Sallie Mae 2011 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

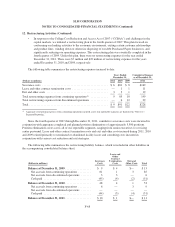

11. Stock-Based Compensation Plans and Arrangements (Continued)

The fair value of restricted stock awards is determined on the grant date based on our stock price and is

amortized to compensation cost on a straight-line basis over the related vesting periods.

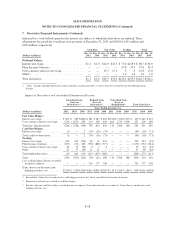

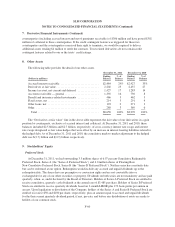

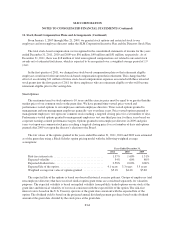

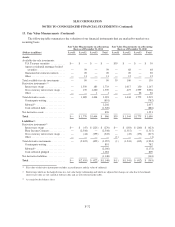

The following table summarizes restricted stock activity for the year ended December 31, 2011.

Number of

Shares

Weighted

Average Grant

Date

Fair Value

Non-vested at December 31, 2010 ................................ 701,737 $11.98

Granted ..................................................... 166,750 13.56

Vested(1) .................................................... (451,625) 12.98

Canceled .................................................... (4,000) 10.31

Non-vested at December 31, 2011(2) .............................. 412,862 $12.07

(1) The total fair value of shares that vested during the years ended December 31, 2011, 2010 and 2009, was $6 million, $9 million and

$9 million, respectively.

(2) As of December 31, 2011, there was $1 million of unrecognized compensation cost related to restricted stock net of estimated

forfeitures, which is expected to be recognized over a weighted average period of 1.4 years.

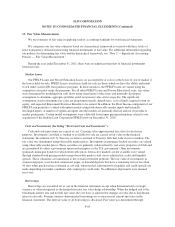

Restricted Stock Units

Restricted stock units (“RSUs”) are equity awards granted to employees that entitle the holder to shares of

our common stock when the award vests. The fair value of each grant is determined on the grant date based on

our stock price and is amortized to compensation cost on a straight-line basis over the related vesting periods.

RSUs generally vest over three years and in some cases based on corporate earnings-related performance targets.

Non-vested RSUs are entitled to dividend equivalent units that vest subject to the same vesting requirements as

the underlying RSU award.

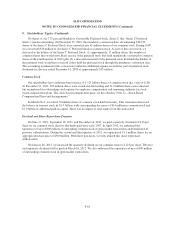

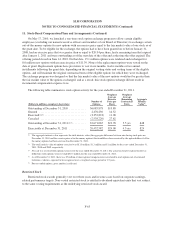

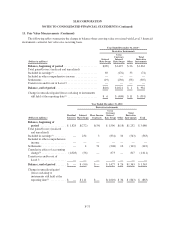

The following table summarizes RSU activity for the year ended December 31, 2011.

Number of

RSUs

Weighted

Average Grant

Date

Fair Value

Outstanding at December 31, 2010 .............................. 96,681 $10.50

Granted .................................................... 2,779,075 14.75

Vested and converted to common stock(1) ......................... (41,625) 10.45

Canceled ................................................... (103,441) 14.61

Outstanding at December 31, 2011(2) ............................. 2,730,690 $14.67

(1) The total fair value of RSUs that vested and converted to common stock during the years ended December 31, 2011, 2010 and 2009

was $.4 million, $.4 million and $.1 million, respectively.

(2) As of December 31, 2011, there was $11 million of unrecognized compensation cost related to RSUs net of estimated forfeitures,

which is expected to be recognized over a weighted average period of 2.2 years.

F-66