Sallie Mae 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

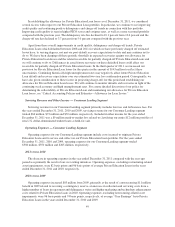

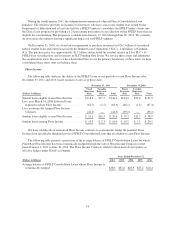

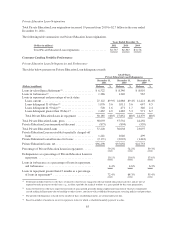

During the fourth-quarter 2011, the Administration announced a Special Direct Consolidation Loan

Initiative. The initiative provides an incentive to borrowers who have at least one student loan owned by the

Department of Education and at least one held by a FFELP lender to consolidate the FFELP lender’s loans into

the Direct Loan program by providing a 0.25 percentage point interest rate reduction on the FFELP loans that are

eligible for consolidation. The program is available from January 17, 2012 through June 30, 2012. We currently

do not foresee the initiative having a significant impact on our FFELP segment.

On December 31, 2010, we closed on our agreement to purchase an interest in $26.1 billion of securitized

federal student loans and related assets from the Student Loan Corporation (“SLC”), a subsidiary of Citibank,

N.A. The purchase price was approximately $1.1 billion and included the residual interest in 13 of SLC’s 14

FFELP loan securitizations and its interest in SLC Funding Note Issuer. We service these assets and administer

the securitization trusts. Because we have determined that we are the primary beneficiary of these trusts we have

consolidated these trusts onto our balance sheet.

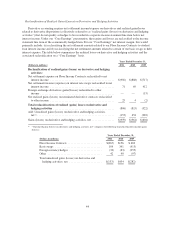

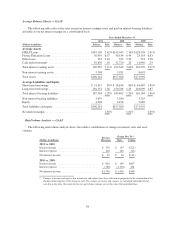

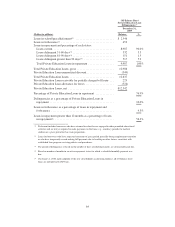

Floor Income

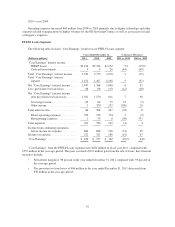

The following table analyzes the ability of the FFELP Loans in our portfolio to earn Floor Income after

December 31, 2011 and 2010, based on interest rates as of those dates.

December 31, 2011 December 31, 2010

(Dollars in billions)

Fixed

Borrower

Rate

Variable

Borrower

Rate Total

Fixed

Borrower

Rate

Variable

Borrower

Rate Total

Student loans eligible to earn Floor Income ...... $118.3 $17.7 $136.0 $124.5 $21.0 $145.5

Less: post-March 31, 2006 disbursed loans

required to rebate Floor Income .............. (62.7) (1.2) (63.9) (66.1) (1.3) (67.4)

Less: economically hedged Floor Income

Contracts ............................... (41.5) — (41.5) (39.2) — (39.2)

Student loans eligible to earn Floor Income ...... $ 14.1 $16.5 $ 30.6 $ 19.2 $19.7 $ 38.9

Student loans earning Floor Income ............ $ 14.1 $ 2.3 $ 16.4 $ 19.2 $ 1.3 $ 20.5

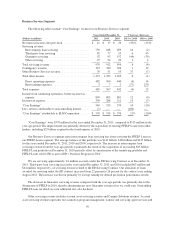

We have sold the above referenced Floor Income contracts to economically hedge the potential Floor

Income from specifically identified pools of FFELP Consolidation Loans that are eligible to earn Floor Income.

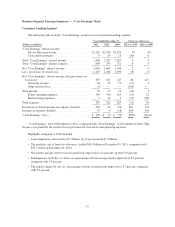

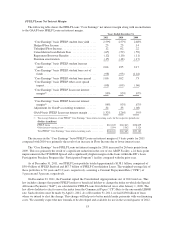

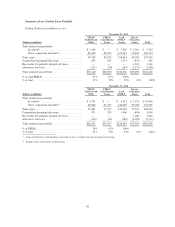

The following table presents a projection of the average balance of FFELP Consolidation Loans for which

Fixed Rate Floor Income has been economically hedged through the sale of Floor Income Contracts for the

period January 1, 2012 to June 30, 2016. The Floor Income Contracts related to these loans do not qualify as

effective hedges under GAAP accounting.

Years Ended December 31,

(Dollars in billions) 2012 2013 2014 2015 2016

Average balance of FFELP Consolidation Loans whose Floor Income is

economically hedged ....................................... $38.3 $32.6 $28.3 $27.2 $10.4

54