Sallie Mae 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Availability of Federal Funds

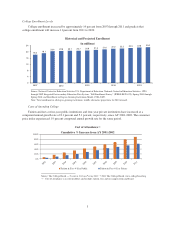

There has been a substantial increase in borrowing from federal loan programs in recent years. In the AY

ended June 30, 2011, according to the College Board, borrowing from federal loan programs totaled $104 billion, an

increase of nearly 70 percent since AY ending June 30, 2007. The College Board also reported that federal grants

increased 17 percent to $49.1 billion from $41.9 billion in the most recent AY and have increased more than 150

percent since AY 2006-2007. Over the same period of time, borrowing from Private Education Loan programs

decreased nearly 70 percent, dropping to an estimated $6 billion, down significantly from the peak of $21.1 billion

in the AY 2007-2008 and down $800 million as compared to AY 2009-2010. We believe the drop in borrowing

from Private Education Loan programs has been caused in large measure by these increases in federal loan limits

and the increasing availability of federal funds and the strengthening of Private Education Loan underwriting

standards.

Students and their families can borrow money directly from the federal government to pay for all or part of

college education costs under the Direct Student Loan Program (“DSLP”). The loans can be used to cover the

cost of tuition, and room and board. Currently, a dependent undergraduate student can borrow from $5,500 to

$7,500 annually, depending on their class level. An independent undergraduate student can borrow from $9,500

to $12,500 annually, depending on their class level. A graduate student can borrow up to the full cost of

attendance. Rising enrollment and college costs and increases in borrowing limits have caused federal student

loan programs to grow at a 10-year annual growth rate of 12 percent. The number of borrowers using DSLP is

expected to increase five percent per year over the next three years.

Our Approach to Advising Students and Their Families

Students and their families use multiple sources of funding to pay for their college education, including

savings, current income, grants, scholarships, federal government loans and private education loans.

We advise students and their families to follow the “1-2-3 approach” to paying for college. In recent years,

we have increased our focus on business-to-consumer and business-to-business activities that align with each of

these three steps and our future plans revolve largely around continuing to develop these types of activities.

Step 1: Use scholarships, grants, savings and income.

Sallie Mae makes available to consumers at no charge an extensive online database of scholarships which

includes information about more than 2 million scholarships with an aggregate value in excess of $16 billion.

Our Upromise consumer savings network helps families jumpstart their save-for-college plan by providing

financial rewards on everyday purchases. Traditional savings products, like High Yield Savings Accounts, Money

Market Accounts and CDs, are available through the Sallie Mae Bank (the “Bank”). In addition, our Upromise

Investments Inc. subsidiary is the largest administrator of direct-to-consumer 529 college-savings plans.

We also provide services to families who prefer to pay some or all of their college expenses using current

income. Sallie Mae’s Campus Solutions business administers interest-free tuition payment plans on behalf of

higher education institutions. In addition, we process tuition refunds on behalf of colleges and universities that

may be disbursed to students a number of ways, including through the Bank’s No-Fee-Student Checking with

Debit product.

Step 2: Pursue federal government loan options.

Sallie Mae encourages consumers to explore federal government loan options. Our free online tool, the

Education Investment Planner, helps families estimate the full cost of a college degree and build a customized

plan to pay for college. The Education Investment Planner takes families through a series of questions, prompting

users to model various funding sources — including 529 college savings plans, parent and student savings and

income, scholarships, federal and state grants, institutional aid, and if necessary, federal and private student

loans. For those who include student loans in their pay-for-college plan, the Education Investment Planner

estimates what their monthly payments could be after graduation and helps users project how much a graduate

would need to earn to keep payments manageable.

4