Sallie Mae 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. Student Loans (Continued)

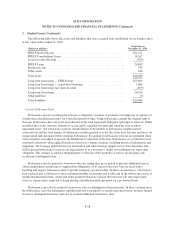

As of December 31, 2011 and 2010, 71 percent and 68 percent, respectively, of our student loan portfolio

was in repayment.

Loan Acquisitions and Sales

In December 2008, we sold approximately $494 million (principal and accrued interest) of FFELP Loans to

ED at a price of 97 percent of principal and unpaid interest pursuant to ED’s authority under ECASLA to make

such purchases, and recorded a loss on the sale. Additionally, in early January 2009, we sold an additional $486

million (principal and accrued interest) in FFELP Loans to ED under this program. The loss related to this sale in

January was recognized in 2008 as the loans were classified as held-for-sale. The total loss recognized on these

two sales for the year ended December 31, 2008 was $53 million and was recorded in “Losses on sales of loans

and securities, net” in the consolidated statements of income.

In 2009, we sold to ED approximately $18.5 billion face amount of loans as part of the Purchase Program

(approximately $840 million face amount of loans was sold in the third quarter of 2009, with the remainder sold

in the fourth quarter of 2009). Outstanding debt of $18.5 billion was paid down related to the Participation

Program pursuant to ECASLA in connection with these loan sales. These loan sales resulted in a $284 million

gain. The settlement of the fourth-quarter sale of loans out of the Participation Program included repaying the

debt by delivering the related loans to ED in a non-cash transaction and receipt of cash from ED for $484 million,

representing the reimbursement of a one-percent payment made to ED plus a $75 fee per loan.

In 2010, we sold to ED approximately $20.4 billion face amount of loans as part of the Purchase Program.

These loan sales resulted in a $321 million gain. Outstanding debt of $20.3 billion has been paid down related to

the Participation Program in connection with these loan sales.

On December 31, 2010, we closed on our agreement to purchase an interest in $26.1 billion of securitized

federal student loans and related assets and $25.0 billion of liabilities from the Student Loan Corporation

(“SLC”), a subsidiary of Citibank, N.A. The purchase price was approximately $1.1 billion. The assets purchased

include the residual interest in 13 of SLC’s 14 FFELP loan securitizations and its interest in SLC Funding Note

Issuer related to the U.S. Department of Education’s Straight-A Funding asset-backed commercial paper conduit.

We will also service these assets and administer the securitization trusts. We converted all of the underlying

loans to our servicing platform by October 2011, and had an interim subservicing agreement for Citibank to

service the loans prior to conversion. Because we have determined that we are the primary beneficiary of these

trusts we have consolidated these trusts onto our balance sheet. The transaction was funded by a 5-year term loan

provided by Citibank in an amount equal to the purchase price.

F-27