Sallie Mae 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

6. Borrowings (Continued)

(ii) the residual cash flow derived from the assets securing the loan. In addition, the remaining balance is due on

December 31, 2015. Residual cash flow in excess of that needed to make quarterly principal payments is

restricted but we are permitted, at our option, to prepay the obligation, in whole or in part, at any time without

penalty.

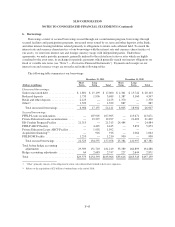

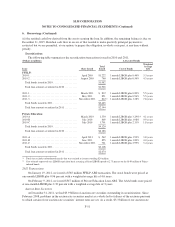

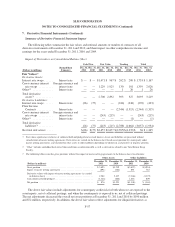

Securitizations

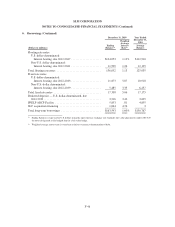

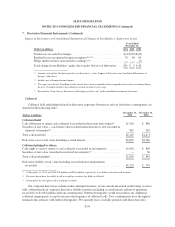

The following table summarizes the securitization transactions issued in 2010 and 2011.

(Dollars in millions) AAA-rated bonds

Issue Date Issued

Total

Issued Cost of Funds

Weighted

Average

Life

FFELP:

2010-1 ..................................... April 2010 $1,222 1 month LIBOR plus 0.46% 3.3 years

2010-2 ..................................... August 2010 760 1 month LIBOR plus 0.56% 4.3 years

Total bonds issued in 2010 ................... $1,982

Total loan amount securitized in 2010 .......... $1,965

2011-1 ..................................... March 2011 $ 812 1 month LIBOR plus 0.89% 5.5 years

2011-2 ..................................... May2011 821 1 month LIBOR plus 0.94% 5.5 years

2011-3 ..................................... November 2011 812(1) 1 month LIBOR plus 1.28% 7.8 years

Total bonds issued in 2011 ................... $2,445

Total loan amount securitized in 2011 .......... $2,344

Private Education:

2010-A March 2010 1,550 1 month LIBOR plus 3.29%(2) 4.1 years

2010-B .................................... July 2010 869 1 month LIBOR plus 1.98% 0.9 years

2010-C .................................... July 2010 1,701 1 month LIBOR plus 2.33% 1.8 years

Total bonds issued in 2010 ................... $4,120

Total loan amount securitized in 2010 .......... $6,186

2011-A .................................... April 2011 $ 562 1 month LIBOR plus 1.99% 3.8 years

2011-B .................................... June 2011 825 1 month LIBOR plus 1.89% 4.0 years

2011-C .................................... November 2011 721 1 month LIBOR plus 2.99% 3.4 years

Total bonds issued in 2011 ................... $2,108

Total loan amount securitized in 2011 .......... $2,674

(1) Total size excludes subordinated tranche that was retained at issuance totaling $24 million.

(2) Cost of funds expressed on a LIBOR-equivalent basis assuming a Prime/LIBOR spread of 2.75 percent on the $149 million of Prime-

indexed bonds.

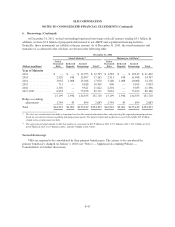

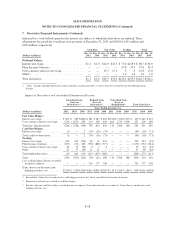

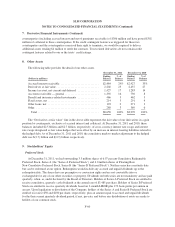

2012 Transactions

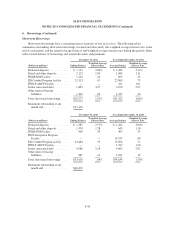

On January 19, 2012, we issued a $765 million FFELP ABS transaction. The AAA bonds were priced at

one-month LIBOR plus 0.96 percent with a weighted average life of 4.6 years.

On February 9, 2012, we issued $547 million of Private Education Loan ABS. The AAA bonds were priced

at one-month LIBOR plus 2.32 percent with a weighted average life of 3 years.

Auction Rate Securities

At December 31, 2011, we had $3.9 billion of auction rate securities outstanding in securitizations. Since

February 2008, problems in the auction rate securities market as a whole led to failures of the auctions pursuant

to which certain of our auction rate securities’ interest rates are set. As a result, $3.3 billion of our auction rate

F-51