PNC Bank 2013 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

D

ERIVATIVES

N

OT

D

ESIGNATED

A

S

H

EDGING

I

NSTRUMENTS UNDER

GAAP

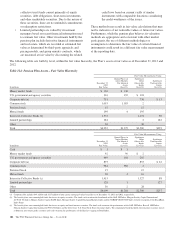

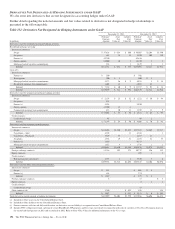

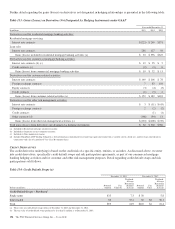

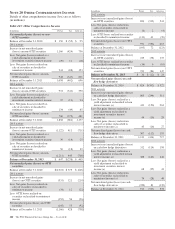

We also enter into derivatives that are not designated as accounting hedges under GAAP.

Further detail regarding the notional amounts and fair values related to derivatives not designated in hedge relationships is

presented in the following table:

Table 132: Derivatives Not Designated As Hedging Instruments under GAAP

December 31, 2013 December 31, 2012

In millions

Notional/

Contract

Amount

Asset

Fair

Value (a)

Liability

Fair

Value (b)

Notional/

Contract

Amount

Asset

Fair

Value (a)

Liability

Fair

Value (b)

Derivatives used for residential mortgage banking activities:

Residential mortgage servicing

Interest rate contracts:

Swaps $ 37,424 $ 654 $ 360 $ 59,607 $2,204 $1,790

Swaptions 845 18 18 5,890 209 119

Futures (c) 49,250 49,816

Futures options 24,000 10 2 34,350 5 2

Mortgage-backed securities commitments 832 3 3,429 3 1

Subtotal $112,351 $ 682 $ 383 $153,092 $2,421 $1,912

Loan sales

Interest rate contracts:

Futures (c) $ 350 $ 702

Bond options 200 $ 1 900 $ 3

Mortgage-backed securities commitments 5,173 26 $ 9 8,033 5 $ 14

Residential mortgage loan commitments 1,605 13 4,092 85

Subtotal $ 7,328 $ 40 $ 9 $ 13,727 $ 93 $ 14

Subtotal $119,679 $ 722 $ 392 $166,819 $2,514 $1,926

Derivatives used for commercial mortgage banking activities

Interest rate contracts:

Swaps $ 2,158 $ 23 $ 52 $ 1,222 $ 56 $ 84

Swaptions 125 3

Futures (c) 4,598 2,030

Futures options 45,500 15 4

Commercial mortgage loan commitments 673 20 11 1,259 12 9

Subtotal $ 53,054 $ 58 $ 70 $ 4,511 $ 68 $ 93

Credit contracts:

Credit default swaps 95 95 2

Subtotal $ 53,149 $ 58 $ 70 $ 4,606 $ 70 $ 93

Derivatives used for customer-related activities:

Interest rate contracts:

Swaps $134,408 $2,540 $2,445 $127,567 $3,869 $3,917

Caps/floors – Sold 4,789 11 4,588 1

Caps/floors – Purchased 5,519 37 4,187 21

Swaptions 2,354 49 51 2,285 82 35

Futures (c) 1,856 9,113

Mortgage-backed securities commitments 1,515 4 3 1,736 2 2

Subtotal $150,441 $2,630 $2,510 $149,476 $3,974 $3,955

Foreign exchange contracts 14,316 192 172 10,737 126 112

Equity contracts 105 1 3

Credit contracts:

Risk participation agreements 4,777 2 4 3,530 5 6

Subtotal $169,534 $2,824 $2,686 $163,848 $4,106 $4,076

Derivatives used for other risk management activities:

Interest rate contracts:

Swaps $ 511 $ 601 $ 4

Futures (c) 838 274

Subtotal $ 1,349 $ 875 $ 4

Foreign exchange contracts 817$3

Equity contracts 822

Credit contracts:

Credit default swaps 15

Other contracts (d) 1,340 $ 422 898 358

Subtotal $ 2,697 $ 422 $ 1,813 $ 6 $ 363

Total derivatives not designated as hedging instruments $345,059 $3,604 $3,570 $337,086 $6,696 $6,458

(a) Included in Other assets on our Consolidated Balance Sheet.

(b) Included in Other liabilities on our Consolidated Balance Sheet.

(c) Futures contracts settle in cash daily and therefore, no derivative asset or liability is recognized on our Consolidated Balance Sheet.

(d) Includes PNC’s obligation to fund a portion of certain BlackRock LTIP programs and the swaps entered into in connection with sales of a portion of Visa Class B common shares in

the second and third quarters of 2013 and second half of 2012. Refer to Note 9 Fair Value for additional information on the Visa swaps.

192 The PNC Financial Services Group, Inc. – Form 10-K