Sallie Mae 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

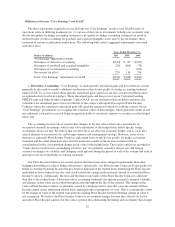

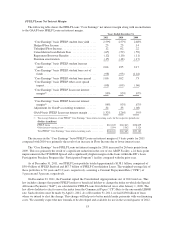

3) Securitization Accounting: On January 1, 2010, we adopted the new consolidation accounting guidance

which consolidated our off-balance sheet securitization trusts. As a result, from 2010 forward, there is no longer

a difference between our GAAP and “Core Earnings” presentation for securitization accounting. (See “Note 2 —

Significant Accounting Policies” for further detail). Prior to the adoption of the new consolidation accounting

guidance on January 1, 2010, certain securitization transactions in our FFELP Loans and Consumer Lending

business segments were accounted for as sales of assets. Under “Core Earnings” for the FFELP Loans and

Consumer Lending business segments, we present all securitization transactions as long-term non-recourse

financings. The upfront “gains” on sale from securitization transactions, as well as ongoing “securitization

servicing and Residual Interest revenue (loss)” presented in accordance with GAAP, were excluded from “Core

Earnings” and were replaced by interest income, provisions for loan losses, and interest expense as earned or

incurred on the securitization loans. The additional net interest margin included in “Core Earnings” contained

any related fees or costs such as Consolidation Loan Rebate Fees, premium and discount amortization as well as

any Repayment Borrower Benefit yield adjustments. We also excluded transactions with our off-balance sheet

trusts from “Core Earnings” as they were considered intercompany transactions on a “Core Earnings” basis.

While we believe that our “Core Earnings” presentation presents the economic substance of results from our loan

portfolios, when compared to GAAP results, it understates earnings volatility from securitization gains,

securitization servicing income and Residual Interest income.

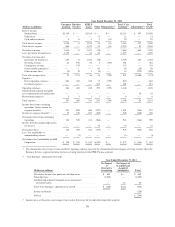

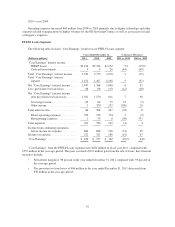

The following table summarizes “Core Earnings” securitization adjustments for the Consumer Lending and

FFELP Loans business segments for the year ended December 31, 2009.

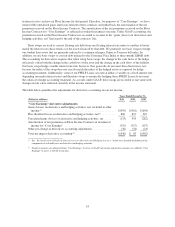

Year Ended

December 31,

(Dollars in millions) 2009

“Core Earnings” securitization adjustments:

Net interest income on securitized loans, before provisions for loan losses and before intercompany

transactions .................................................................... $(942)

Provisions for loan losses ........................................................... 445

Net interest income on securitized loans, after provisions for loan losses, before intercompany

transactions .................................................................... (497)

Intercompany transactions with off-balance sheet trusts ................................... 1

Net interest income on securitized loans, after provisions for loan losses ...................... (496)

Securitization servicing and Residual Interest revenue .................................... 295

Total “Core Earnings” securitization adjustments(1) ...................................... $(201)

(1) Negative amounts are subtracted from “Core Earnings” to arrive at GAAP net income and positive amounts are added to “Core Earnings”

to arrive at GAAP net income.

46