Sallie Mae 2011 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

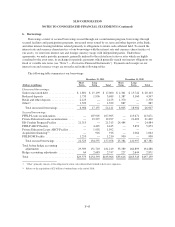

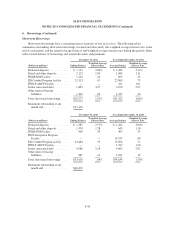

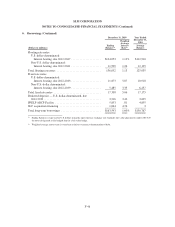

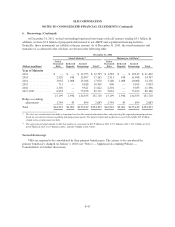

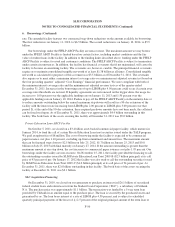

6. Borrowings (Continued)

rate. The amended facility features two contractual step-down reductions on the amount available for borrowing.

The first reduction is on January 11, 2013, to $6.5 billion. The second reduction is on January 10, 2014, to $5.5

billion.

Our borrowings under the FFELP ABCP Facility are non-recourse. The maximum amount we may borrow

under the FFELP ABCP Facility is limited based on certain factors, including market conditions and the fair

value of student loans in the facility. In addition to the funding limits described above, funding under the FFELP

ABCP Facility is subject to usual and customary conditions. The FFELP ABCP Facility is subject to termination

under certain circumstances. In addition, the facility has financial covenants that if not maintained, will cause the

facility to become an amortizing facility. The covenants are, however, curable. The principal financial covenants

require us to maintain consolidated tangible net worth of at least $1.38 billion at all times. Consolidated tangible

net worth as calculated for purposes of this covenant was $3.5 billion as of December 31, 2011. The covenants

also require us to meet either a minimum interest coverage ratio or a minimum net adjusted revenue test based on

the four preceding quarters’ adjusted “Core Earnings” financial performance. We were compliant with both of

the minimum interest coverage ratio and the minimum net adjusted revenue tests as of the quarter ended

December 31, 2011. Increases in the borrowing rate of up to LIBOR plus 4.50 percent could occur if certain asset

coverage ratio thresholds are not met. If liquidity agreements are not renewed on the trigger dates, the usage fee

increases to 1.00 percent over the applicable funding rate on January 11, 2013 and 1.50 percent over the

applicable funding rate on January 10, 2014. Failure to pay off the FFELP ABCP Facility on the maturity date or

to reduce amounts outstanding below the annual maximum step downs will result in a 90-day extension of the

facility with the interest rate increasing from LIBOR plus 2.00 percent to LIBOR plus 3.00 percent over that

period. If, at the end of the 90-day extension, these required paydown amounts have not been made, the collateral

can be foreclosed upon. As of December 31, 2011, there was approximately $4.4 billion outstanding in this

facility. The book basis of the assets securing this facility at December 31, 2011 was $5.0 billion.

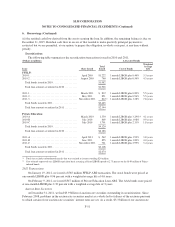

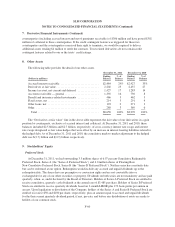

Private Education Loan ABCP Facility

On October 5, 2011, we closed on a $3.4 billion asset-backed commercial paper facility, which matures in

January 2014, to fund the call of certain Private Education Loan trust securities issued under the TALF program.

We paid an upfront fee of $8 million. The cost of borrowing under the facility is expected to be commercial

paper issuance cost plus 1.10 percent, excluding up-front commitment and unused fees. The maximum amount

that can be financed steps down to $2.5 billion on July 25, 2012, $1.7 billion on January 25, 2013 and $0.8

billion on July 25, 2013 with final maturity on January 27, 2014. If the amount outstanding is greater than the

maximum amount at any step down, the cost increases to commercial paper issuance cost plus 1.95 percent. Our

borrowings under the facility are non-recourse. On November 15, 2011, the facility provided the financing to call

the outstanding securities issued by SLM Private Education Loan Trust 2009-B ($2.5 billion principal) at its call

price of 93 percent of par. On January 17, 2012 the facility was also used to call the outstanding securities issued

by SLM Private Education Loan Trust 2009-C ($1.0 billion principal) at its call price of 94 percent of par. At

December 31, 2011, there was $2.0 billion outstanding in this facility. The book basis of the assets securing the

facility at December 31, 2011 was $3.1 billion.

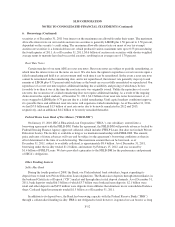

SLC Acquisition Financing

On December 31, 2010, we closed on our agreement to purchase an interest in $26.1 billion of securitized

federal student loans and related assets from the Student Loan Corporation (“SLC”), a subsidiary of Citibank,

N.A. The purchase price was approximately $1.1 billion. The transaction was funded by a 5-year term loan

provided by Citibank in an amount equal to the purchase price. The loan is secured by the purchased assets and

guaranteed by us. The loan bears interest at a rate of LIBOR plus 4.50 percent, and is subject to scheduled

quarterly principal payments of the lesser of (i) 2.5 percent of the original principal amount of the term loan or

F-50