Sallie Mae 2011 Annual Report Download - page 51

Download and view the complete annual report

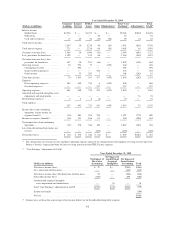

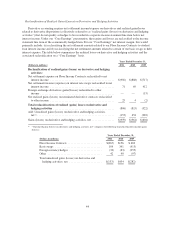

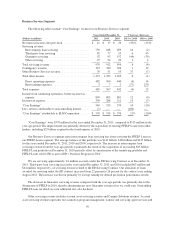

Please find page 51 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In establishing the allowance for Private Education Loan losses as of December 31, 2011, we considered

several factors with respect to our Private Education Loan portfolio. In particular, we continue to see improving

credit quality and continuing positive delinquency and charge-off trends in connection with this portfolio.

Improving credit quality is seen in higher FICO scores and cosigner rates, as well as a more seasoned portfolio

compared with the previous year. The delinquency rate has declined to 10.1 percent from 10.6 percent and the

charge-off rate has declined to 3.7 percent from 5.0 percent compared with the previous year.

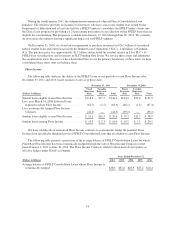

Apart from these overall improvements in credit quality, delinquency and charge-off trends, Private

Education Loans which defaulted between 2008 and 2011 for which we have previously charged off estimated

losses have, to varying degrees, not met our post-default recovery expectations to date and may continue not to

do so. We have been charging off these periodic shortfalls in expected recoveries against our allowance for

Private Education Loan losses and the related receivable for partially charged-off Private Education Loans and

we will continue to do so. Differences in actual future recoveries on these defaulted loans could affect our

receivable for partially charged-off Private Education Loans. In the third quarter of 2011, we increased our

provision for Private Education Loan losses for the quarter in the amount of $143 million to reflect these

uncertainties. Continuing historically high unemployment rates may negatively affect future Private Education

Loan default and recovery expectations over our estimated two-year loss confirmation period. Consequently, we

have also given consideration to these factors in projecting charge-offs for this period and establishing our

allowance for Private Education Loan losses. We will continue to monitor defaults and recoveries in light of the

continuing weak economy and high unemployment rates. For a more detailed discussion of our policy for

determining the collectability of Private Education Loan and maintaining our allowance for Private Education

Loan losses, see “Critical Accounting Policies and Estimates—Allowance for Loan Losses.”

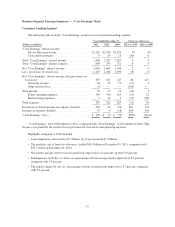

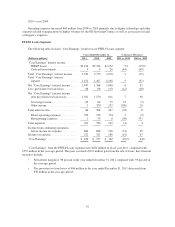

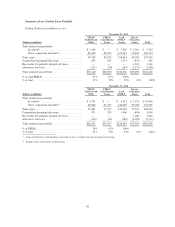

Servicing Revenue and Other Income — Consumer Lending Segment

Servicing revenue for our Consumer Lending segment primarily includes late fees and forbearance fees. For

the years ended December 31, 2011, 2010 and 2009, servicing revenue for our Consumer Lending segment

totaled $64 million, $72 million and $70 million, respectively. Included in other income for the year ended

December 31, 2011 was a $9 million mark-to-market loss related to classifying our entire $12 million portfolio of

non-U.S. dollar-denominated student loans as held-for-sale.

Operating Expenses — Consumer Lending Segment

Operating expenses for our Consumer Lending segment include costs incurred to originate Private

Education Loans and to service and collect on our Private Education Loan portfolio. For the years ended

December 31, 2011, 2010 and 2009, operating expenses for our Consumer Lending segment totaled

$304 million, $350 million and $265 million, respectively.

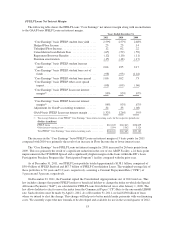

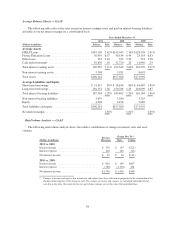

2011 versus 2010

The decrease in operating expenses in the year ended December 31, 2011 compared with the year-ago

period was primarily the result of our cost cutting initiatives. Operating expenses, excluding restructuring-related

asset impairments, were 82 basis points and 96 basis points of average Private Education Loans in the years

ended December 31, 2011 and 2010, respectively.

2010 versus 2009

Operating expenses increased $85 million from 2009, primarily as the result of a non-recurring $11 million

benefit in 2009 related to reversing a contingency reserve, an increase in collection and servicing costs from a

higher number of loans in repayment and delinquency status and higher marketing and technology enhancement

costs related to Private Education Loans in 2010. Operating expenses, excluding restructuring-related asset

impairments, were 96 basis points and 74 basis points, respectively, of average “Core Earnings” basis Private

Education Loans in the years ended December 31, 2010 and 2009.

49