PNC Bank 2013 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.O

THER

F

INANCIAL

A

SSETS

A

CCOUNTED FOR AT

F

AIR

V

ALUE ON A

N

ONRECURRING

B

ASIS

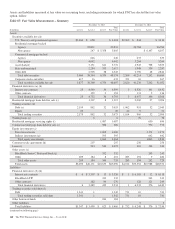

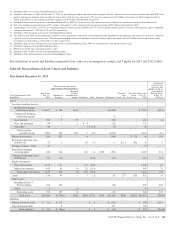

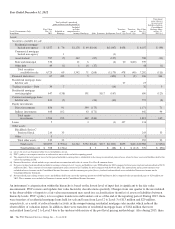

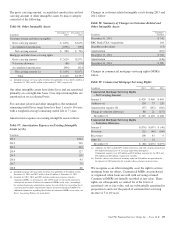

We may be required to measure certain other financial assets

at fair value on a nonrecurring basis. These adjustments to fair

value usually result from the application of lower-of-cost-or-

fair value accounting or write-downs of individual assets due

to impairment and are included in Table 90 and Table 91.

N

ONACCRUAL

L

OANS

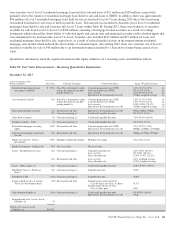

The amounts below for nonaccrual loans represent the fair

value of those loans which have been adjusted due to

impairment. The impairment is primarily based on the

appraised value of the collateral or LGD percentage. The LGD

percentage is used to determine the weighted average loss

severity of the nonaccrual loans.

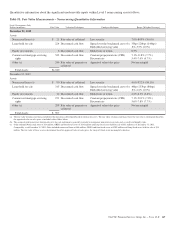

As part of the appraisal process, persons ordering or reviewing

appraisals are independent of the asset manager. Appraisals

must be provided by licensed or certified appraisers and

conform to the Uniform Standards of Professional Appraisal

Practice. For loans secured by commercial properties where

the underlying collateral is in excess of $250,000, appraisals

are obtained at least annually. In certain instances (e.g.,

physical changes in the property), a more recent appraisal is

obtained. Additionally, borrower ordered appraisals are not

permitted, and PNC ordered appraisals are regularly reviewed.

For loans secured by commercial properties where the

underlying collateral is $250,000 and less, there is no

requirement to obtain an appraisal. In instances where an

appraisal is not obtained, the collateral value is determined

consistent with external third-party appraisal standards by an

internal person independent of the asset manager. PNC has a

real estate valuation services group whose sole function is to

manage the real estate appraisal solicitation and evaluation

process for commercial loans. All third-party appraisals are

reviewed by this group, including consideration of comments/

questions on the appraisal by the reviewer, customer

relationship manager, credit officer, and underwriter. Upon

resolving these comments/questions through discussions with

the third-party appraiser, adjustments to the initial appraisal

may occur and be incorporated into the final issued appraisal

report.

If an appraisal is outdated due to changed project or market

conditions, or if the net book value is utilized, management

uses an LGD percentage which represents the exposure PNC

expects to lose in the event a borrower defaults on an

obligation. Accordingly, LGD, which represents the loss

severity, is a function of collateral recovery rates and loan-to-

value. Those rates are established based upon actual PNC loss

experience and external market data. In instances where we

have agreed to sell the property to a third party, the fair value

is based on the contractual sales price adjusted for costs to

sell. In these instances, the most significant unobservable

input is the appraised value or the sales price. The estimated

costs to sell are incremental direct costs to transact a sale such

as broker commissions, legal, closing costs and title transfer

fees. The costs must be essential to the sale and would not

have been incurred if the decision to sell had not been made.

The costs to sell are based on costs associated with our actual

sales of commercial and residential OREO and foreclosed

assets, which are assessed annually.

L

OANS

H

ELD FOR

S

ALE

The amounts below for loans held for sale include the carrying

value of commercial mortgage loans which are intended to be

sold with servicing retained. The fair value of the commercial

mortgage loans is determined using discounted cash flows.

Significant observable market data includes the applicable

benchmark U.S. Treasury interest rates. These instruments are

classified within Level 3. Significant unobservable inputs

include a spread over the benchmark curve and the embedded

servicing value. Significant increases (decreases) to the spread

over the benchmark curve would result in a significantly lower

(higher) carrying value of the assets. Significant increases

(decreases) in the embedded servicing value would result in

significantly higher (lower) carrying value.

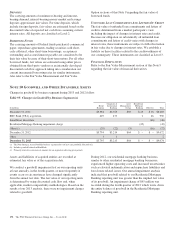

Loans held for sale also includes syndicated commercial loan

inventory. The fair value of the syndicated commercial loan

inventory is primarily determined based on prices provided by

a third-party vendor. The third-party vendor prices are based

upon dealer quotes. For nonrecurring fair value measurements,

these instruments are classified within Level 2. There were no

loans held for sale categorized as Level 2 at December 31,

2013 or 2012.

E

QUITY

I

NVESTMENTS

The amounts below for equity investments represent the

carrying value of Low Income Housing Tax Credit (LIHTC)

investments held for sale calculated using a discounted cash

flow model. The significant unobservable input is

management’s estimate of required market rate of return. The

market rate of return is based on comparison to recent LIHTC

sales in the market. Significant increases (decreases) in this

input would result in a significantly lower (higher) carrying

value of the investments.

C

OMMERCIAL

M

ORTGAGE

S

ERVICING

R

IGHTS

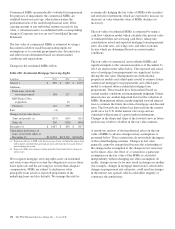

Commercial MSRs are periodically evaluated for impairment

and the amounts below reflect an impairment of three strata at

December 31, 2013, two strata at December 31, 2012 and

three strata at December 31, 2011, respectively. For purposes

of impairment, the commercial MSRs are stratified based on

asset type, which characterizes the predominant risk of the

underlying financial asset. The fair value of commercial

MSRs is estimated by using a discounted cash flow model

incorporating unobservable inputs for assumptions as to

constant prepayment rates, discount rates and other factors.

Significant increases (decreases) in constant prepayment rates

and discount rates would result in significantly lower (higher)

commercial MSR value determined based on current market

conditions and expectations.

The PNC Financial Services Group, Inc. – Form 10-K 165