Sallie Mae 2011 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

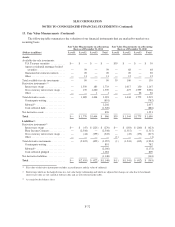

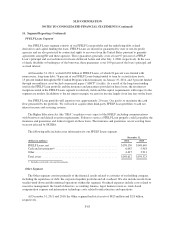

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

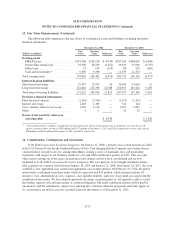

13. Fair Value Measurements (Continued)

Year Ended December 31, 2009

(Dollars in millions)

Residual

Interests

Derivative

Instruments Total

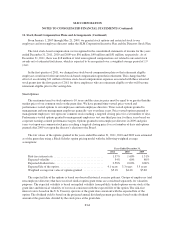

Balance, beginning of period ............................. $2,200 $ (341) $1,859

Total gains/(losses) (realized and unrealized):

Included in earnings(1) .................................... 120 91 211

Included in other comprehensive income ..................... — — —

Settlements ............................................. (492) 434 (58)

Transfers in and/or out of Level 3 ........................... — 1,068 1,068

Balance, end of period ................................... $1,828 $1,252 $3,080

Change in unrealized gains/(losses) relating to instruments still

held at the reporting date ................................ $ (330)(4) $ 439(2) $ 109

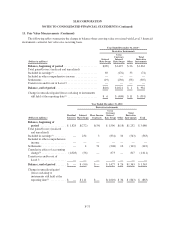

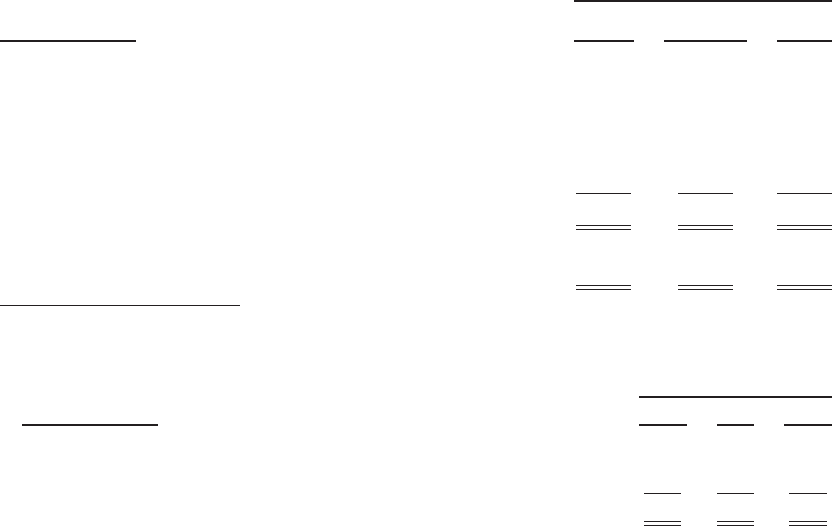

(1) “Included in earnings” comprises the following amounts recorded in the specified line item in the consolidated statements of

income:

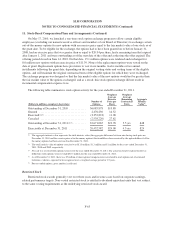

Years Ended December 31,

(Dollars in millions) 2011 2010 2009

Servicing and securitization revenue ............................................ $ — $ — $120

Gains (losses) on derivative and hedging activities, net ............................. (298) (732) 298

Interest expense ............................................................ 224 169 (207)

Total ..................................................................... $ (74) $(563) $ 211

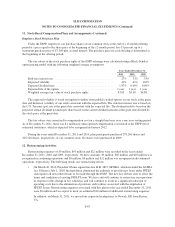

(2) Recorded in “gains (losses) on derivative and hedging activities, net” in the consolidated statements of income.

(3) Upon adoption of new consolidation accounting guidance on January 1, 2010, we consolidated all of our previously off-balance

sheet securitization trusts (see “Note 2 — Significant Accounting Policies — Consolidation”). This resulted in the removal of the

Residual Interest and the recording of the fair value of swaps previously not in our consolidated results.

(4) Recorded in “securitization servicing and Residual Interest revenue” in the consolidated statements of income.

F-74