PNC Bank 2013 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266

|

|

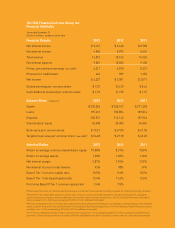

The PNC Financial Services Group, Inc.

Financial Highlights

Year ended December 31

Dollars in millions, except per share data

Financial Results 2013 2012 2011

Net interest income $ 9,147 $ 9,640 $ 8,700

Noninterest income 6,865 5,872 5,626

Total revenue 16,012 15,512 14,326

Noninterest expense 9,801 10,582 9,105

Pretax, pre-provision earnings (non-GAAP) 6,211 4,930 5,221

Provision for credit losses 643 987 1,152

Net income $ 4,227 $ 3,001 $ 3,071

Diluted earnings per common share $ 7.39 $ 5.30 $ 5.64

Cash dividends declared per common share $ 1.72 $ 1.55 $ 1.15

Balance Sheet At year end 2013 2012 2011

Assets $ 320,296 $ 305,107 $ 271,205

Loans 195,613 185,856 159,014

Deposits 220,931 213,142 187,966

Shareholders’ equity 42,408 39,003 34,053

Book value per common share $ 72.21 $ 67.05 $ 61.52

Tangible book value per common share (non-GAAP) $ 54.68 $ 49.18 $ 45.20

Selected Ratios 2013 2012 2011

Return on average common shareholders’ equity 10.88% 8.31% 9.56%

Return on average assets 1.38% 1.02% 1.16%

Net interest margin 3.57% 3.94% 3.92%

Noninterest income to total revenue 43% 38% 39%

Basel I Tier 1 common capital ratio 10.5% 9.6% 10.3%

Basel I Tier 1 risk-based capital ratio 12.4% 11.6% 12.6%

Pro forma Basel III Tier 1 common capital ratio 9.4% 7.5%

PNC believes that pretax, pre-provision earnings serves as a useful tool to help evaluate the ability to provide for credit costs through operations.

PNC believes that tangible book value per common share serves as a useful tool to help evaluate the strength and discipline of a company’s

capital management strategies and as an additional, conservative measure of total company value. See the Statistical Information (Unaudited)

section included in Item 8 of the accompanying 2013 Form 10-K for additional information.

PNC’s pro forma Basel III Tier 1 common capital ratio was estimated without benefit of phase-ins and based on estimated Basel III risk-weighted

assets, using the lower of the ratio calculated under the standardized and advanced approaches. See the Funding and Capital Resources section

included in Item 7 of the accompanying 2013 Form 10-K for additional information.

These Financial Highlights should be read in conjunction with disclosures in the accompanying 2013 Form 10-K including the audited financial

statements. Certain prior period amounts included in the Financial Highlights have been reclassified to conform with the current period presentation.