Sallie Mae 2011 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

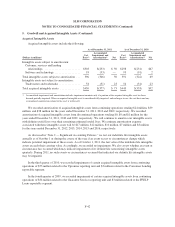

6. Borrowings (Continued)

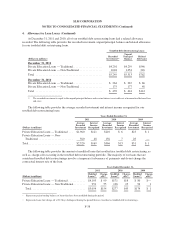

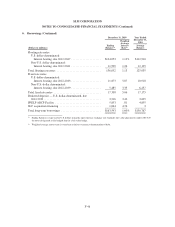

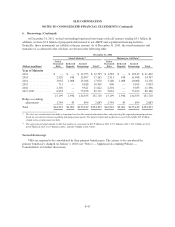

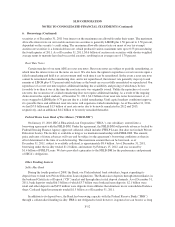

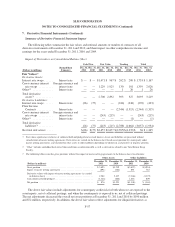

At December 31, 2011, we had outstanding long-term borrowings with call features totaling $5.1 billion. In

addition, we have $7.4 billion of prepayable debt related to our ABCP and acquisition financing facilities.

Generally, these instruments are callable at the par amount. As of December 31, 2011, the stated maturities and

maturities if accelerated to the call dates are shown in the following table:

December 31, 2011

Stated Maturity(1) Maturity to Call Date(1)

(Dollars in millions)

Senior

Unsecured

Debt

Brokered

Deposits

Secured

Borrowings Total(2)

Senior

Unsecured

Debt

Brokered

Deposits

Secured

Borrowings Total

Year of Maturity

2012 ............... $ — $ — $ 12,795 $ 12,795 $ 1,583 $ — $ 19,819 $ 21,402

2013 ............... 2,320 948 13,897 17,165 2,311 948 11,488 14,747

2014 ............... 3,034 1,008 13,036 17,078 3,160 1,008 10,008 14,176

2015 ............... 711 — 9,628 10,339 800 — 9,103 9,903

2016 ............... 2,301 — 9,321 11,622 2,301 — 9,035 11,336

2017-2047 ........... 6,833 — 75,878 82,711 5,044 — 75,102 80,146

15,199 1,956 134,555 151,710 15,199 1,956 134,555 151,710

Hedge accounting

adjustments ........ 1,744 45 894 2,683 1,744 45 894 2,683

Total ............... $16,943 $2,001 $135,449 $154,393 $16,943 $2,001 $135,449 $154,393

(1) We view our securitization trust debt as long-term based on the contractual maturity dates and projecting the expected principal paydowns

based on our current estimates regarding loan prepayment speeds. The projected principal paydowns in year 2012 include $12.8 billion

related to the securitization trust debt.

(2) The aggregate principal amount of debt that matures in each period is $12.9 billion in 2012, $17.3 billion in 2013, $17.2 billion in 2014,

$10.4 billion in 2015, $11.7 billion in 2016, and $83.3 billion in 2017-2047.

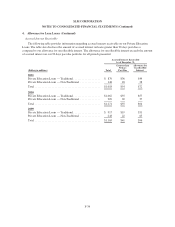

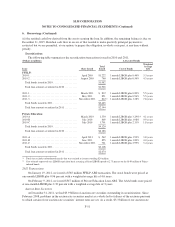

Secured Borrowings

VIEs are required to be consolidated by their primary beneficiaries. The criteria to be considered the

primary beneficiary changed on January 1, 2010 (see “Note 2 — Significant Accounting Policies —

Consolidation” for further discussion).

F-47