Sallie Mae 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

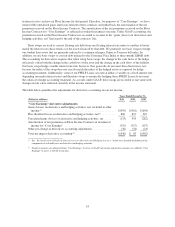

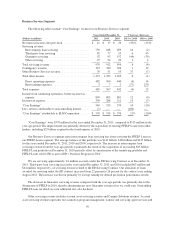

Cumulative Impact of Derivative Accounting under GAAP compared to “Core Earnings”

As of December 31, 2011, derivative accounting has reduced GAAP equity by approximately $1.0 billion as

a result of approximately $1.0 billion (after-tax) of cumulative net unrealized net losses recognized for GAAP,

but not in “Core Earnings.” The following table rolls forward the cumulative impact to GAAP equity due to these

unrealized net losses related to derivative accounting.

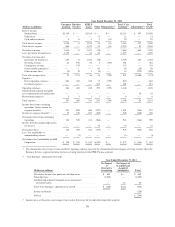

Years Ended December 31,

(Dollars in millions) 2011 2010 2009

Beginning impact of derivative accounting on

GAAP equity .............................. $(676) $(737) $(452)

Net impact of net unrealized gains/(losses) under

derivative accounting ........................ (301) 61 (285)

Ending impact of derivative accounting on GAAP

equity .................................... $(977) $(676) $(737)

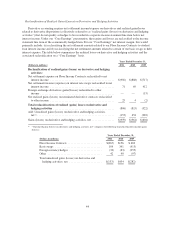

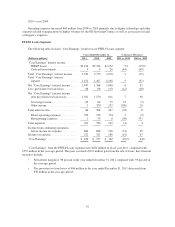

In addition, net Floor premiums received on Floor Income Contracts that have not been amortized into

“Core Earnings” as of the respective year-ends are presented in the table below. These net premiums will be

recognized in “Core Earnings” in future periods and are presented below net of tax. As of December 31, 2011,

the remaining amortization term of the net floor premiums was approximately 4.5 years.

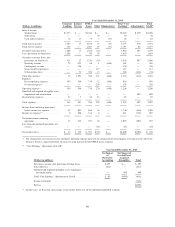

(Dollars in millions)

December 31,

2011

December 31,

2010

December 31,

2009

Unamortized net Floor premiums

(net of tax) ................... $(772) $(363) $(421)

2) Goodwill and Acquired Intangibles: Our “Core Earnings” exclude goodwill and intangible impairment

and the amortization of acquired intangibles. The following table summarizes the goodwill and acquired

intangible adjustments.

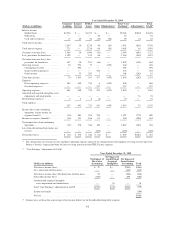

Years Ended December 31,

(Dollars in millions) 2011 2010 2009

“Core Earnings” goodwill and acquired intangibles adjustments:

Goodwill and intangible impairment of acquired intangibles from continuing

operations ........................................................... $— $(660) $(36)

Goodwill and intangible impairment of acquired intangibles from discontinued

operations, net of tax .................................................. — — (1)

Amortization of acquired intangibles from continuing operations ................. (24) (39) (38)

Amortization of acquired intangibles from discontinued operations, net of tax ....... — — (1)

Total “Core Earnings” goodwill and acquired intangibles adjustments(1) ............ $(24) $(699) $(76)

(1) Negative amounts are subtracted from “Core Earnings” to arrive at GAAP net income and positive amounts are added to “Core

Earnings” to arrive at GAAP net income.

45