PNC Bank 2013 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

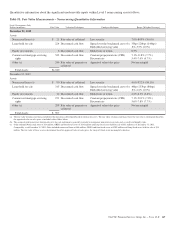

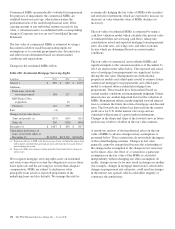

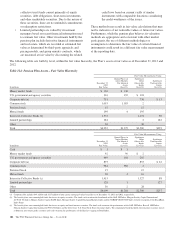

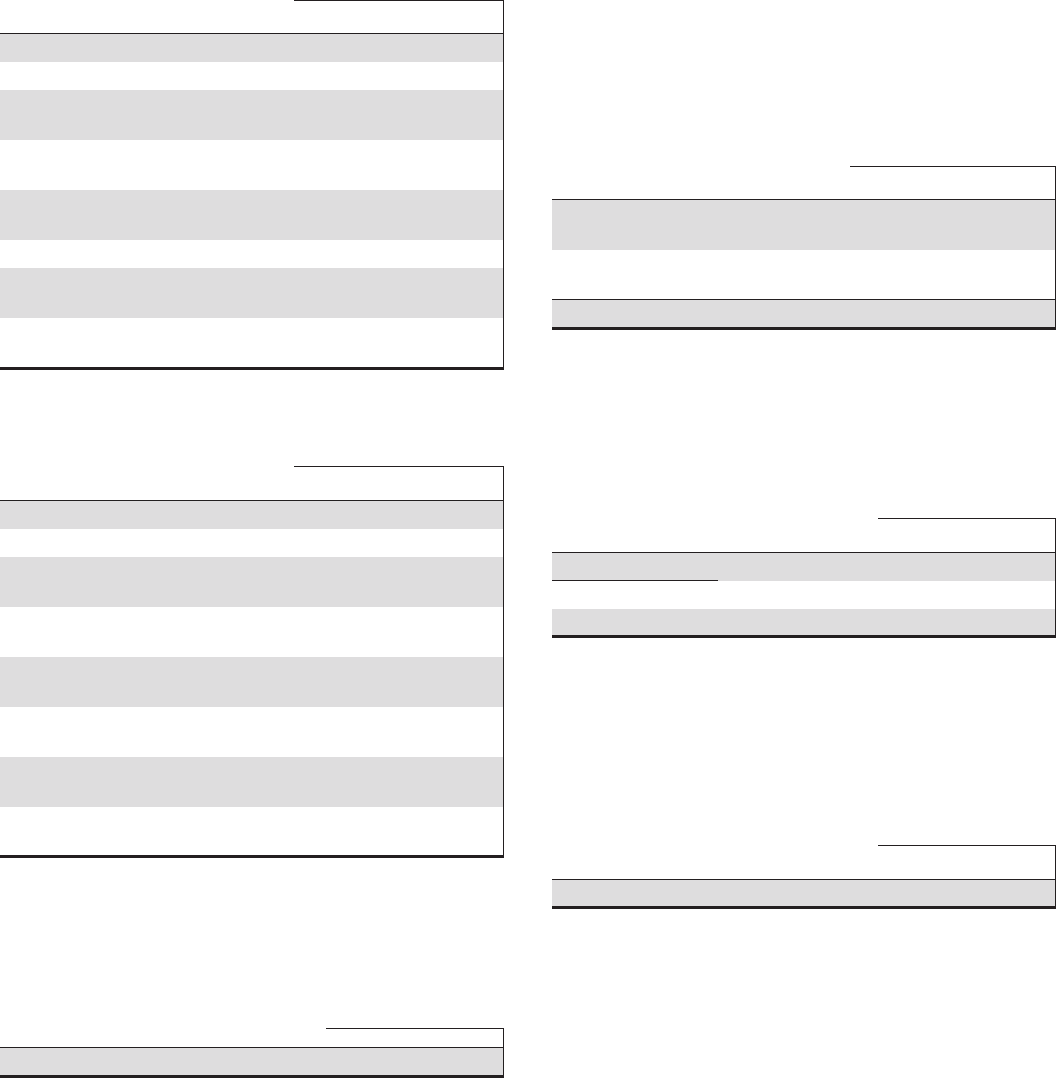

The following tables set forth the fair value of commercial and

residential MSRs and the sensitivity analysis of the

hypothetical effect on the fair value of MSRs to immediate

adverse changes of 10% and 20% in those assumptions:

Table 101: Commercial Mortgage Loan Servicing Rights –

Key Valuation Assumptions

Dollars in millions

December 31

2013

December 31

2012

Fair Value $ 552 $ 427

Weighted-average life (years) 5.3 4.8

Weighted-average constant prepayment

rate 7.52% 7.63%

Decline in fair value from 10%

adverse change $ 12 $ 8

Decline in fair value from 20%

adverse change $ 23 $ 16

Effective discount rate 6.91% 7.70%

Decline in fair value from 10%

adverse change $ 18 $ 12

Decline in fair value from 20%

adverse change $ 35 $ 23

Table 102: Residential Mortgage Loan Servicing Rights –

Key Valuation Assumptions

Dollars in millions

December 31

2013

December 31

2012

Fair value $1,087 $ 650

Weighted-average life (years) 7.9 4.3

Weighted-average constant prepayment

rate 7.61% 18.78%

Decline in fair value from 10%

adverse change $ 47 $ 45

Decline in fair value from 20%

adverse change $ 91 $ 85

Weighted-average option adjusted

spread 10.24% 11.15%

Decline in fair value from 10%

adverse change $ 47 $ 26

Decline in fair value from 20%

adverse change $ 91 $ 49

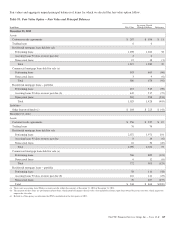

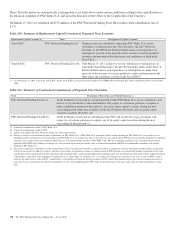

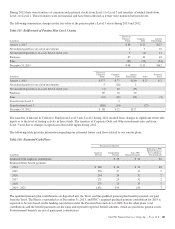

Fees from mortgage and other loan servicing, comprised of

contractually specified servicing fees, late fees and ancillary

fees, follows:

Table 103: Fees from Mortgage and Other Loan Servicing

In millions 2013 2012 2011

Fees from mortgage and other loan servicing $544 $557 $641

We also generate servicing fees from fee-based activities

provided to others for which we do not have an associated

servicing asset.

Fees from commercial MSRs, residential MSRs and other loan

servicing are reported on our Consolidated Income Statement

in the line items Corporate services, Residential mortgage, and

Consumer services, respectively.

N

OTE

11 P

REMISES

,E

QUIPMENT AND

L

EASEHOLD

I

MPROVEMENTS

Premises, equipment and leasehold improvements, stated at

cost less accumulated depreciation and amortization, were as

follows:

Table 104: Premises, Equipment and Leasehold

Improvements

In millions

December 31

2013

December 31

2012

Total Premises, equipment and leasehold

improvements (a) $ 8,903 $ 8,337

Accumulated depreciation and

amortization (3,285) (2,909)

Net book value $ 5,618 $ 5,428

(a) Primarily relates to equipment and buildings.

Depreciation expense on premises, equipment and leasehold

improvements and amortization expense, primarily for

capitalized internally developed software, was as follows:

Table 105: Depreciation and Amortization Expense

Year ended December 31

In millions 2013 2012 2011

Continuing operations:

Depreciation $546 $521 $474

Amortization 23 19 22

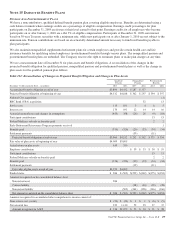

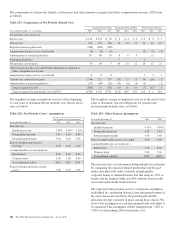

We lease certain facilities and equipment under agreements

expiring at various dates through the year 2081. We account

for these as operating leases. Rental expense on such leases

was as follows:

Table 106: Lease Rental Expense

Year ended December 31

In millions 2013 2012 2011

Continuing operations: $412 $405 $357

Required minimum annual rentals that we owe on

noncancelable leases having initial or remaining terms in

excess of one year totaled $2.7 billion at December 31, 2013.

Future minimum annual rentals are as follows:

• 2014: $389 million,

• 2015: $339 million,

• 2016: $288 million,

• 2017: $251 million,

• 2018: $221 million, and

• 2019 and thereafter: $1.2 billion.

The PNC Financial Services Group, Inc. – Form 10-K 175