Sallie Mae 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

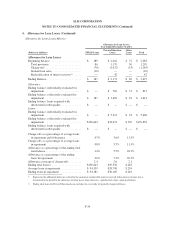

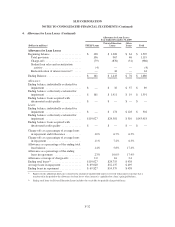

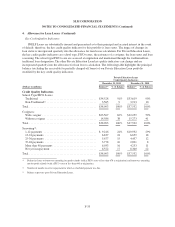

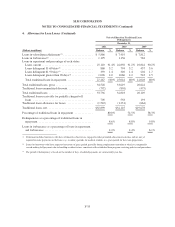

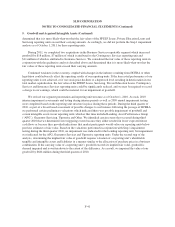

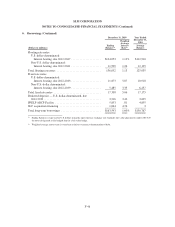

4. Allowance for Loan Losses (Continued)

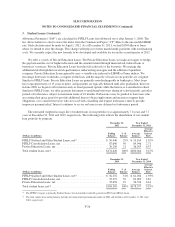

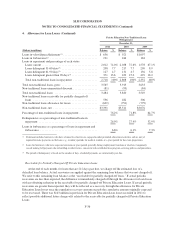

Private Education Non-Traditional Loan

Delinquencies

December 31,

2011 2010 2009

(Dollars in millions) Balance % Balance % Balance %

Loans in-school/grace/deferment(1) ........................ $ 656 $ 921 $1,097

Loans in forbearance(2) ................................. 191 184 184

Loans in repayment and percentage of each status:

Loans current ....................................... 2,012 74.0% 2,038 72.6% 1,578 67.1%

Loans delinquent 31-60 days(3) ......................... 208 7.7 217 7.7 209 8.9

Loans delinquent 61-90 days(3) ......................... 127 4.7 131 4.7 136 5.8

Loans delinquent greater than 90 days(3) .................. 371 13.6 422 15.0 429 18.2

Total non-traditional loans in repayment ................. 2,718 100% 2,808 100% 2,352 100%

Total non-traditional loans, gross ......................... 3,565 3,913 3,633

Non-traditional loans unamortized discount ................. (81) (93) (84)

Total non-traditional loans .............................. 3,484 3,820 3,549

Non-traditional loans receivable for partially charged-off

loans ............................................. 536 482 306

Non-traditional loans allowance for losses .................. (629) (791) (779)

Non-traditional loans, net ............................... $3,391 $3,511 $3,076

Percentage of non-traditional loans in repayment ............. 76.2% 71.8% 64.7%

Delinquencies as a percentage of non-traditional loans in

repayment ......................................... 26.0% 27.4% 32.9%

Loans in forbearance as a percentage of loans in repayment and

forbearance ........................................ 6.6% 6.1% 7.3%

(1) Deferment includes borrowers who have returned to school or are engaged in other permitted educational activities and are not yet

required to make payments on the loans, e.g., residency periods for medical students or a grace period for bar exam preparation.

(2) Loans for borrowers who have requested extension of grace period generally during employment transition or who have temporarily

ceased making full payments due to hardship or other factors, consistent with established loan program servicing policies and procedures.

(3) The period of delinquency is based on the number of days scheduled payments are contractually past due.

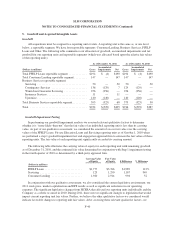

Receivable for Partially Charged-Off Private Education Loans

At the end of each month, for loans that are 212 days past due, we charge off the estimated loss of a

defaulted loan balance. Actual recoveries are applied against the remaining loan balance that was not charged off.

We refer to this remaining loan balance as the “receivable for partially charged-off loans.” If actual periodic

recoveries are less than expected, the difference is immediately charged off through the allowance for loan losses

with an offsetting reduction in the receivable for partially charged-off Private Education Loans. If actual periodic

recoveries are greater than expected, they will be reflected as a recovery through the allowance for Private

Education Loan losses once the cumulative recovery amount exceeds the cumulative amount originally expected

to be recovered. There was $143 million in provision for Private Education Loan losses recorded in 2011 to

reflect possible additional future charge-offs related to the receivable for partially charged-off Private Education

Loans.

F-36