PNC Bank 2013 Annual Report Download - page 99

Download and view the complete annual report

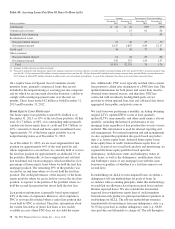

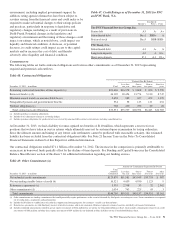

Please find page 99 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(a) An account is considered in re-default if it is 60 days or more delinquent after modification. The data in this table represents loan modifications completed during the quarters ending

June 30, 2012 through June 30, 2013 and represents a vintage look at all quarterly accounts and the number of those modified accounts (for each quarterly vintage) 60 days or more

delinquent at six, nine, twelve, and fifteen months after modification. Account totals include active and inactive accounts that were delinquent when they achieved inactive status.

Accounts that are no longer 60 days or more delinquent, or were re-modified since prior period, are removed from re-default status in the period they are cured or re-modified.

(b) Vintage refers to the quarter in which the modification occurred.

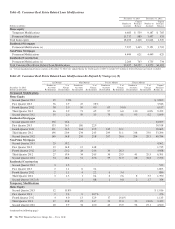

(c) Reflects December 31, 2013 unpaid principal balances of the re-defaulted accounts for the Second Quarter 2013 Vintage at Six Months, for the First Quarter 2013 Vintage at Nine

Months, for the Fourth Quarter 2012 Vintage at Twelve Months, and for the Third Quarter 2012 and prior Vintages at Fifteen Months.

(d) There were no Residential Construction modified loans which became six months past due in the third quarter of 2012.

In addition to temporary loan modifications, we may make

available to a borrower a payment plan or a HAMP trial

payment period. Under a payment plan or a HAMP trial

payment period, there is no change to the loan’s contractual

terms so the borrower remains legally responsible for payment

of the loan under its original terms.

Payment plans may include extensions, re-ages and/or

forbearance plans. All payment plans bring an account current

once certain requirements are achieved and are primarily

intended to demonstrate a borrower’s renewed willingness and

ability to re-pay. Due to the short term nature of the payment

plan, there is a minimal impact to the ALLL.

Under a HAMP trial payment period, we establish an alternate

payment, generally at an amount less than the contractual

payment amount, for the borrower during this short time

period. This allows a borrower to demonstrate successful

payment performance before permanently restructuring the

loan into a HAMP modification. Subsequent to successful

borrower performance under the trial payment period, we will

capitalize the original contractual amount past due and

restructure the loan’s contractual terms, along with bringing

the restructured account to current. As the borrower is often

already delinquent at the time of participation in the HAMP

trial payment period, there is not a significant increase in the

ALLL. If the trial payment period is unsuccessful, the loan

will be evaluated for further action based upon our existing

policies.

Residential conforming and certain residential construction

loans have been permanently modified under HAMP or, if

they do not qualify for a HAMP modification, under PNC-

developed programs, which in some cases may operate

similarly to HAMP. These programs first require a reduction

of the interest rate followed by an extension of term and, if

appropriate, deferral of principal payments. As of

December 31, 2013 and December 31, 2012, 5,834 accounts

with a balance of $.9 billion and 4,188 accounts with a

balance of $.6 billion, respectively, of residential real estate

loans had been modified under HAMP and were still

outstanding on our balance sheet.

We do not re-modify a defaulted modified loan except for

subsequent significant life events, as defined by the OCC. A

modified loan continues to be classified as a TDR for the

remainder of its term regardless of subsequent payment

performance.

C

OMMERCIAL

L

OAN

M

ODIFICATIONS AND

P

AYMENT

P

LANS

Modifications of terms for commercial loans are based on

individual facts and circumstances. Commercial loan

modifications may involve reduction of the interest rate,

extension of the term of the loan and/or forgiveness of

principal. Modified commercial loans are usually already

nonperforming prior to modification. We evaluate these

modifications for TDR classification based upon whether we

granted a concession to a borrower experiencing financial

difficulties. Additional detail on TDRs is discussed below as

well as in Note 5 Asset Quality in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

Beginning in 2010, we established certain commercial loan

modification and payment programs for small business loans,

Small Business Administration loans, and investment real

estate loans. As of December 31, 2013 and December 31,

2012, $47 million and $68 million, respectively, in loan

balances were covered under these modification and payment

plan programs. Of these loan balances, $16 million and $24

million have been determined to be TDRs as of December 31,

2013 and December 31, 2012.

The PNC Financial Services Group, Inc. – Form 10-K 81