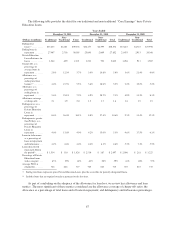

Sallie Mae 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

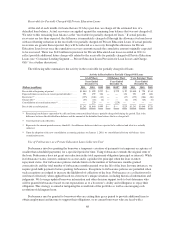

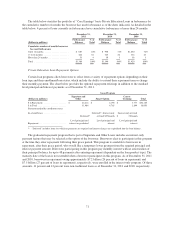

In addition to the assets listed in the table above, we hold a number of other unencumbered assets,

consisting primarily of Private Education Loans and other assets. At December 31, 2011, we had a total of

$20.2 billion of unencumbered assets (which includes the assets that comprise our primary liquidity and are

available to serve as collateral for our secondary liquidity), excluding goodwill and acquired intangibles. Total

unencumbered student loans, net, comprised $12.0 billion of our unencumbered assets of which $11.0 billion and

$1.0 billion related to Private Education Loans, net, and FFELP Loans, net, respectively.

For further discussion of our various sources of liquidity, such as the ED Conduit Program, the Sallie Mae

Bank, our continued access to the ABS market, our asset-backed financing facilities, the lending agreement we

entered into with the FHLB-DM and our issuance of unsecured debt, see “Note 6 — Borrowings” to our

consolidated financial statements.

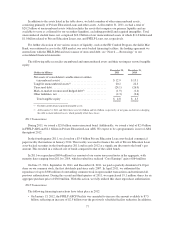

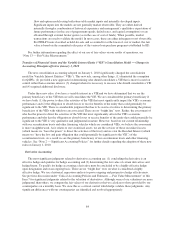

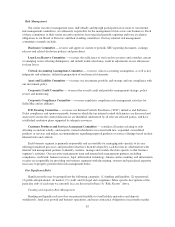

The following table reconciles encumbered and unencumbered assets and their net impact on total tangible

equity.

(Dollars in billions)

December 31,

2011

December 31,

2010

Net assets of consolidated variable interest entities

(encumbered assets) ................................ $12.9 $ 13.1

Tangible unencumbered assets(1) ........................ 20.2 22.3

Unsecured debt ...................................... (24.1) (26.9)

Mark-to-market on unsecured hedged debt(2) .............. (1.9) (1.4)

Other liabilities, net .................................. (2.3) (2.6)

Total tangible equity ............................... $ 4.8 $ 4.5

(1) Excludes goodwill and acquired intangible assets.

(2) At December 31, 2011 and 2010, there were $1.6 billion and $1.4 billion, respectively, of net gains on derivatives hedging

this debt in unencumbered assets, which partially offset these losses.

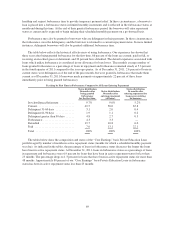

2011 Transactions

During 2011, we issued a $2.0 billion senior unsecured bond. Additionally, we issued a total of $2.4 billion

in FFELP ABS and $2.1 billion in Private Education Loan ABS. We expect to be a programmatic issuer of ABS

throughout 2012.

In the fourth-quarter 2011, we closed on a $3.4 billion Private Education Loan asset-backed commercial

paper facility that matures in January 2014. This facility was used to finance the call of Private Education Loan

asset-backed securities in the fourth-quarter 2011 and in early 2012 at a significant discount to the bond’s par

amount. This resulted in a reduced cost of funds compared to that of the called bonds.

In 2011 we repurchased $894 million face amount of our senior unsecured notes in the aggregate, with

maturity dates ranging from 2011 to 2014, which resulted in a realized “Core Earnings” gain of $64 million.

On June 17, 2011, September 16, 2011, and December 16, 2011, we paid a quarterly dividend of $.10 per

share on our common stock, the first dividends paid since early 2007. In April 2011, we authorized the

repurchase of up to $300 million of outstanding common stock in open market transactions and terminated all

previous authorizations. During the second and third quarters of 2011, we repurchased 19.1 million shares for an

aggregate purchase price of $300 million. With this action, we fully utilized this share repurchase authorization.

2012 Transactions

The following financing transactions have taken place in 2012:

• On January 13, 2012, the FFELP ABCP Facility was amended to increase the amount available to $7.5

billion, reflecting an increase of $2.5 billion over the previously scheduled facility reduction. In addition,

77