Sallie Mae 2011 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

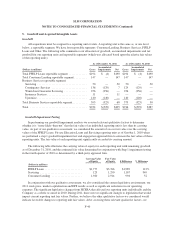

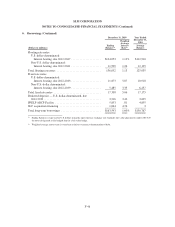

5. Goodwill and Acquired Intangible Assets

Goodwill

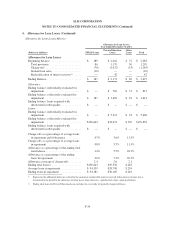

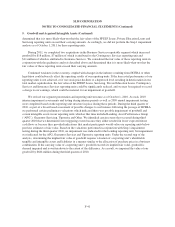

All acquisitions must be assigned to a reporting unit or units. A reporting unit is the same as, or one level

below, a reportable segment. We have four reportable segments: Consumer Lending, Business Services, FFELP

Loans and Other. The following table summarizes our allocation of goodwill, accumulated impairments and net

goodwill for our reporting units and reportable segments (which was allocated based upon the relative fair values

of the reporting units).

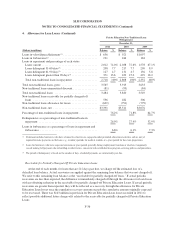

As of December 31, 2011 As of December 31, 2010

(Dollars in millions) Gross

Accumulated

Impairments Net Gross

Accumulated

Impairments Net

Total FFELP Loans reportable segment ............. $194 $ (4) $190 $194 $ (4) $190

Total Consumer Lending reportable segment ......... 147 — 147 147 — 147

Business Services reportable segment:

Servicing ................................... 50 — 50 50 — 50

Contingency Services ......................... 136 (129) 7 129 (129) —

Wind-down Guarantor Servicing ................ 256 (256) — 256 (256) —

Insurance Services ............................ 11 — 11 — — —

Upromise ................................... 140 (140) — 140 (140) —

Total Business Services reportable segment .......... 593 (525) 68 575 (525) 50

Total ........................................ $934 $(529) $405 $916 $(529) $387

Goodwill Impairment Testing

In performing our goodwill impairment analysis we assessed relevant qualitative factors to determine

whether it is “more-likely-than-not” that the fair value of an individual reporting unit is less than its carrying

value. As part of our qualitative assessment, we considered the amount of excess fair value over the carrying

values of the FFELP Loans, Private Education Loans and Servicing reporting units as of October 1, 2010 when

we performed a step 1 goodwill impairment test and engaged an appraisal firm to estimate the fair values of these

reporting units. The fair value of each reporting unit significantly exceeded its carrying amount.

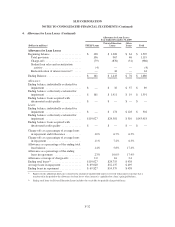

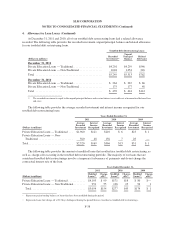

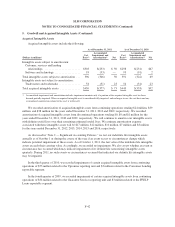

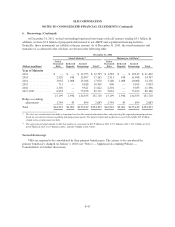

The following table illustrates the carrying value of equity for each reporting unit with remaining goodwill

as of December 31, 2010, and the estimated fair value determined in conjunction with Step 1 impairment testing

in the fourth quarter of 2010 as determined by a third-party appraisal firm.

Carrying Value

of Equity

Fair Value

of Equity $ Difference % Difference

(Dollars in millions)

FFELP Loans .......................... $1,777 $3,766 $1,989 112%

Servicing ............................. 123 1,290 1,167 949

Consumer Lending ..................... 1,920 2,914 994 52

In conjunction with our qualitative assessment, we also considered the current legislative environment, our

2011 stock price, market capitalization and EPS results as well as significant reductions in our operating

expenses. The significant legislative changes from HCERA that affected our reporting units individually and the

Company as a whole occurred in 2010. During 2011, there were no significant changes to legislation that would

impact current reporting unit fair values. Further, we believe the other qualitative factors we considered would

indicate favorable changes to reporting unit fair values. After assessing these relevant qualitative factors, we

F-40