Sallie Mae 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Assets under management in 529 college-savings plans total $37.5 billion and grew 9 percent year-over-

year. We recently were selected to continue as the program manager for New York’s 529 College Savings

Program under a seven-year contract, which is currently being negotiated. New York has the largest direct

529 plan in the country.

• We launched Sallie Mae Insurance Services in 2011, offering college students and higher education

institutions tuition, renters’ and student health insurance.

• We acquired SC Services & Associates, Inc., a provider of collections services to local governments and

courts to enhance and complement our other contingency collection businesses.

Maximize Cash Flows from FFELP Loans

We have a $138 billion portfolio of FFELP Loans that is expected to generate significant amounts of cash

flow and earnings in the coming years. We planned to improve our net interest margin, further minimize income

volatility and opportunistically purchase additional FFELP Loan portfolios such as the portfolio we purchased at

the end of 2010. We achieved this goal in 2011 by acquiring $1.6 billion of FFELP loans and improving our net

interest margin from 93 basis points in 2010 to 98 basis points in 2011.

Reinstate Dividends and/or Share Repurchases

We achieved our objective of either paying dividends or repurchasing shares, or both by the second half of

2011. Beginning in June, we began to pay quarterly dividends of $.10 per share on our common stock, the first

since 2007. In April 2011, we authorized the repurchase of up to $300 million of outstanding common stock in

open-market transactions and terminated all previous authorizations. During the second and third quarters of

2011, we paid $300 million to repurchase 19.1 million common shares on the open market.

2012 Outlook

We expect the operating strength we demonstrated in 2011 to continue in 2012. We plan to increase “Core

Earnings” primarily through improving Private Education Loan portfolio performance and lower operating

expenses. Loan originations are also expected to increase in 2012.

We expect to remain an active participant in the capital markets in 2012. Our term ABS activity will feature

multiple transactions backed by both FFELP collateral, primarily reducing the ED Conduit Facility, as well as

Private Education Loan collateral. We will remain an opportunistic issuer in the unsecured debt markets

primarily to facilitate asset liability management activities. Recent transactions in all of the above mentioned

categories have been met with strong demand and provide term financing which is a key component of our

business model.

Recognizing the strong financial position we are in, the Board of Directors approved a 25 percent increase

in our quarterly dividend and a $500 million share repurchase program in January 2012. Despite this significant

return of capital to our shareholders from earnings, we expect to end 2012 with a stronger balance sheet and

better capital ratios.

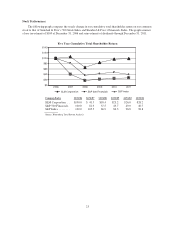

Credit losses within our Private Education Loan portfolio are primarily driven by the quality of loans

entering repayment, improving underlying portfolio quality, the quality of new originations and the general

economic environment. The fourth-quarter 2011 repayment cohort, at $1.5 billion, was the smallest in the last

five years, and had better FICO scores and higher cosigner rates than in previous years which should result in

lower future losses. The underlying portfolio has continued to improve with 62 percent of the loans cosigned, less

than 10 percent non-traditional and over 72 percent of our customers currently in repayment having made more

than 12 payments. In addition, the loans originated in 2011 had an average FICO score of 748 and were 91

percent cosigned; these statistics are our highest ever for a loan origination cohort. As a result, we believe that

charge-offs and provision for loan losses will continue their downward trend.

30