Sallie Mae 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

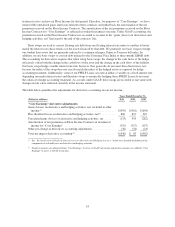

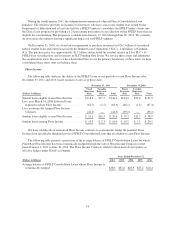

2010 versus 2009

Operating expenses increased $60 million from 2009 to 2010 primarily due to higher technology and other

expenses related to preparation for higher volumes for the ED Servicing Contract as well as an increase in legal

contingency expenses.

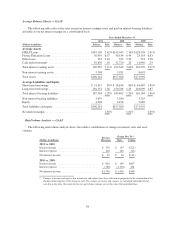

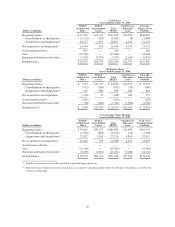

FFELP Loans Segment

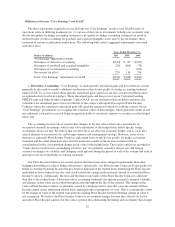

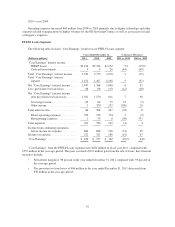

The following table includes “Core Earnings” results for our FFELP Loans segment.

Years Ended December 31, % Increase (Decrease)

(Dollars in millions) 2011 2010 2009 2011 vs. 2010 2010 vs. 2009

“Core Earnings” interest income:

FFELP Loans .................... $2,914 $2,766 $3,252 5% (15)%

Cash and investments .............. 5 9 26 (44) (65)

Total “Core Earnings” interest income . . 2,919 2,775 3,278 5 (15)

Total “Core Earnings” interest

expense ......................... 1,472 1,407 2,238 5 (37)

Net “Core Earnings” interest income .... 1,447 1,368 1,040 6 32

Less: provisions for loan losses ........ 86 98 119 (12) (18)

Net “Core Earnings” interest income

after provisions for loan losses ....... 1,361 1,270 921 7 38

Servicing revenue ................. 85 68 75 25 (9)

Other income .................... 1 320 292 (100) 10

Total other income .................. 86 388 367 (78) 6

Direct operating expenses .......... 760 736 754 3 (2)

Restructuring expenses ............. 1 54 8 (98) 575

Total expenses ..................... 761 790 762 (4) 4

Income from continuing operations,

before income tax expense .......... 686 868 526 (21) 65

Income tax expense ................. 252 311 186 (19) 67

“Core Earnings” .................... $ 434 $ 557 $ 340 (22)% 64%

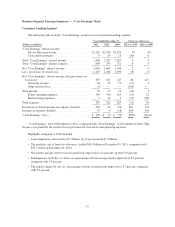

“Core Earnings” from the FFELP Loans segment were $434 million in fiscal year 2011, compared with

$557 million in the year-ago period. The prior year had a $321 million gain from the sale of loans. Key financial

measures include:

• Net interest margin of .98 percent in the year ended December 31, 2011 compared with .93 percent in

the year-ago period.

• The provision for loan losses of $86 million in the year ended December 31, 2011 decreased from

$98 million in the year-ago period.

52