Sallie Mae 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

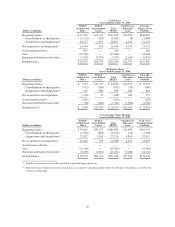

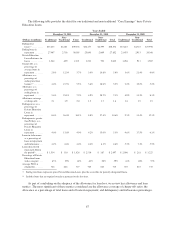

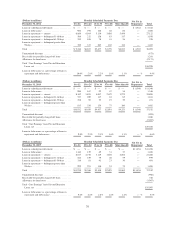

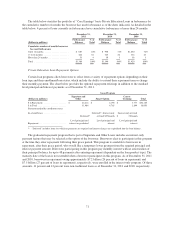

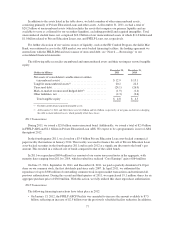

(Dollars in millions) Monthly Scheduled Payments Due Not Yet in

RepaymentDecember 31, 2011 0to12 13 to 24 25 to 36 37 to 48 More than 48 Total

Loans in-school/grace/deferment ............... $ — $ — $ — $ — $ — $ 6,522 $ 6,522

Loans in forbearance ......................... 920 194 126 66 80 — 1,386

Loans in repayment — current ................. 6,866 6,014 5,110 3,486 5,646 — 27,122

Loans in repayment — delinquent 31-60 days ..... 506 212 158 83 117 — 1,076

Loans in repayment — delinquent 61-90 days ..... 245 100 78 41 56 — 520

Loans in repayment — delinquent greater than

90 days .................................. 709 317 205 102 134 — 1,467

Total ..................................... $ 9,246 $6,837 $5,677 $3,778 $6,033 $ 6,522 38,093

Unamortized discount ........................ (873)

Receivable for partially charged-off loans ........ 1,241

Allowance for loan losses ..................... (2,171)

Total “Core Earnings” basis Private Education

Loans, net ............................... $36,290

Loans in forbearance as a percentage of loans in

repayment and forbearance .................. 10.0% 2.8% 2.2% 1.8% 1.3% — % 4.4%

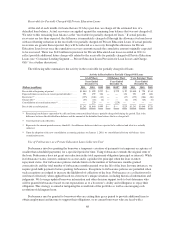

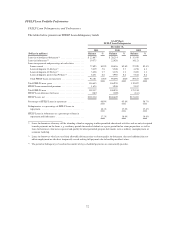

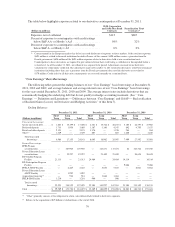

(Dollars in millions) Monthly Scheduled Payments Due Not Yet in

RepaymentDecember 31, 2010 0to12 13 to 24 25 to 36 37 to 48 More than 48 Total

Loans in-school/grace/deferment ............... $ — $ — $ — $ — $ — $ 8,340 $ 8,340

Loans in forbearance ......................... 980 167 92 47 54 — 1,340

Loans in repayment — current ................. 8,342 5,855 4,037 2,679 3,975 — 24,888

Loans in repayment — delinquent 31-60 days ..... 537 209 117 63 85 — 1,011

Loans in repayment — delinquent 61-90 days ..... 258 92 55 27 39 — 471

Loans in repayment — delinquent greater than

90 days .................................. 815 336 156 75 100 — 1,482

Total ..................................... $10,932 $6,659 $4,457 $2,891 $4,253 $ 8,340 37,532

Unamortized discount ........................ (894)

Receivable for partially charged-off loans ........ 1,040

Allowance for loan losses ..................... (2,022)

Total “Core Earnings” basis Private Education

Loans, net ............................... $35,656

Loans in forbearance as a percentage of loans in

repayment and forbearance .................. 9.0% 2.5% 2.1% 1.6% 1.3% — % 4.6%

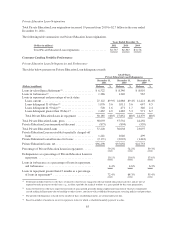

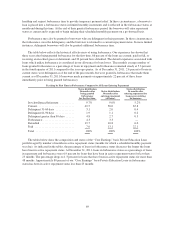

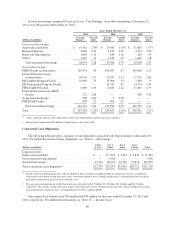

(Dollars in millions) Monthly Scheduled Payments Due Not Yet in

RepaymentDecember 31, 2009 0to12 13 to 24 25 to 36 37 to 48 More than 48 Total

Loans in-school/grace/deferment ............... $ — $ — $ — $ — $ — $11,456 $11,456

Loans in forbearance ......................... 1,144 139 69 31 37 — 1,420

Loans in repayment — current ................. 8,817 4,730 3,119 1,878 2,864 — 21,408

Loans in repayment — delinquent 31-60 days ..... 642 159 79 40 59 — 979

Loans in repayment — delinquent 61-90 days ..... 316 81 41 23 30 — 491

Loans in repayment — delinquent greater than

90 days .................................. 999 251 110 53 75 — 1,488

Total ..................................... $11,918 $5,360 $3,418 $2,025 $3,065 $11,456 37,242

Unamortized discount ........................ (908)

Receivable for partially charged-off loans ........ 728

Allowance for loan losses ..................... (1,967)

Total “Core Earnings” basis Private Education

Loans, net ............................... $35,095

Loans in forbearance as a percentage of loans in

repayment and forbearance .................. 9.6% 2.6% 2.0% 1.6% 1.2% — % 5.5%

70