PNC Bank 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PNC’s control structure is balanced in terms of efficiency and

effectiveness with the risks that we are willing to take, as

defined by our risk appetite. Controls are in place across the

risk taxonomy to monitor established risk limits.

R

ISK

M

ONITORING AND

R

EPORTING

PNC uses similar tools to monitor and report risk as when

performing Risk Identification. These tools include KRIs,

KPIs, RCSAs, scenario analysis, stress testing, special

investigations and controls.

The risk identification and quantification processes, the risk

control and limits reviews, and the tools used for risk

monitoring provide the basis for risk reporting. The objective

of risk reporting is comprehensive risk aggregation and

transparent communication of aggregated risks, as well as

mitigation strategies, to the Risk Committee of the Board of

Directors, Corporate Committees, Working Committees and

other designated parties for effective decision making.

Risk reports are produced at the line of business level,

functional risk level and the enterprise level. The enterprise

level risk report aggregates risks identified in the functional

and business reports to define the enterprise risk profile. The

enterprise risk profile is a point-in-time assessment of

enterprise risk. The risk profile represents PNC’s overall risk

position in relation to the desired enterprise risk appetite and

overall risk capacity. The determination of the enterprise risk

profile is based on analysis of quantitative reporting of risk

limits and other measures along with qualitative assessments.

Quarterly aggregation of our risk profile enables a clear view

of our risk level relative to our quantitative risk appetite and

overall risk capacity. The enterprise level report is provided

through the governance structure to the Board of Directors.

C

REDIT

R

ISK

M

ANAGEMENT

Credit risk represents the possibility that a customer,

counterparty or issuer may not perform in accordance with

contractual terms. Credit risk is inherent in the financial

services business and results from extending credit to

customers, purchasing securities, and entering into financial

derivative transactions and certain guarantee contracts. Credit

risk is one of our most significant risks. Our processes for

managing credit risk are embedded in PNC’s risk culture and

in our decision-making processes using a systematic approach

whereby credit risks and related exposures are: identified and

assessed, managed through specific policies and processes,

measured and evaluated against our risk tolerance and credit

concentration limits, and reported, along with specific

mitigation activities, to management and the Board through

our governance structure.

A

SSET

Q

UALITY

O

VERVIEW

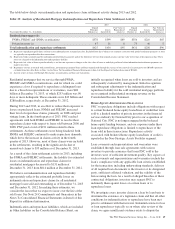

Asset quality trends in 2013, which include the impact of

alignment with interagency supervisory guidance during the

first quarter of 2013, improved from December 31, 2012.

• Nonperforming assets decreased from $3.8 billion at

December 31, 2012 to $3.5 billion as of December 31,

2013 mainly due to a reduction in total commercial

nonperforming loans, primarily related to commercial

real estate. OREO also added to the decline in

nonperforming assets due to an increase in sales.

Overall consumer nonperforming loans increased $264

million due to the impact from the alignment with

interagency supervisory guidance for loans and lines

of credit related to consumer loans which resulted in

$426 million of loans being classified as

nonperforming in the first quarter of 2013. This

increase was partially offset by a decrease in

nonperforming consumer troubled debt restructurings

as more loans returned to performing status upon

achieving six months of performance under the

restructured terms and other consumer nonperforming

loans principal activity.

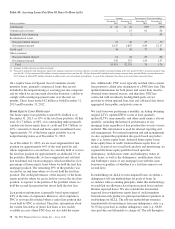

• Overall loan delinquencies of $2.5 billion decreased

$1.3 billion, or 33%, from year-end 2012 levels. The

reduction was largely due to a reduction in accruing

government insured residential real estate loans past

due 90 days or more of approximately $830 million,

the majority of which we took possession of and

conveyed the real estate, or are in the process of

conveyance and claim resolution. Additionally, there

was a decline in total consumer loan delinquencies of

$395 million during the first quarter of 2013,

pursuant to alignment with interagency supervisory

guidance whereby loans were moved from various

delinquency categories to either nonperforming or, in

the case of loans accounted for under the fair value

option, nonaccruing, or charged off.

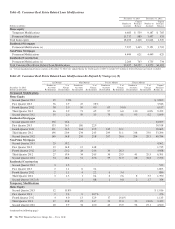

• Net charge-offs were $1.1 billion in 2013, down from

net charge-offs of $1.3 billion in 2012, due to

improving credit quality throughout the year, which

was partially offset by the impact of alignment with

interagency supervisory guidance in the first quarter

of 2013 which increased charge-offs.

• Provision for credit losses in 2013 declined to $643

million compared with $987 million in 2012. The

decline in the comparisons was driven primarily by

overall credit quality improvement, which included

improvement in expected cash flows for our

purchased impaired loan portfolio. Increasing value

of residential real estate is among the factors

contributing to improved credit quality.

• The level of ALLL decreased to $3.6 billion at

December 31, 2013 from $4.0 billion at

December 31, 2012.

The PNC Financial Services Group, Inc. – Form 10-K 73