Sallie Mae 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

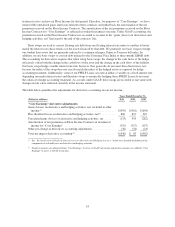

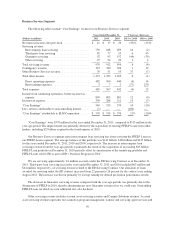

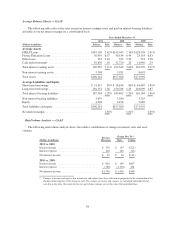

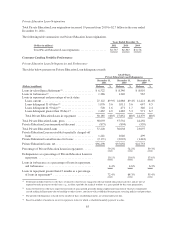

FFELP Loans Net Interest Margin

The following table shows the FFELP Loans “Core Earnings” net interest margin along with reconciliation

to the GAAP-basis FFELP Loans net interest margin.

Years Ended December 31,

2011 2010 2009

“Core Earnings” basis FFELP student loan yield .... 2.59% 2.57% 2.68%

Hedged Floor Income .......................... .25 .23 .14

Unhedged Floor Income ........................ .12 .02 .22

Consolidation Loan Rebate Fees ................. (.65) (.59) (.59)

Repayment Borrower Benefits ................... (.12) (.10) (.11)

Premium amortization ......................... (.15) (.18) (.17)

“Core Earnings” basis FFELP student loan net

yield ..................................... 2.04 1.95 2.17

“Core Earnings” basis FFELP student loan cost of

funds ..................................... (.98) (.93) (1.44)

“Core Earnings” basis FFELP student loan spread . . . 1.06 1.02 .73

“Core Earnings” basis FFELP other asset spread

impact .................................... (.08) (.09) (.06)

“Core Earnings” basis FFELP Loans net interest

margin(1) .................................. .98% .93% .67%

“Core Earnings” basis FFELP Loans net interest

margin(1) .................................. .98% .93% .67%

Adjustment for GAAP accounting treatment ........ .34 .33 (.08)

GAAP-basis FFELP Loans net interest margin ...... 1.32% 1.26% .59%

(1) The average balances of our FFELP “Core Earnings” basis interest-earning assets for the respective periods are:

(Dollars in millions)

FFELP Loans ............................................. $143,109 $142,043 $150,059

Other interest-earning assets .................................. 5,194 5,562 5,126

Total FFELP “Core Earnings” basis interest-earning assets .......... $148,303 $147,605 $155,185

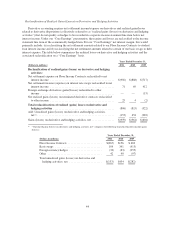

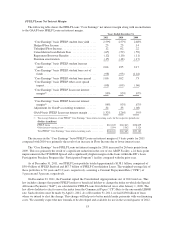

The increase in the “Core Earnings” basis FFELP Loans net interest margin of 5 basis points for 2011

compared with 2010 was primarily the result of an increase in Floor Income due to lower interest rates.

The “Core Earnings” basis FFELP Loans net interest margin for 2010 increased by 26 basis points from

2009. This was primarily the result of a significant reduction in the cost of our ABCP Facility, a 24 basis point

improvement in the CP/LIBOR Spread and a significantly higher margin on the loans within the ED’s Loan

Participation Purchase Program (the “Participation Program”) facility compared with the prior year.

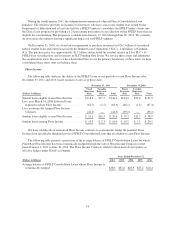

As of December 31, 2011, our FFELP Loan portfolio totaled approximately $138.1 billion, comprised of

$50.4 billion of FFELP Stafford and $87.7 billion of FFELP Consolidation Loans. The weighted-average life of

these portfolios is 5.0 years and 9.2 years, respectively, assuming a Constant Prepayment Rate (“CPR”) of

5 percent and 3 percent, respectively.

On December 23, 2011, the President signed the Consolidated Appropriations Act of 2012 into law. This

law includes changes that permit FFELP lenders or beneficial holders to change the index on which the Special

Allowance Payments (“SAP”) are calculated for FFELP Loans first disbursed on or after January 1, 2000. The

law allows holders to elect to move the index from the Commercial Paper (“CP”) Rate to the one-month LIBOR

rate. Such elections must be made by April 1, 2012. As of December 31, 2011, we had $130 billion of loans

where we intend to elect the change. This change will help us to better match lender payments with our financing

costs. We currently expect the new formula to be developed and available for use in the second quarter of 2012.

53