PNC Bank 2013 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

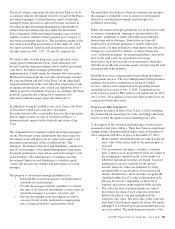

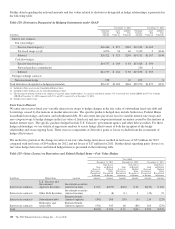

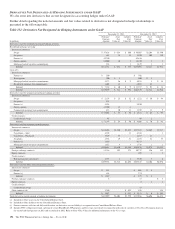

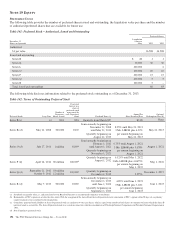

Further detail regarding the notional amounts and fair values related to derivatives designated in hedge relationships is presented in

the following table:

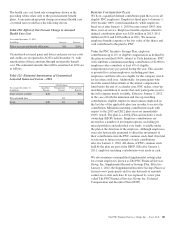

Table 128: Derivatives Designated As Hedging Instruments under GAAP

December 31, 2013 December 31, 2012

In millions

Notional/

Contract

Amount

Asset

Fair

Value (a)

Liability

Fair

Value (b)

Notional/

Contract

Amount

Asset

Fair

Value (a)

Liability

Fair

Value (b)

Interest rate contracts:

Fair value hedges:

Receive-fixed swaps (c) $16,446 $ 871 $230 $12,394 $1,365

Pay-fixed swaps (c) (d) 4,076 54 66 2,319 2 $144

Subtotal $20,522 $ 925 $296 $14,713 $1,367 $144

Cash flow hedges:

Receive-fixed swaps (c) $14,737 $ 264 $ 58 $13,428 $ 504

Forward purchase commitments 250 1

Subtotal $14,737 $ 264 $ 58 $13,678 $ 505

Foreign exchange contracts:

Net investment hedge 938 10 879 8

Total derivatives designated as hedging instruments $36,197 $1,189 $364 $29,270 $1,872 $152

(a) Included in Other assets on our Consolidated Balance Sheet.

(b) Included in Other liabilities on our Consolidated Balance Sheet.

(c) The floating rate portion of interest rate contracts is based on money-market indices. As a percent of notional amount, 43% were based on 1-month LIBOR and 57% on 3-month

LIBOR at December 31, 2013 compared with 51% and 49%, respectively, at December 31, 2012.

(d) Includes zero-coupon swaps.

F

AIR

V

ALUE

H

EDGES

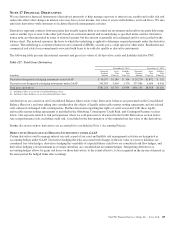

We enter into receive-fixed, pay-variable interest rate swaps to hedge changes in the fair value of outstanding fixed-rate debt and

borrowings caused by fluctuations in market interest rates. The specific products hedged may include bank notes, Federal Home

Loan Bank borrowings, and senior and subordinated debt. We also enter into pay-fixed, receive-variable interest rate swaps and

zero-coupon swaps to hedge changes in the fair value of fixed rate and zero-coupon investment securities caused by fluctuations in

market interest rates. The specific products hedged include U.S. Treasury, government agency and other debt securities. For these

hedge relationships, we use statistical regression analysis to assess hedge effectiveness at both the inception of the hedge

relationship and on an ongoing basis. There were no components of derivative gains or losses excluded from the assessment of

hedge effectiveness.

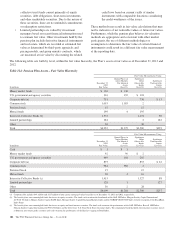

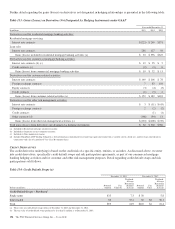

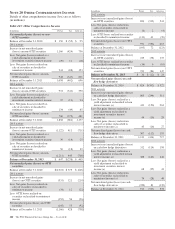

The ineffective portion of the change in value of our fair value hedge derivatives resulted in net losses of $37 million for 2013

compared with net losses of $54 million for 2012 and net losses of $17 million for 2011. Further detail regarding gains (losses) on

fair value hedge derivatives and related hedged items is presented in the following table:

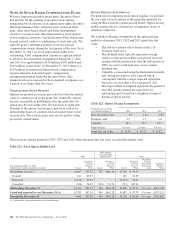

Table 129: Gains (Losses) on Derivatives and Related Hedged Items – Fair Value Hedges

Year ended

December 31, 2013 December 31, 2012 December 31, 2011

Gain

(Loss) on

Derivatives

Recognized

in Income

Gain (Loss)

on Related

Hedged

Items

Recognized

in Income

Gain

(Loss) on

Derivatives

Recognized

in Income

Gain (Loss)

on Related

Hedged

Items

Recognized

in Income

Gain

(Loss) on

Derivatives

Recognized

in Income

Gain (Loss)

on Related

Hedged

Items

Recognized

in Income

In millions Hedged Items Location Amount Amount Amount Amount Amount Amount

Interest rate contracts

U.S. Treasury and

Government

Agencies Securities

Investment securities

(interest income) $ 102 $(107) $(26) $ 23 $(153) $ 162

Interest rate contracts Other Debt Securities

Investment securities

(interest income) 9 (8) (1) 1 (23) 23

Interest rate contracts Subordinated debt

Borrowed funds

(interest expense) (393) 368 (30) (9) 214 (229)

Interest rate contracts

Bank notes and

senior debt

Borrowed funds

(interest expense) (351) 343 68 (80) 265 (276)

Total $(633) $ 596 $ 11 $(65) $ 303 $(320)

190 The PNC Financial Services Group, Inc. – Form 10-K