PNC Bank 2013 Annual Report Download - page 240

Download and view the complete annual report

Please find page 240 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

27 S

UBSEQUENT

E

VENTS

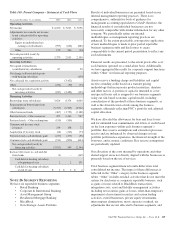

On January 16, 2014, PNC Bank, N.A. established a new bank note program under which it may from time to time offer up to $25

billion aggregate principal amount at any one time outstanding of its unsecured senior and subordinated notes due more than nine

months from their date of issue (in the case of senior notes) and due five years or more from their date of issue (in the case of

subordinated notes). The $25 billion of notes authorized to be issued and outstanding at any one time includes notes issued by PNC

Bank, N.A. prior to January 16, 2014 and those notes PNC Bank, N.A. has acquired through the acquisition of other banks, in each

case for so long as such notes remain outstanding. The terms of the new program do not affect any of the bank notes issued prior to

January 16, 2014. Under this program, on January 28, 2014, PNC Bank, N.A. issued:

• $750 million of senior notes with a maturity date of January 28, 2019. Interest is payable semi-annually, at a fixed rate of

2.200% on January 28 and July 28 of each year, beginning on July 28, 2014, and

• $1.0 billion of senior notes with a maturity date of January 27, 2017. Interest is payable semi-annually, at a fixed rate of

1.125% on January 27 and July 27 of each year, beginning on July 27, 2014.

During January 2014, we sold 1 million Visa Class B common shares and entered into a swap agreement with the purchaser of the

shares, resulting in an after-tax gain of $40 million.

S

TATISTICAL

I

NFORMATION

(U

NAUDITED

)

THE PNC FINANCIAL SERVICES GROUP, INC.

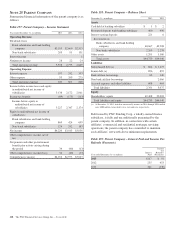

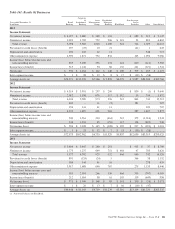

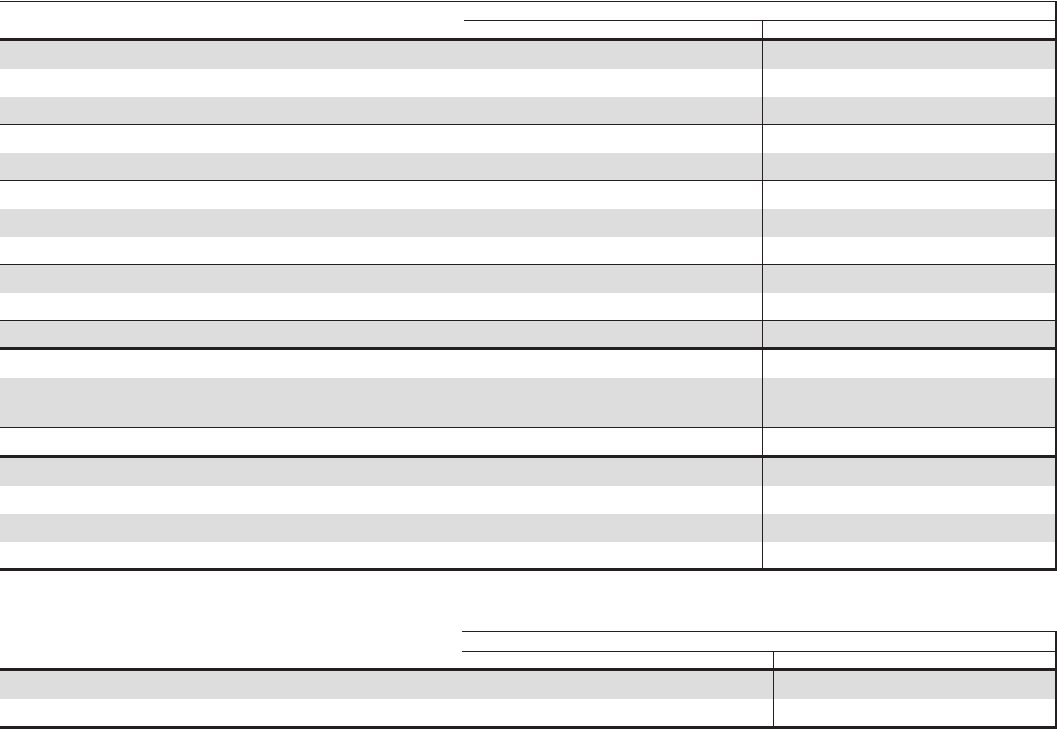

Selected Quarterly Financial Data (a)

Dollars in millions,

except per share data

2013 2012

Fourth Third Second First Fourth Third Second First

Summary Of Operations

Interest income $2,479 $2,448 $2,469 $2,611 $2,671 $2,670 $2,796 $2,597

Interest expense 213 214 211 222 247 271 270 306

Net interest income 2,266 2,234 2,258 2,389 2,424 2,399 2,526 2,291

Noninterest income (b) 1,807 1,686 1,806 1,566 1,645 1,689 1,097 1,441

Total revenue 4,073 3,920 4,064 3,955 4,069 4,088 3,623 3,732

Provision for credit losses 113 137 157 236 318 228 256 185

Noninterest expense 2,547 2,424 2,435 2,395 2,829 2,650 2,648 2,455

Income before income taxes and noncontrolling interests 1,413 1,359 1,472 1,324 922 1,210 719 1,092

Income taxes 352 320 349 320 203 285 173 281

Net income 1,061 1,039 1,123 1,004 719 925 546 811

Less: Net income (loss) attributable to noncontrolling interests 13 2 1 (9) 1 (14) (5) 6

Preferred stock dividends and discount accretion and

redemptions 50 71 53 75 54 63 25 39

Net income attributable to common shareholders $ 998 $ 966 $1,069 $ 938 $ 664 $ 876 $ 526 $ 766

Per Common Share Data

Book value $72.21 $69.92 $68.46 $68.23 $67.05 $66.41 $64.00 $63.26

Basic earnings from net income (c) 1.87 1.82 2.02 1.78 1.26 1.66 1.00 1.45

Diluted earnings from net income (c) 1.85 1.79 1.99 1.76 1.24 1.64 .98 1.44

(a) Reflects the impact of the acquisition of RBC Bank (USA) beginning on March 2, 2012.

(b) Noninterest income included private equity gains/(losses) and net gains on sales of securities in each quarter as follows:

2013 2012

in millions Fourth Third Second First Fourth Third Second First

Private equity gains/(losses) $99 $43 $33 $27 $43 $25 $47 $50

Net gains on sales of securities 3 21 61 14 45 40 62 57

(c) The sum of the quarterly amounts for 2013 and 2012 does not equal the respective year’s amount because the quarterly calculations are based on a changing number of average shares.

222 The PNC Financial Services Group, Inc. – Form 10-K