Sallie Mae 2011 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

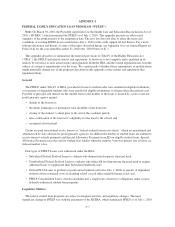

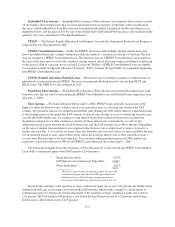

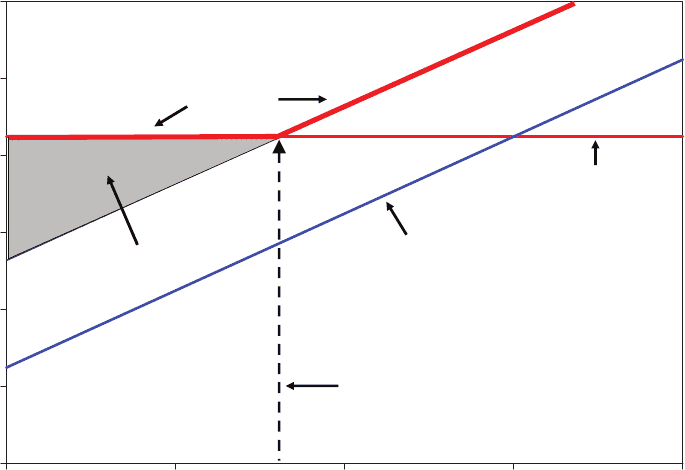

Graphic Depiction of Floor Income:

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

0.00% 1.00% 2.00% 3.00% 4.00%

Commercial Paper Rate

Floor Strike Rate @ 1.61%

Lender Yield

Floor Income

Fixed Borrower Rate = 4.25%

Special Allowance Payment (SAP) Rate = 2.64%

Floating Debt Rate

Fixed Borrower Rate

Yield

Floor Income Contracts — We enter into contracts with counterparties under which, in exchange for an

upfront fee representing the present value of the Floor Income that we expect to earn on a notional amount of

underlying student loans being economically hedged, we will pay the counterparties the Floor Income earned on

that notional amount over the life of the Floor Income Contract. Specifically, we agree to pay the counterparty

the difference, if positive, between the fixed borrower rate less the SAP (see definition below) spread and the

average of the applicable interest rate index on that notional amount, regardless of the actual balance of

underlying student loans, over the life of the contract. The contracts generally do not extend over the life of the

underlying student loans. This contract effectively locks in the amount of Floor Income we will earn over the

period of the contract. Floor Income Contracts are not considered effective hedges under ASC 815, “Derivatives

and Hedging,” and each quarter we must record the change in fair value of these contracts through income.

Guarantor(s) — State agencies or non-profit companies that guarantee (or insure) FFELP Loans made by

eligible lenders under The Higher Education Act of 1965 (“HEA”), as amended.

Private Education Loans — Education loans to students or parents of students that are non-federal loans

and loans not insured or guaranteed under the FFELP. The Private Education Loans we make are largely to

bridge the gap between the cost of higher education and the amount funded through financial aid, federal loans or

borrowers’ resources. Private Education Loans include loans for higher education (undergraduate and graduate

degrees) and for alternative education, such as career training, private kindergarten through secondary education

schools and tutorial schools. Certain higher education loans have repayment terms similar to FFELP Loans,

whereby repayments begin after the borrower leaves school while others require repayment of interest or a fixed

pay amount while the borrower is still in school. Our higher education Private Education Loans are not

dischargeable in bankruptcy, except in certain limited circumstances.

In the context of our Private Education Loan business, we use the term “non-traditional loans” to describe

education loans made to certain borrowers that have or are expected to have a high default rate as a result of a

number of factors, including having a lower tier credit rating, low program completion and graduation rates or,

G-3