Sallie Mae 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Critical Accounting Policies and Estimates

Management’s Discussion and Analysis of Financial Condition and Results of Operations addresses our

consolidated financial statements, which have been prepared in accordance with generally accepted accounting

principles in the United States of America (“GAAP”). “Note 2 — Significant Accounting Policies” includes a

summary of the significant accounting policies and methods used in the preparation of our consolidated financial

statements. The preparation of these financial statements requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and the reported amounts of income and

expenses during the reporting periods. Actual results may differ from these estimates under varying assumptions

or conditions. On a quarterly basis, management evaluates its estimates, particularly those that include the most

difficult, subjective or complex judgments and are often about matters that are inherently uncertain. The most

significant judgments, estimates and assumptions relate to the following critical accounting policies that are

discussed in more detail below.

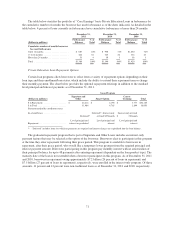

Allowance for Loan Losses

In determining the allowance for loan losses, we estimate the principal amount of loans that will default

over the next two years (two years being the expected period between a loss event and default) and how much we

will recover over time related to the defaulted amount. Our historical experience indicates that, on average, the

time between the date that a borrower experiences a default causing event (e.g., the loss trigger event) and the

date that we charge off the unrecoverable portion of that loan is two years. Additionally, we estimate an

allowance amount sufficient to cover life-of-loan expected losses for loans classified as a troubled debt

restructuring (see further discussion below). In the first quarter of 2011, we implemented a new model to

estimate the Private Education Loan default amount. Both the prior model and new model are considered

“migration models”. Our prior allowance model (in place through December 31, 2010) segmented the portfolio

into categories of similar risk characteristics of which we consider school type, credit scores, existence of a

cosigner, loan status and loan seasoning as the key credit quality indicators. Our new model uses these credit

quality indicators, but incorporates a more granular segmentation of seasoning data into the calculation. Another

change in the new allowance model relates to the historical period of experience that we use as a starting point

for projecting future defaults. Our new model is based upon a seasonal average, adjusted to the most recent three

to six months of actual collection experience as the starting point and applies expected macroeconomic changes

and collection procedure changes to estimate expected losses caused by loss events incurred as of the balance

sheet date. Our previous model primarily used a one year historical default experience period and incorporated

the estimated impact of macroeconomic factors and collection procedure changes on a qualitative basis. Our

current model places a greater emphasis on the more recent default experience rather than the default experience

for older historical periods, as we believe the recent default experience is more indicative of the probable losses

incurred in the loan portfolio today. While we incorporated the new model in the first quarter of 2011, the overall

process for calculating the appropriate amount of allowance for Private Education Loan loss did not change.

Significantly more judgment has been required over the last several years, compared with years prior, in light of

the U.S. economy and its effect on our customer’s ability to pay their obligations. We believe that the current

model more accurately reflects recent borrower behavior, loan performance, and collection performance, as well

as expectations about economic factors. There was no adjustment to our allowance for loan loss upon

implementing this new default projection model in the first quarter of 2011.

Similar to estimating defaults, we begin with historical borrower payment behavior to estimate the timing

and amount of future recoveries on Private Education Loan defaults. We use judgment in determining whether

historical performance is representative of what we expect to recover in the future. In contrast to the overall

improvements in credit quality, delinquency and charge-off trends we saw in 2011, Private Education Loans

which defaulted between 2008 and 2011 for which we have previously charged off estimated losses have, to

varying degrees, not met our recovery expectations to date and may continue not to do so. (See “Business

Segment Earnings Summary — “Core Earnings” Basis — Consumer Lending Segment — Private Education

Loans Provision for Loan Losses and Charge-offs” of this Item 7, for further discussion.)

81