PNC Bank 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

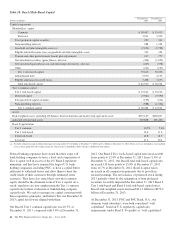

bank holding companies and banks must have Basel I capital

ratios of at least 6% for Tier 1 risk-based, 10% for total risk-

based, and 5% for leverage.

The Basel II framework, which was adopted by the Basel

Committee on Banking Supervision in 2004, seeks to provide

more risk-sensitive regulatory capital calculations and

promote enhanced risk management practices among large,

internationally active banking organizations. The U.S. banking

agencies initially adopted rules to implement the Basel II

capital framework in 2004. In July 2013, the U.S. banking

agencies adopted final rules (referred to as the advanced

approaches) that modified the Basel II framework effective

January 1, 2014. See Item 1 Business – Supervision and

Regulation and Item 1A Risk Factors in this Report. Prior to

fully implementing the advanced approaches established by

these rules to calculate risk-weighted assets, PNC and PNC

Bank, N.A. must successfully complete a “parallel run”

qualification phase. Both PNC and PNC Bank, N.A. entered

this parallel run phase under the Basel II capital framework on

January 1, 2013. This phase must last at least four consecutive

quarters, although, consistent with the experience of other

U.S. banks, we currently anticipate a multi-year parallel run

period.

In July 2013, the U.S. banking agencies also adopted final

rules that: (i) materially modify the definition of, and required

deductions from, regulatory capital (referred to as the Basel III

rule); and (ii) revise the framework for the risk-weighting of

assets under Basel I (referred to as the standardized approach).

The Basel III rule became effective for PNC on January 1,

2014, although many of its provisions are phased-in over a

period of years, with the rules generally becoming fully

effective on January 1, 2019. The standardized approach rule

becomes effective on January 1, 2015.

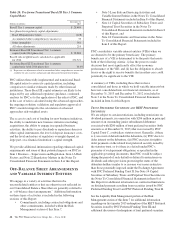

Tier 1 common capital as defined under the Basel III rule differs

materially from Basel I. For example, under Basel III, significant

common stock investments in unconsolidated financial

institutions, mortgage servicing rights and deferred tax assets

must be deducted from capital to the extent they individually

exceed 10%, or in the aggregate exceed 15%, of the institution’s

adjusted Tier 1 common capital. Also, Basel I regulatory capital

excludes other comprehensive income related to both available

for sale securities and pension and other postretirement plans,

whereas under Basel III these items are a component of PNC’s

capital. The Basel III final rule also eliminates the Tier 1

treatment of trust preferred securities for bank holding companies

with $15 billion or more in assets. In the third quarter of 2013, we

concluded our redemptions of the discounted trust preferred

securities assumed through acquisitions. See Item 1 Business-

Supervision and Regulation and Note 14 Capital Securities of

Subsidiary Trusts and Perpetual Trust Securities in the Notes To

Consolidated Financial Statements in Item 8 of this Report for

additional discussion of our previous redemptions of trust

preferred securities.

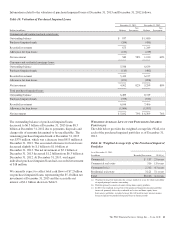

We provide information below regarding PNC’s pro forma

fully phased-in Basel III Tier 1 common capital ratio under

both the advanced approaches and standardized approach

frameworks and how it differs from the Basel I Tier 1

common capital ratios shown in Table 18 above. After PNC

exits parallel run, its regulatory Basel III risk-based capital

ratios will be the lower of the ratios as calculated under the

standardized and advanced approaches.

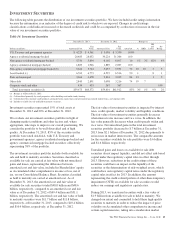

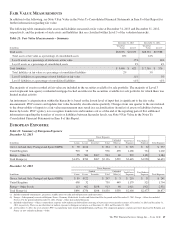

Table 19: Estimated Pro forma Fully Phased-In Basel III

Tier 1 Common Capital Ratio

Dollars in millions

December 31

2013

December 31

2012

Basel I Tier 1 common capital $ 28,484 $ 24,951

Less regulatory capital adjustments:

Basel III quantitative limits (1,386) (2,330)

Accumulated other comprehensive

income (a) 196 276

All other adjustments 162 (396)

Estimated Fully Phased-In Basel III Tier

1 common capital $ 27,456 $ 22,501

Estimated Basel III advanced

approaches risk-weighted assets 290,080 301,006

Pro forma Fully Phased-In Basel III

advanced approaches Tier 1 common

capital ratio 9.5% 7.5%

Estimated Basel III standardized

approach risk-weighted assets 291,977 N/A

Pro forma Fully Phased-In Basel III

standardized approach Tier 1

common capital ratio 9.4% N/A

(a) Represents net adjustments related to accumulated other comprehensive income for

available for sale securities and pension and other postretirement benefit plans.

Basel III advanced approaches risk-weighted assets were

estimated based on the advanced approaches rules and

application of Basel II.5, and reflect credit, market and

operational risk. Basel III standardized approach risk-

weighted assets were estimated based on the standardized

approach rules and reflect credit and market risk.

As a result of the staggered effective dates of the final U.S.

capital rules issued in July 2013, as well as the fact that PNC

remains in the parallel run qualification phase for the

advanced approaches, PNC’s regulatory risk-based capital

ratios in 2014 will be based on the definitions of, and

deductions from, capital under Basel III (as such definitions

and deductions are phased-in for 2014) and Basel I risk-

weighted assets (but subject to certain adjustments as defined

by the Basel III rules). We refer to the capital ratios calculated

using these Basel III phased-in provisions and Basel I risk-

weighted assets as the transitional Basel III ratios.

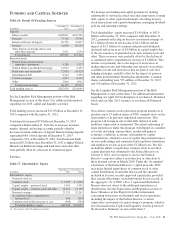

We provide in the table below a pro forma illustration of the

Basel III transitional Tier I common capital ratio using

December 31, 2013 data and the Basel III phase-in schedule in

effect for 2014.

The PNC Financial Services Group, Inc. – Form 10-K 47