PNC Bank 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.senior notes) and due five years or more from their date of

issue (in the case of subordinated notes). The $25 billion of

notes authorized to be issued and outstanding at any one time

includes notes issued by PNC Bank, N.A. prior to January 16,

2014 and those notes PNC Bank, N.A. has acquired through

the acquisition of other banks, in each case for so long as such

notes remain outstanding. The terms of the new program do

not affect any of the bank notes issued prior to January 16,

2014.

See Note 27 Subsequent Events in the Notes To Consolidated

Financial Statements in Item 8 of this Report for information

on the issuance of senior notes of $750 million and $1.0

billion on January 28, 2014.

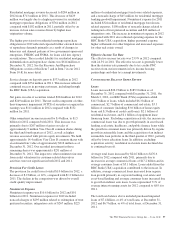

PNC Bank, N.A. is a member of the FHLB-Pittsburgh and, as

such, has access to advances from FHLB-Pittsburgh secured

generally by residential mortgage loans, other mortgage-

related loans and commercial mortgage-backed securities. At

December 31, 2013, our unused secured borrowing capacity

was $9.2 billion with FHLB-Pittsburgh. Total FHLB

borrowings increased to $12.9 billion at December 31, 2013

from $9.4 billion at December 31, 2012 due to $16.4 billion of

new issuances offset by $12.9 billion in calls and maturities.

The FHLB-Pittsburgh also periodically provides standby

letters of credit on behalf of PNC Bank, N.A. to secure certain

public deposits. PNC Bank, N.A. began using standby letters

of credit issued by the FHLB-Pittsburgh in response to

anticipated regulatory changes to strengthen the liquidity

requirements for large banks. If the FHLB-Pittsburgh is

required to make payment for a beneficiary’s draw, the

payment amount is converted into a collateralized advance to

PNC Bank, N.A. At December 31, 2013, standby letters of

credit issued on our behalf by the FHLB-Pittsburgh totaled

$6.2 billion. There were no standby letters of credit issued on

our behalf by the FHLB-Pittsburgh at December 31, 2012.

PNC Bank, N.A. has the ability to offer up to $10.0 billion of

its commercial paper to provide additional liquidity. As of

December 31, 2013, there was $5.0 billion outstanding under

this program. During the fourth quarter of 2013, PNC

finalized the wind down of Market Street Funding LLC

(“Market Street”), a multi-seller asset-backed commercial

paper conduit administered by PNC Bank, N.A. As part of the

wind down process, the commitments and outstanding loans

of Market Street were assigned to PNC Bank, N.A., which

will fund these commitments and loans by utilizing its

diversified funding sources. In conjunction with the

assignment of commitments and loans the associated liquidity

facilities were terminated along with the program-level credit

enhancement provided to Market Street. At December 31,

2013, Market Street’s commercial paper was repaid in full.

The wind down did not have a material impact to PNC’s

financial condition or results of operation.

PNC Bank, N.A. can also borrow from the Federal Reserve

Bank of Cleveland’s (Federal Reserve Bank) discount window

to meet short-term liquidity requirements. The Federal

Reserve Bank, however, is not viewed as the primary means

of funding our routine business activities, but rather as a

potential source of liquidity in a stressed environment or

during a market disruption. These potential borrowings are

secured by commercial loans. At December 31, 2013, our

unused secured borrowing capacity was $19.5 billion with the

Federal Reserve Bank.

P

ARENT

C

OMPANY

L

IQUIDITY

–U

SES

Obligations requiring the use of liquidity can generally be

characterized as either contractual or discretionary. The parent

company’s contractual obligations consist primarily of debt

service related to parent company borrowings and funding

non-bank affiliates. As of December 31, 2013, there were

approximately $1.4 billion of parent company borrowings

with maturities of less than one year.

Additionally, the parent company maintains adequate liquidity

to fund discretionary activities such as paying dividends to

PNC shareholders, share repurchases, and acquisitions. See

the Parent Company Liquidity – Sources section below.

See Supervision and Regulation in Item 1 of this Report for

information regarding the Federal Reserve’s CCAR process,

including its impact on our ability to take certain capital

actions, including plans to pay or increase common stock

dividends, reinstate or increase common stock repurchase

programs, or redeem preferred stock or other regulatory

capital instruments, as well as for information on new

qualitative and quantitative liquidity risk management

standards proposed by the U.S. banking agencies.

During 2013, the parent company used cash for the following:

• On March 14, 2013, we used $1.4 billion of parent

company cash to purchase senior extendible floating

rate bank notes issued by PNC Bank, N.A,

• On March 19, 2013, PNC announced the redemption

completed on April 19, 2013 of depositary shares

representing interests in PNC’s 9.875% Fixed-To-

Floating Rate Non-Cumulative Preferred Stock,

Series L. Each depositary share represents a 1/4,000th

interest in a share of the Series L Preferred Stock. All

6,000,000 depositary shares outstanding were

redeemed, as well as all 1,500 shares of Series L

Preferred Stock underlying such depositary shares,

resulting in a net outflow of $150 million,

• On April 23, 2013, we completed the redemption of

the $15 million of trust preferred securities issued by

Yardville Capital Trust VI, originally called on

March 22, 2013,

• On May 23, 2013, we completed the redemption of

the $30 million of trust preferred securities issued by

Fidelity Capital Trust III, originally called on April 8,

2013,

The PNC Financial Services Group, Inc. – Form 10-K 89