Sallie Mae 2011 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

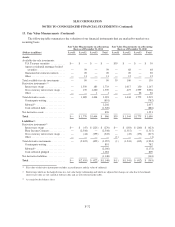

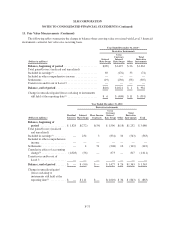

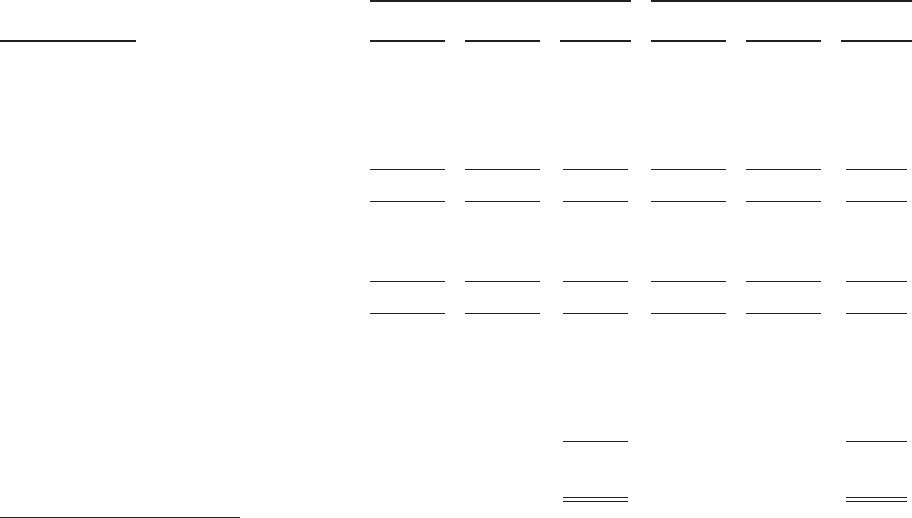

13. Fair Value Measurements (Continued)

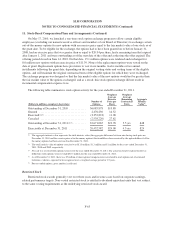

The following table summarizes the fair values of our financial assets and liabilities, including derivative

financial instruments.

December 31, 2011 December 31, 2010

(Dollars in millions)

Fair

Value

Carrying

Value Difference

Fair

Value

Carrying

Value Difference

Earning assets

FFELP Loans ..................... $134,196 $138,130 $ (3,934) $147,163 $148,649 $(1,486)

Private Education Loans ............. 33,968 36,290 (2,322) 30,949 35,656 (4,707)

Other loans ....................... 73 193 (120) 88 270 (182)

Cash and investments(1) .............. 9,789 9,789 — 11,553 11,553 —

Total earning assets ................... 178,026 184,402 (6,376) 189,753 196,128 (6,375)

Interest-bearing liabilities

Short-term borrowings ................ 29,547 29,573 26 33,604 33,616 12

Long-term borrowings ................ 141,605 154,393 12,788 154,355 163,544 9,189

Total interest-bearing liabilities ......... 171,152 183,966 12,814 187,959 197,160 9,201

Derivative financial instruments

Floor Income Contracts ............... (2,544) (2,544) — (1,315) (1,315) —

Interest rate swaps .................... 1,463 1,463 — 744 744 —

Cross currency interest rate swaps ....... 1,116 1,116 — 1,811 1,811 —

Other .............................. 1 1 — 25 25 —

Excess of net asset fair value over

carrying value .................... $ 6,438 $ 2,826

(1) “Cash and investments” includes available-for-sale investments that consist of investments that are primarily U.S. Treasury or U.S.

agency securities whose cost basis is $85 million and $137 million at December 31, 2011 and 2010, respectively, versus a fair value of

$90 million and $139 million at December 31, 2011 and 2010, respectively.

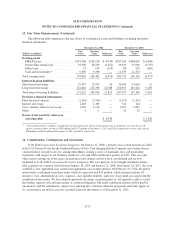

14. Commitments, Contingencies and Guarantees

In Re SLM Corporation Securities Litigation. On January 31, 2008, a putative class action lawsuit was filed

in the U.S. District Court for the Southern District of New York alleging that the Company and certain officers

violated federal securities laws by, among other things, issuing a series of materially false and misleading

statements with respect to our financial results for year-end 2006 and the first quarter of 2007. This case and

other actions arising out of the same circumstances and alleged acts have been consolidated and are now

identified as In Re SLM Corporation Securities Litigation. The case purports to be brought on behalf of those

who acquired our common stock between January 18, 2007 and January 23, 2008. On January 24, 2012, the court

certified a class, appointed class counsel and appointed a class representative. On February 10, 2012, the parties

entered into a settlement term sheet under which we agreed to pay $35 million, which amount includes all

attorneys’ fees, administration costs, expenses, class member benefits, and costs of any kind associated with the

resolution of this matter. We have denied vigorously all claims asserted against us, but agreed to settle to avoid

the burden, expense, risk and uncertainty of continued litigation. The entire settlement amount will be paid by

our insurers and the settlement is subject to us entering into a formal settlement agreement and Court approval.

As a result there are no loss accruals recorded related to this matter as of December 31, 2011.

F-75