Sallie Mae 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

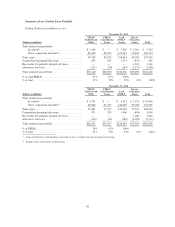

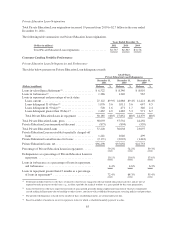

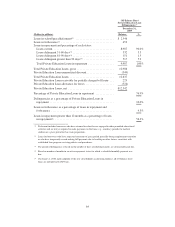

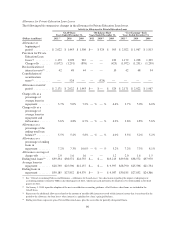

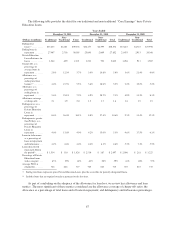

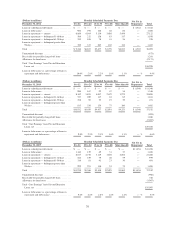

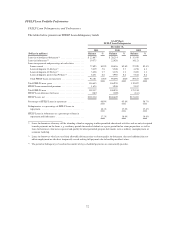

Allowance for Private Education Loan Losses

The following table summarizes changes in the allowance for Private Education Loan losses.

Activity in Allowance for Private Education Loans

GAAP-Basis

Years Ended December 31,

Off-Balance Sheet

Years Ended December 31,

“Core Earnings” Basis

Years Ended December 31,

(Dollars in millions) 2011(1) 2010 2009 2011 2010(2) 2009 2011(1) 2010 2009

Allowance at

beginning of

period ........... $ 2,022 $ 1,443 $ 1,308 $— $ 524 $ 505 $ 2,022 $ 1,967 $ 1,813

Provision for Private

Education Loan

losses(1) .......... 1,179 1,298 967 — — 432 1,179 1,298 1,399

Charge-offs ....... (1,072) (1,291) (876) — — (423) (1,072) (1,291) (1,299)

Reclassification of

interest reserve(3) . . . 42 48 44 — — 10 42 48 54

Consolidation of

securitization

trusts(2) ........... — 524 — — (524) ————

Allowance at end of

period ........... $ 2,171 $ 2,022 $ 1,443 $— $ — $ 524 $ 2,171 $ 2,022 $ 1,967

Charge-offs as a

percentage of

average loans in

repayment ........ 3.7% 5.0% 7.2% — % — % 4.4% 3.7% 5.0% 6.0%

Charge-offs as a

percentage of

average loans in

repayment and

forbearance ....... 3.6% 4.8% 6.7% — % — % 4.2% 3.6% 4.8% 5.6%

Allowance as a

percentage of the

ending total loan

balance(4) ......... 5.5% 5.2% 5.8% — % — % 4.0% 5.5% 5.2% 5.2%

Allowance as a

percentage of ending

loans in

repayment ........ 7.2% 7.3% 10.0% — % — % 5.2% 7.2% 7.3% 8.1%

Allowance coverage of

charge-offs ....... 2.0 1.6 1.6 — — 1.2 2.0 1.6 1.5

Ending total loans(4) . . $39,334 $38,572 $24,755 $— $ — $13,215 $39,334 $38,572 $37,970

Average loans in

repayment ........ $28,790 $25,596 $12,137 $— $ — $ 9,597 $28,790 $25,596 $21,734

Ending loans in

repayment ........ $30,185 $27,852 $14,379 $— $ — $ 9,987 $30,185 $27,852 $24,366

(1) See “Critical Accounting Policies and Estimates – Allowance for Loan Losses” for a discussion regarding the impact of adopting new

accounting guidance related to TDRs in the third quarter of 2011, which increased provisions for loan losses by $124 million in the third

quarter of 2011.

(2) On January 1, 2010, upon the adoption of the new consolidation accounting guidance, all off-balance sheet loans are included in the

GAAP-basis.

(3) Represents the additional allowance related to the amount of uncollectible interest reserved within interest income that is transferred in the

period to the allowance for loan losses when interest is capitalized to a loan’s principal balance.

(4) Ending total loans represents gross Private Education Loans, plus the receivable for partially charged-off loans.

66