Sallie Mae 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In the fourth-quarter 2011, we also closed a $3.4 billion Private Education Loan asset-backed commercial

paper facility that matures in January 2014. This facility was used to finance the call of Private Education Loan

asset-backed securities at significant discounts to the par value.

We also achieved a key management objective of again being able to return capital to our shareholders.

During the second and third quarters of 2011, we repurchased 19.1 million common shares on the open market as

part of our previously announced $300 million share repurchase program authorization. We have fully utilized

this authorization. We declared and paid a $.10 per share dividend during the second, third and fourth quarters of

2011.

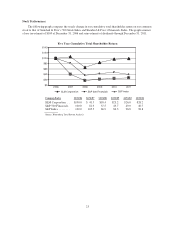

2011 Management Objectives

In 2011 we set out five major goals to create shareholder value. They were: (1) reduce our operating

expenses; (2) prudently grow Consumer Lending segment assets and revenue; (3) increase Business Services

segment revenue; (4) maximize cash flows from FFELP Loans; and (5) reinstate dividends and/or share

repurchases. We believe we achieved each of these objectives in 2011. The following describes our performance

relative to each of our 2011 goals.

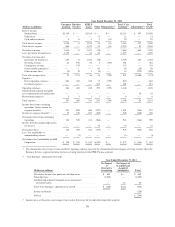

Reduce Operating Expenses

The elimination of FFELP by HCERA greatly reduced our revenue generating capabilities. In 2010 we

originated $14 billion of loans, 84 percent of them FFELP Loans; in 2011 we originated $2.7 billion of new

loans, all of them Private Education Loans. As a result of the decline in our FFELP related revenue, we

determined we must effectively match our cost structure to our ongoing business. As such, we set a goal of

having a quarterly operating expense of $250 million in the fourth quarter of 2011 (by comparison, our 2010

fourth-quarter operating expenses were $308 million). We achieved this goal as our fourth-quarter 2011

operating expenses were $243 million.

Prudently Grow Consumer Lending Segment Assets and Revenue

Successfully growing Private Education Loan lending is the key component of our long-term plan to grow

shareholder value. We achieved this goal by originating increasing numbers of high quality Private Education

Loans, with higher net interest margins and lower charge-offs and provision for loan losses. Originations were 19

percent higher in 2011 compared with 2010 with average FICO and cosigner rates higher compared with the

prior year. “Core Earnings” net interest margin increased from 3.9 percent to 4.1 percent. Charge-offs decreased

to 3.7 percent of loans in repayment from 5.0 percent in 2010. Provision for loan loss decreased to $1.18 billion

from $1.3 billion in 2010.

Increase Business Services Segment Revenue

Our Business Services segment comprises several businesses with customers related to FFELP that will

experience revenue declines and several businesses with customers that provide growth opportunities. Our

growth businesses are ED servicing, ED collections, other school-based asset type servicing and collections,

Campus Solutions, Sallie Mae Insurance Services, transaction processing and 529 college-savings plan account

asset servicing. We achieved this goal as our Business Services segment revenue increased from $1.3 billion in

2010 to $1.4 billion in 2011.

• Our allocation of new customer loans awarded for servicing under our ED Servicing Contract increased

from 22 percent to 26 percent for the current contract year ending August 15, 2012. The increase was

driven primarily by our top ranking for default prevention performance results. We are servicing

approximately 3.6 million accounts under the ED Servicing Contract as of December 31, 2011.

• Campus Solutions added 44 new refund disbursement clients in 2011. We also announced a Sallie Mae

Bank No-Fee Student Checking Account with Debit as an enhanced refund disbursement choice for

schools and students. This new option complements existing Campus Solutions refund disbursement

choices that include electronic deposit to the bank account of the student’s choice, debit card or a check.

29