PNC Bank 2013 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

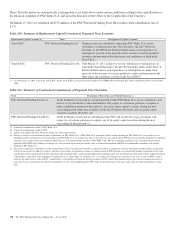

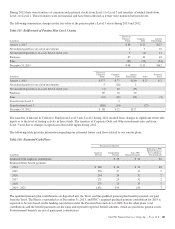

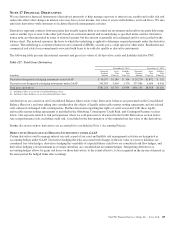

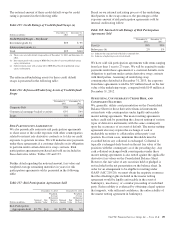

The health care cost trend rate assumptions shown in the

preceding tables relate only to the postretirement benefit

plans. A one-percentage-point change in assumed health care

cost trend rates would have the following effects.

Table 120: Effect of One Percent Change in Assumed

Health Care Cost

Year ended December 31, 2013

In millions Increase Decrease

Effect on year end benefit obligation $11 $(10)

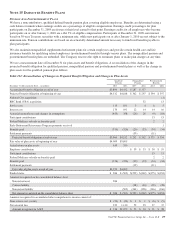

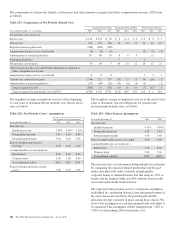

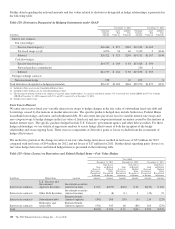

Unamortized actuarial gains and losses and prior service costs

and credits are recognized in AOCI each December 31, with

amortization of these amounts through net periodic benefit

cost. The estimated amounts that will be amortized in 2014 are

as follows.

Table 121: Estimated Amortization of Unamortized

Actuarial Gains and Losses – 2014

2014 Estimate

Year ended December 31

In millions

Qualified

Pension

Nonqualified

Pension

Postretirement

Benefits

Prior service (credit) $(8) $(2)

Net actuarial loss $3

Total $(8) $3 $(2)

D

EFINED

C

ONTRIBUTION

P

LANS

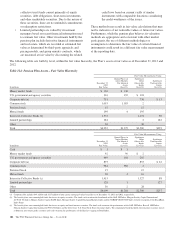

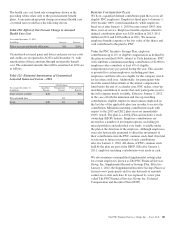

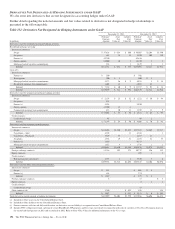

We have a qualified defined contribution plan that covers all

eligible PNC employees. Employees hired prior to January 1,

2010 became 100% vested immediately, while employees

hired on or after January 1, 2010 become vested 100% after

three years of service. Employee benefits expense related to

defined contribution plans was $120 million in 2013, $111

million in 2012 and $105 million in 2011. We measure

employee benefits expense as the fair value of the shares and

cash contributed to the plan by PNC.

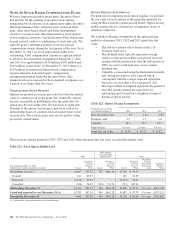

Under the PNC Incentive Savings Plan, employee

contributions up to 4% of eligible compensation as defined by

the plan are matched 100%, subject to Code limitations. PNC

will contribute a minimum matching contribution of $2,000 to

employees who contribute at least 4% of eligible

compensation every pay period during the year. This amount

is prorated for certain employees, including part-time

employees and those who are eligible for the company match

for less than a full year. Additionally, for participants who

meet the annual deferral limit or the annual compensation

limit before the end of a calendar year, PNC makes a true-up

matching contribution to ensure that such participants receive

the full company match available. Effective January 1, 2012,

in the case of both the minimum and true-up matching

contributions, eligible employees must remain employed on

the last day of the applicable plan year in order to receive the

contribution. Minimum matching contributions made with

respect to the 2013 and 2012 plan years are immediately

100% vested. The plan is a 401(k) Plan and includes a stock

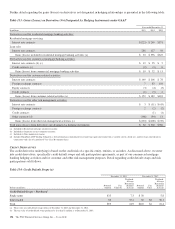

ownership (ESOP) feature. Employee contributions are

invested in a number of investment options, including pre

mixed portfolios and individual core funds, available under

the plan at the direction of the employee. Although employees

were also historically permitted to direct the investment of

their contributions into the PNC common stock fund, this fund

was frozen to future investments of such contributions

effective January 1, 2010. All shares of PNC common stock

held by the plan are part of the ESOP. Effective January 1,

2011, employer matching contributions were made in cash.

We also maintain a nonqualified supplemental savings plan

for certain employees, known as The PNC Financial Services

Group, Inc. Supplemental Incentive Savings Plan. Effective

January 1, 2012, the Supplemental Incentive Savings Plan was

frozen to new participants and for any deferrals of amounts

earned on or after such date. It was replaced by a new plan

called The PNC Financial Services Group, Inc. Deferred

Compensation and Incentive Plan (DCIP).

The PNC Financial Services Group, Inc. – Form 10-K 185