Sallie Mae 2011 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. Commitments, Contingencies and Guarantees (Continued)

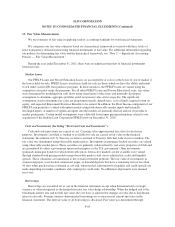

Mark A. Arthur et al. v. Sallie Mae, Inc. On February 2, 2010, a putative class action suit was filed by a

borrower in U.S. District Court for the Western District of Washington alleging that we contacted consumers on

their cellular telephones via autodialer without their consent in violation of the Telephone Consumer Protection

Act, 47 U.S.C. § 227 et seq. (“TCPA”). Each violation under the TCPA provides for $500 in statutory damages

($1,500 if a willful violation is shown). Plaintiffs were seeking statutory damages, damages for willful violations,

attorneys’ fees, costs, and injunctive relief. On October 7, 2011, we entered into an amended settlement

agreement under which the Company agreed to a settlement fund of $24.15 million. We have denied vigorously

all claims asserted against us, but agreed to settle to avoid the burden, expense, risk and uncertainty of continued

litigation. On January 10, 2012, the Court denied, without prejudice, the Motion for Preliminary Approval of the

amended settlement agreement noting, however, that although the proposed settlement satisfies the Court’s

requirement of overall fairness, the Court expressed concern regarding the proposed form of notice and other

forms to be provided in connection with the settlement. On February 9, 2012, the Plaintiffs filed a Renewed

Motion for Preliminary Approval addressing the Court’s concerns. As of December 31, 2011 we have accrued

$24.15 million related to this matter.

ED’s Office of the Inspector General (“OIG”) commenced an audit regarding Special Allowance Payments

on September 10, 2007. On August 3, 2009, we received the final audit report of the OIG related to our billing

practices for Special Allowance Payments. Among other things, the OIG recommended that ED instruct us to

return approximately $22 million in alleged special allowance overpayments. We continue to believe that our

practices were consistent with longstanding ED guidance and all applicable rules and regulations and intend to

continue disputing these findings. We provided our response to the Secretary of Education on October 2, 2009

and we provided additional information to ED in 2010. We have not received any further requests since that time.

At this time, we estimate the range of potential exposure to be $0 to $22 million. We have not accrued any loss

related to this matter as of December 31, 2011.

The Company and its subsidiaries and affiliates also are subject to various claims, lawsuits and other actions

that arise in the normal course of business. Most of these matters are claims by borrowers disputing the manner

in which their loans have been processed or the accuracy of our reports to credit bureaus. In addition, our

collections subsidiaries are routinely named in individual plaintiff or class action lawsuits in which the plaintiffs

allege that those subsidiaries have violated a federal or state law in the process of collecting their accounts. We

believe that these claims, lawsuits and other actions will not have a material adverse effect on our business,

financial condition or results of operations. Finally, from time to time, the Company receives information and

document requests from state attorneys general and Congressional committees concerning certain business

practices. Our practice has been and continues to be to cooperate with the state attorneys general and

Congressional committees and to be responsive to any such requests.

Contingencies

In the ordinary course of business, we and our subsidiaries are routinely defendants in or parties to pending

and threatened legal actions and proceedings including actions brought on behalf of various classes of claimants.

These actions and proceedings may be based on alleged violations of consumer protection, securities,

employment and other laws. In certain of these actions and proceedings, claims for substantial monetary damage

are asserted against us and our subsidiaries.

In the ordinary course of business, we and our subsidiaries are subject to regulatory examinations,

information gathering requests, inquiries and investigations. In connection with formal and informal inquiries in

these cases, we and our subsidiaries receive numerous requests, subpoenas and orders for documents, testimony

and information in connection with various aspects of our regulated activities.

F-76