PNC Bank 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B

LACK

R

OCK

(Unaudited)

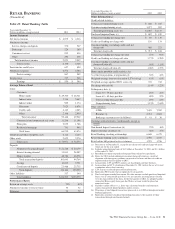

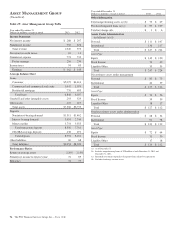

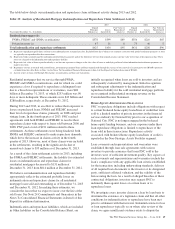

Table 27: BlackRock Table

Information related to our equity investment in BlackRock

follows:

Year ended December 31

Dollars in millions 2013 2012

Business segment earnings (a) $469 $395

PNC’s economic interest in

BlackRock (b) 22% 22%

(a) Includes PNC’s share of BlackRock’s reported GAAP earnings and additional

income taxes on those earnings incurred by PNC.

(b) At December 31.

In billions

December 31

2013

December 31

2012

Carrying value of PNC’s investment in

BlackRock (c) $ 6.0 $5.6

Market value of PNC’s investment in

BlackRock (d) 11.7 7.4

(c) PNC accounts for its investment in BlackRock under the equity method of

accounting, exclusive of a related deferred tax liability of $2.0 billion at

December 31, 2013 and $1.9 billion at December 31, 2012. Our voting interest in

BlackRock common stock was approximately 21% at December 31, 2013.

(d) Does not include liquidity discount.

PNC accounts for its BlackRock Series C Preferred Stock at

fair value, which offsets the impact of marking-to-market the

obligation to deliver these shares to BlackRock to partially

fund BlackRock long-term incentive plan (LTIP) programs.

The fair value amount of the BlackRock Series C Preferred

Stock is included on our Consolidated Balance Sheet in the

caption Other assets. Additional information regarding the

valuation of the BlackRock Series C Preferred Stock is

included in Note 9 Fair Value in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

On January 31, 2013, we transferred 205,350 shares of

BlackRock Series C Preferred Stock to BlackRock to satisfy a

portion of our LTIP obligation. The transfer reduced Other

assets and Other liabilities on our Consolidated Balance Sheet

by $33 million. At December 31, 2013, we hold

approximately 1.3 million shares of BlackRock Series C

Preferred Stock which are available to fund our obligation in

connection with the BlackRock LTIP programs. Additional

information regarding our BlackRock LTIP shares obligation

is included in Note 16 Stock Based Compensation Plans in the

Notes To Consolidated Financial Statements in Item 8 of this

Report.

N

ON

-S

TRATEGIC

A

SSETS

P

ORTFOLIO

(Unaudited)

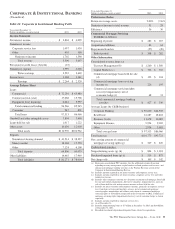

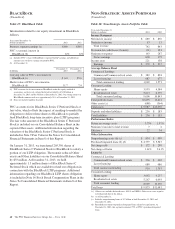

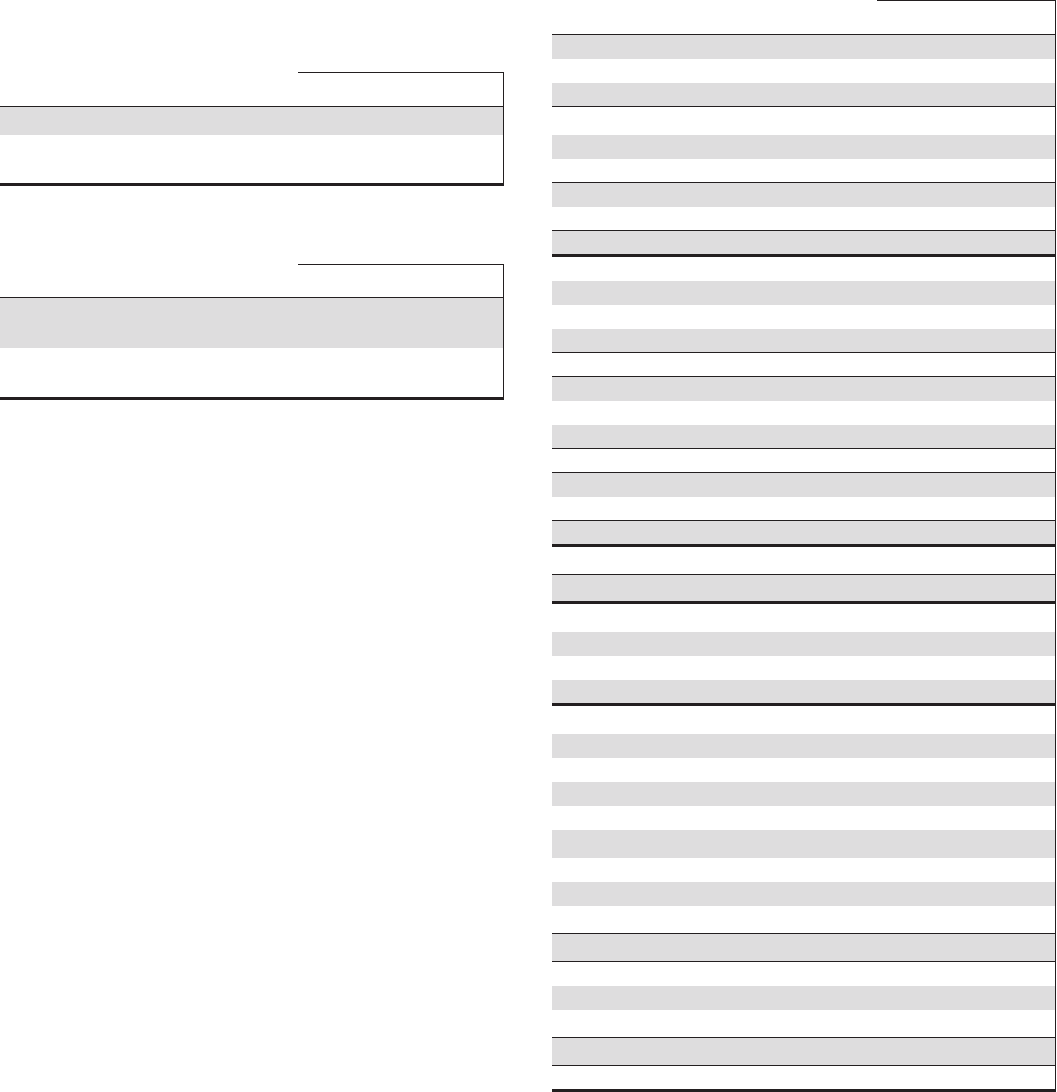

Table 28: Non-Strategic Assets Portfolio Table

Year ended December 31

Dollars in millions 2013 2012

Income Statement

Net interest income $ 689 $ 830

Noninterest income 53 13

Total revenue 742 843

Provision for credit losses (benefit) (21) 181

Noninterest expense 163 287

Pretax earnings 600 375

Income taxes 221 138

Earnings $ 379 $ 237

Average Balance Sheet

Commercial Lending:

Commercial/Commercial real estate $ 382 $ 894

Lease financing 687 677

Total commercial lending 1,069 1,571

Consumer Lending:

Home equity 3,993 4,584

Residential real estate 5,613 6,259

Total consumer lending 9,606 10,843

Total portfolio loans 10,675 12,414

Other assets (a) (688) (364)

Total assets $ 9,987 $12,050

Deposits and other liabilities $ 236 $ 183

Total liabilities $ 236 $ 183

Performance Ratios

Return on average assets 3.79% 1.97%

Noninterest income to total revenue 7 2

Efficiency 22 34

Other Information

Nonperforming assets (b) (c) $ 834 $ 999

Purchased impaired loans (b) (d) $ 4,797 $ 5,547

Net charge-offs $ 172 $ 299

Net charge-off ratio 1.61% 2.41%

Loans (b)

Commercial Lending

Commercial/Commercial real estate $ 236 $ 665

Lease financing 680 686

Total commercial lending 916 1,351

Consumer Lending

Home equity 3,692 4,237

Residential real estate 5,267 6,093

Total consumer lending 8,959 10,330

Total loans $ 9,875 $11,681

(a) Other assets includes deferred taxes, ALLL and OREO. Other assets were negative

in both periods due to the ALLL.

(b) As of December 31.

(c) Includes nonperforming loans of $.7 billion at both December 31, 2013 and

December 31, 2012.

(d) Recorded investment of purchased impaired loans related to acquisitions. At

December 31, 2013, this segment contained 79% of PNC’s purchased impaired

loans.

60 The PNC Financial Services Group, Inc. – Form 10-K