Sallie Mae 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. Student Loans (Continued)

During 2009, we instituted an interest rate reduction program to assist customers in repaying their Private

Education Loans through reduced payments, while continuing to reduce their outstanding principal balance. This

program is offered in situations where the potential for principal recovery, through a modification of the monthly

payment amount, is better than other alternatives currently available. Along with the ability and willingness to

pay, the customer must make three consecutive monthly payments at the reduced rate to qualify for the program.

Once the customer has made the initial three payments, the loans status is returned to current and the interest rate

is reduced for the successive twelve month period.

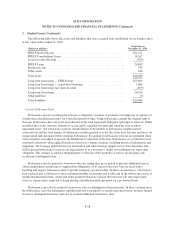

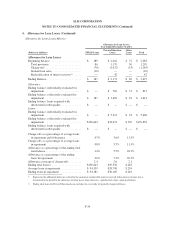

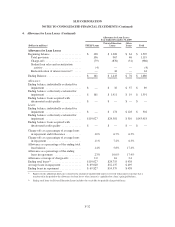

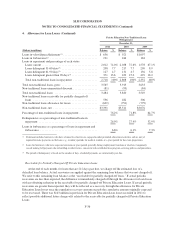

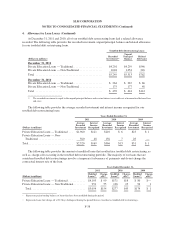

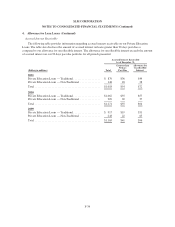

4. Allowance for Loan Losses

Our provisions for loan losses represent the periodic expense of maintaining an allowance sufficient to

absorb incurred probable losses, net of expected recoveries, in the held-for-investment loan portfolios. The

evaluation of the provisions for loan losses is inherently subjective as it requires material estimates that may be

susceptible to significant changes. We believe that the allowance for loan losses is appropriate to cover probable

losses incurred in the loan portfolios. We segregate our Private Education Loan portfolio into two classes of

loans — traditional and non-traditional. Non-traditional loans are loans to (i) borrowers attending for-profit

schools with an original Fair Isaac and Company (“FICO”) score of less than 670 and (ii) borrowers attending

not-for-profit schools with an original FICO score of less than 640. The FICO score used in determining whether

a loan is non-traditional is the greater of the borrower or cosigner FICO score at origination. Traditional loans are

defined as all other Private Education Loans that are not classified as non-traditional.

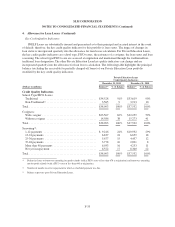

In establishing the allowance for Private Education Loan losses for the year ended 2011, we considered

several additional emerging environmental factors with respect to our Private Education Loan portfolio. In

particular, we continue to see improving credit quality and continuing positive delinquency and charge-off trends

in connection with this portfolio. Improving credit quality is seen in higher FICO scores and cosigner rates, as

well as, a more seasoned portfolio compared to the previous year. The delinquency rate has declined to 10.1

percent from 10.6 percent and the charge-off rate has declined to 3.7 percent from 5.0 percent compared to the

previous year.

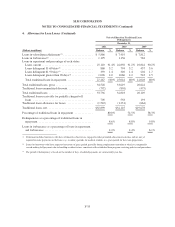

In contrast to these overall improvements in credit quality, delinquency and charge-off trends, Private

Education Loans which defaulted between 2008 and 2011 for which we have previously charged off estimated

losses have, to varying degrees, not met our post-default recovery expectations to date and may continue not to

do so. According to our policy, we have been charging off these periodic shortfalls in expected recoveries against

our allowance for Private Education Loan losses and the related receivable for partially charged-off Private

Education Loans and we will continue to do so. Differences in actual future recoveries on these defaulted loans

could affect our receivable for partially charged-off Private Education Loans. We increased our provision for

Private Education Loan losses for the third quarter of 2011 in the amount of $143 million to reflect these

uncertainties. Continuing historically high unemployment rates may negatively affect future Private Education

Loan default and recovery expectations over our estimated two-year loss confirmation period. Consequently, in

accordance with our policy, we have also given consideration to these factors in projecting charge-offs for this

period and establishing our allowance for Private Education Loan losses. We will continue to monitor defaults

and recoveries in light of the continuing weak economy and elevated unemployment rates. For a more detailed

discussion of our policy for determining the collectability of Private Education Loan and maintaining our

allowance for Private Education Loan losses, see “Note 2—Significant Accounting Policies—Allowance for

Private Education Loan Losses.”

F-29