Sallie Mae 2011 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

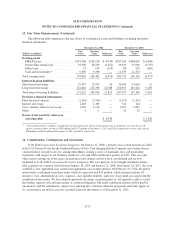

15. Income Taxes (Continued)

As of December 31, 2011, the gross unrecognized tax benefits are $45.9 million. Included in the

$45.9 million are $22.3 million of unrecognized tax benefits that, if recognized, would favorably impact the

effective tax rate.

The IRS began the examination of our 2009 U.S. federal income tax returns during the fourth quarter of

2010, and we expect to resolve this audit during 2012. The resolution of the 2009 audit will not have a material

impact on our unrecognized tax benefits.

The Company or one of its subsidiaries files income tax returns at the U.S. federal level, in most U.S. states,

and various foreign jurisdictions. U.S. federal income tax returns filed for years 2008 and prior have been audited

and are now resolved. Various combinations of subsidiaries, tax years, and jurisdictions remain open for review,

subject to statute of limitations periods (typically 3 to 4 prior years).

16. Segment Reporting

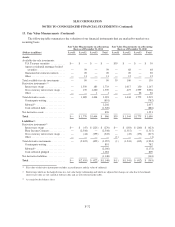

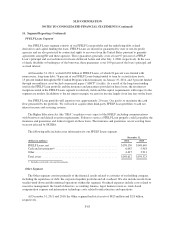

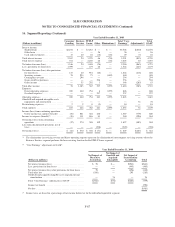

We monitor and assess our ongoing operations and results by three primary operating segments — the

Consumer Lending operating segment, the Business Services operating segment and the FFELP Loan operating

segment. These three operating segments meet the quantitative thresholds for reportable segments. Accordingly,

the results of operations of our Consumer Lending, Business Services and FFELP Loans segments are presented

separately. We have smaller operating segments that consist of business operations that have either been

discontinued or are winding down. These operating segments do not meet the quantitative thresholds to be

considered reportable segments. As a result, the results of operations for these operating segments (Purchased

Paper business and mortgage and other loan business) are combined with gains/losses from the repurchase of

debt, the financial results of our corporate liquidity portfolio and all overhead within the Other reportable

segment. The management reporting process measures the performance of our operating segments based on our

management structure, as well as the methodology we used to evaluate performance and allocate resources.

Management, including our chief operating decision makers, evaluates the performance of our operating

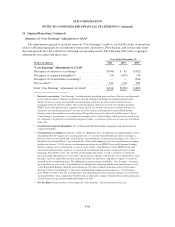

segments based on their profitability. As discussed further below, we measure the profitability of our operating

segments based on “Core Earnings.” Accordingly, information regarding our reportable segments is provided

based on a “Core Earnings” basis.

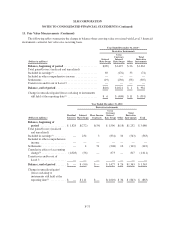

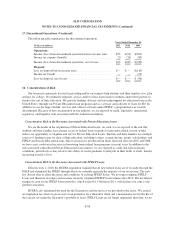

Consumer Lending Segment

In this segment, we originate, acquire, finance and service Private Education Loans. The Private Education

Loans we make are largely to bridge the gap between the cost of higher education and the amount funded through

financial aid, federal loans or borrowers’ resources.

Private Education Loans bear the full credit risk of the borrower. We manage this risk by underwriting and

pricing according to credit risk based upon customized credit scoring criteria and the addition of qualified

cosigners. For the year ended December 31, 2011, our annual charge-off rate for Private Education Loans (as a

percentage of loans in repayment) was 3.7 percent, as compared to 5.0 percent for the prior year.

In 2011, we originated $2.7 billion of Private Education Loans, an increase of 19 percent from the prior year

even as borrowings under Private Education Loan programs contracted by approximately 12 percent. As of

December 31, 2011 and 2010, we had $36.3 billion and $35.7 billion of Private Education Loans outstanding,

respectively. At December 31, 2011, 56 percent of our Private Education Loans were funded with non-recourse,

long-term debt; 51 percent of our Private Education Loans being funded to term by securitization trusts.

F-80