PNC Bank 2013 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F

INANCIAL

A

SSETS

A

CCOUNTED

F

OR

U

NDER

F

AIR

V

ALUE

O

PTION

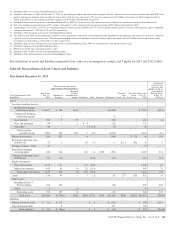

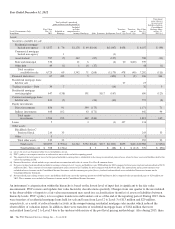

Refer to the Fair Value Measurement section of this Note 9

regarding the fair value of customer resale agreements, trading

loans, residential mortgage loans held for sale, commercial

mortgage loans held for sale, certain portfolio loans,

BlackRock Series C Preferred Stock and other borrowed

funds.

Customer Resale Agreements

Interest income on structured resale agreements is reported on

the Consolidated Income Statement in Other interest income.

Changes in fair value due to instrument-specific credit risk for

2013 and 2012 were not material.

Residential Mortgage-Backed Agency Securities with

Embedded Derivatives

Interest income on these securities is reported on the

Consolidated Income Statement in Other interest income.

Trading Loans

Interest income on trading loans is reported on the

Consolidated Income Statement in Other interest income.

Residential Mortgage Loans Held for Sale

Interest income on these loans is recorded as earned and

reported on the Consolidated Income Statement in Other

interest income. Throughout 2013 and 2012, certain

residential mortgage loans for which we elected the fair value

option were subsequently reclassified to portfolio loans.

Changes in fair value due to instrument-specific credit risk for

2013 and 2012 were not material.

Commercial Mortgage Loans Held for Sale

Interest income on these loans is recorded as earned and

reported on the Consolidated Income Statement in Other

interest income. The impact on earnings of offsetting

economic hedges is not reflected in these amounts. Changes in

fair value due to instrument-specific credit risk for both 2013

and 2012 were not material.

Residential Mortgage Loans – Portfolio

Interest income on these loans is recorded as earned and

reported on the Consolidated Income Statement in either Loan

interest income or Other interest income. Interest income on

the Home Equity Lines of Credit for which we have elected

the fair value option during first quarter 2013 is reported on

the Consolidated Income Statement in Loan interest income.

Other Borrowed Funds

Interest expense on the Other borrowed funds for which we

have elected the fair value option during first quarter 2013 is

reported on the Consolidated Income Statement in Borrowed

funds interest expense.

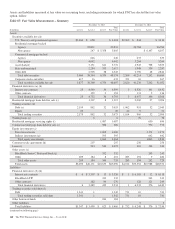

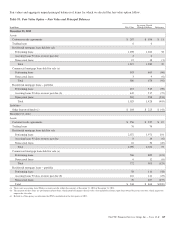

The changes in fair value included in Noninterest income for

items for which we elected the fair value option follow.

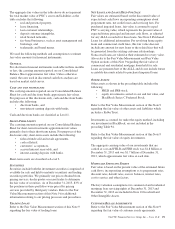

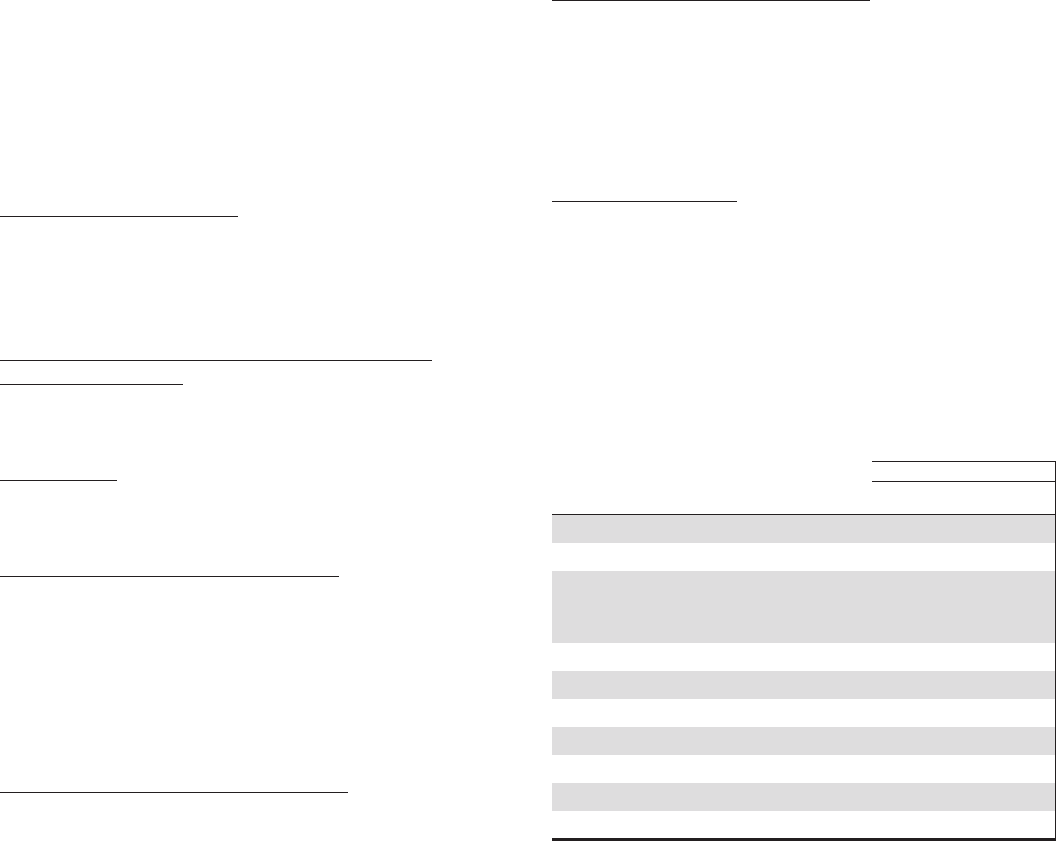

Table 92: Fair Value Option – Changes in Fair Value (a)

Gains (Losses)

Year ended December 31

In millions 2013 2012 2011

Assets

Customer resale agreements $ (7) $ (10) $ (12)

Residential mortgage-backed agency

securities with embedded

derivatives (b) 13 24

Trading loans 3 2

Residential mortgage loans held for sale 247 (180) 172

Commercial mortgage loans held for sale (10) (5) 3

Residential mortgage loans – portfolio 27 (36) (17)

BlackRock Series C Preferred Stock 122 33 (14)

Liabilities

Other borrowed funds (9)

(a) The impact on earnings of offsetting hedged items or hedging instruments is not

reflected in these amounts.

(b) At both December 31, 2013 and December 31, 2012, the balance of residential

mortgage-backed agency securities with embedded derivatives carried in Trading

securities was zero.

168 The PNC Financial Services Group, Inc. – Form 10-K