PNC Bank 2013 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

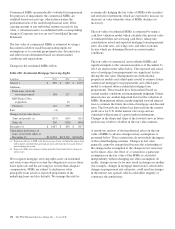

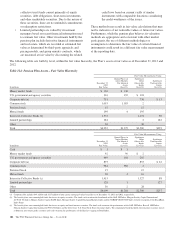

D

EPOSITS

The carrying amounts of noninterest-bearing and interest-

bearing demand, interest-bearing money market and savings

deposits approximate fair values. For time deposits, which

include foreign deposits, fair values are estimated based on the

discounted value of expected net cash flows assuming current

interest rates. All deposits are classified as Level 2.

B

ORROWED

F

UNDS

The carrying amounts of Federal funds purchased, commercial

paper, repurchase agreements, trading securities sold short,

cash collateral, other short-term borrowings, acceptances

outstanding and accrued interest payable are considered to be

their fair value because of their short-term nature. For all other

borrowed funds, fair values are estimated using either prices

obtained from third-party vendors or an internally developed

discounted cash flow approach taking into consideration our

current incremental borrowing rates for similar instruments.

Also refer to the Fair Value Measurement and Fair Value

Option sections of this Note 9 regarding the fair value of

borrowed funds.

U

NFUNDED

L

OAN

C

OMMITMENTS

A

ND

L

ETTERS

O

F

C

REDIT

The fair value of unfunded loan commitments and letters of

credit is determined from a market participant’s view

including the impact of changes in interest rates and credit.

Because our obligation on substantially all unfunded loan

commitments and letters of credit varies with changes in

interest rates, these instruments are subject to little fluctuation

in fair value due to changes in interest rates. We establish a

liability on these facilities related to the creditworthiness of

our counterparty. These instruments are classified as Level 3.

F

INANCIAL

D

ERIVATIVES

Refer to the Fair Value Measurement section of this Note 9

regarding the fair value of financial derivatives.

N

OTE

10 G

OODWILL AND

O

THER

I

NTANGIBLE

A

SSETS

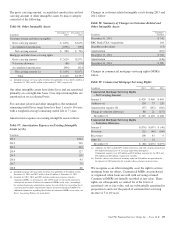

Changes in goodwill by business segment during 2013 and 2012 follow:

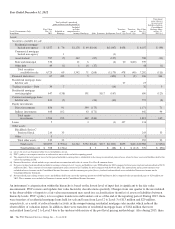

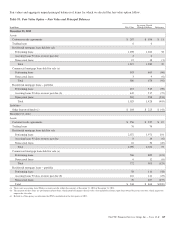

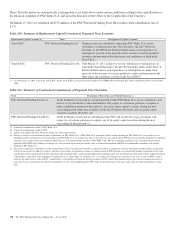

Table 95: Changes in Goodwill by Business Segment (a)

In millions

Retail

Banking

Corporate &

Institutional

Banking

Asset

Management

Group

Residential

Mortgage

Banking Other (b) Total

December 31, 2011 $5,394 $2,763 $69 $ 43 $ 16 $8,285

RBC Bank (USA) acquisition 429 473 2 46 950

SmartStreet divestiture (46) (46)

Residential Mortgage Banking impairment charge (45) (45)

Other (c) (29) (22) (5) (16) (72)

December 31, 2012 $5,794 $3,214 $64 $ – $ – $9,072

Other 11 2

December 31, 2013 $5,795 $3,215 $64 $ – $ – $9,074

(a) The Non-Strategic Assets Portfolio business segment does not have any goodwill allocated to it.

(b) Includes goodwill related to BlackRock.

(c) Primarily related to correction of amounts for an acquisition affecting prior periods.

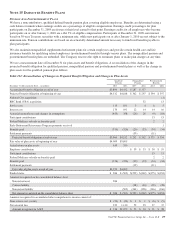

Assets and liabilities of acquired entities are recorded at

estimated fair value as of the acquisition date.

We conduct a goodwill impairment test on our reporting units

at least annually, in the fourth quarter, or more frequently if

events occur or circumstances have changed significantly

from the annual test date. The fair value of our reporting units

is determined by using discounted cash flow and, when

applicable, market comparability methodologies. Based on the

results of our 2013 analysis, there were no impairment charges

related to goodwill.

During 2012, our residential mortgage banking business,

similar to other residential mortgage banking businesses,

experienced higher operating costs and increased uncertainties

such as elevated indemnification and repurchase liabilities and

foreclosure related issues. Our annual impairment analysis

indicated that goodwill related to our Residential Mortgage

Banking reporting unit was greater than the implied fair value

of its goodwill. An impairment charge of $45 million was

recorded during the fourth quarter of 2012 which wrote down

the entire balance of goodwill in the Residential Mortgage

Banking reporting unit.

172 The PNC Financial Services Group, Inc. – Form 10-K