Sallie Mae 2011 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

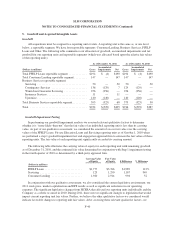

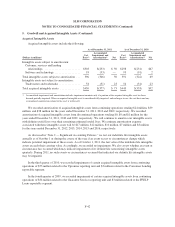

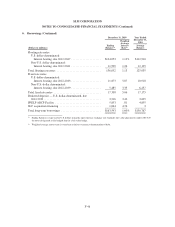

5. Goodwill and Acquired Intangible Assets (Continued)

determined that it is more-likely-than-not that the fair values of the FFELP Loans, Private Education Loans and

Servicing reporting units exceed their carrying amounts. Accordingly, we did not perform the Step 1 impairment

analysis as of October 1, 2011 for these reporting units.

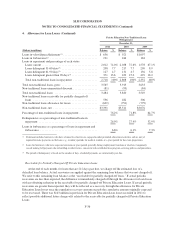

During 2011, we completed two acquisitions in the Business Services reportable segment which increased

goodwill by $18 million, $7 million of which is attributed to the Contingency Services reporting unit and

$11 million of which is attributed to Insurance Services. We considered the fair value of these reporting units in

conjunction with the qualitative analysis described above and determined that it is more-likely-than-not that the

fair values of these reporting units exceed their carrying amounts.

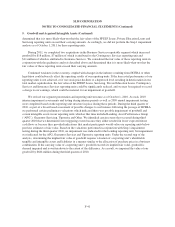

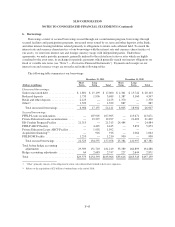

Continued weakness in the economy coupled with changes in the industry resulting from HCERA or other

legislation could adversely affect the operating results of our reporting units. If the forecasted performance of our

reporting units is not achieved, or if our stock price declines to a depressed level resulting in deterioration in our

total market capitalization, the fair value of the FFELP Loans, Servicing, Private Education Loans, Contingency

Services and Insurance Services reporting units could be significantly reduced, and we may be required to record

a charge to our earnings, which could be material, for an impairment of goodwill.

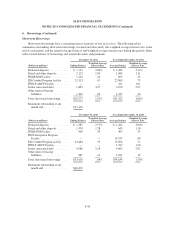

We revised our segment presentation and reporting unit structure as of October 1, 2010. As such, 2010

interim impairment assessments and testing during interim periods as well as 2009 annual impairment testing

were completed based on the reporting unit structure in place during these periods. During the third quarter of

2010, as part of a broad-based assessment of possible changes to our business following the passage of HCERA,

we performed certain preliminary valuations which indicated there was possible impairment of goodwill and

certain intangible assets in our reporting units which at that time included Lending, Asset Performance Group

(“APG”), Guarantor Servicing, Upromise and Other. We identified certain events that occurred during third

quarter 2010 that we determined were triggering events because they either resulted in lower expected future

cash flows or because they provided indications that market participants would value our reporting units below

previous estimates of fair value. Based on the valuations performed in conjunction with Step 1 impairment

testing during the third-quarter 2010, no impairment was indicated for the Lending reporting unit, but impairment

was indicated for the APG, Guarantor Services and Upromise reporting units. Under the second step of the

analysis, determining the implied fair value of goodwill requires valuation of a reporting unit’s identifiable

tangible and intangible assets and liabilities in a manner similar to the allocation of purchase price in a business

combination. If the carrying value of a reporting unit’s goodwill exceeds its implied fair value, goodwill is

deemed impaired and is written down to the extent of the difference. As a result, we impaired the value of our

goodwill by $604 million during the third quarter of 2010.

F-41