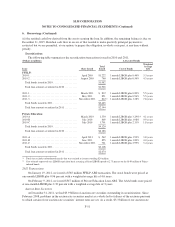

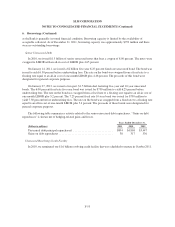

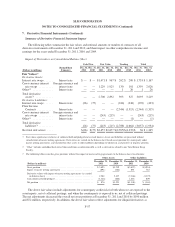

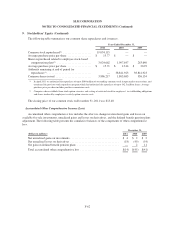

The following table summarizes activity related to the senior unsecured debt repurchases. “Gains on debt

repurchases” is shown net of hedging-related gains and losses.

Years Ended December 31,

(Dollars in millions) 2011 2010 2009

Unsecured debt principal repurchased ............................ $894 $4,868 $3,447

Gains on debt repurchases ...................................... 38 317 536

Unsecured Revolving Credit Facility

In 2010, we terminated our $1.6 billion revolving credit facility that was scheduled to mature in October 2011.

F-53