PNC Bank 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.continuity management (BCM) program. BCM manages the

organization’s capabilities to provide services in the case of an

event resulting in material disruption of business activities

affecting our people, facilities, technology, or suppliers. The

BCM program leads the efforts to identify and mitigate internal

and external business disruptive threats to PNC through

effective resiliency as well as recovery planning and testing.

Prioritization of investments in people, processes, technology

and facilities is based on business process criticality, likelihood

of events, and business risk. A testing program validates our

resiliency and recovery capabilities on an ongoing basis, and an

integrated governance model is designed to help assure

appropriate management reporting. The BCR function serves as

a second line of defense conducting various activities to

challenge the policies, processes, and elements of the business

continuity program. These activities include performing policy

gap analysis as well as conducting quality control risk

assessments which provide an independent review of the

viability, correctness, and effectiveness of various areas and

elements of the BCM program.

Enterprise Compliance is responsible for coordinating the

compliance risk component of PNC’s Operational Risk

framework. Compliance issues are identified and tracked

through enterprise-wide monitoring and tracking programs.

Key compliance risk issues are escalated through a

comprehensive risk reporting process at both a business and

enterprise level and incorporated, as appropriate, into the

development and assessment of the firm’s operational risk

profile. The Compliance, Conflicts & Ethics Policy

Committee, chaired by the Chief Compliance Officer,

provides oversight for compliance, conflicts and ethics

programs and strategies across PNC. This committee also

oversees the compliance processes related to fiduciary and

investment risk. In order to help understand, and where

appropriate, proactively address emerging regulatory issues,

Enterprise Compliance communicates regularly with various

regulators with supervisory or regulatory responsibilities with

respect to PNC, its subsidiaries or businesses and participates

in forums focused on regulatory and compliance matters in the

financial services industry.

PNC monitors and manages insurable risks through a

combination of risk mitigation, retention and transfer

consistent with the organization’s risk philosophy. PNC uses

insurance where appropriate to mitigate the effects of

operational risk events. PNC self-insures select risks through

its wholly-owned captive insurance company Alpine

Indemnity Limited.

Insurance decisions and activities are led by PNC’s Corporate

Insurance Group. The alignment of Corporate Insurance

within the enterprise risk management governance structure

facilitates increased cross-functional integration and

engagement, and is a primary governance strategy.

Management holds regular meetings with the lines of business

regarding risk evaluation and the utilization of insurance as a

risk transfer technique. Furthermore, Corporate Insurance

management and the Insurance Risk Committee have primary

oversight of reporting insurance related activities through a

governance structure that allows management to fully vet risk

information.

PNC, through a subsidiary company, Alpine Indemnity

Limited, provides insurance coverage for select corporate

programs. PNC’s risks associated with its participation as an

insurer for these programs are mitigated through policy limits

and annual aggregate limits. Decisions surrounding PNC’s

retention of its operating risks through deductibles or captive

participation are made in conjunction with the Insurance Risk

Committee.

On a quarterly basis, an enterprise operational risk report is

developed to report key operational risks to senior

management and the Board of Directors. The report

encompasses key operational risk management conclusions,

including the overall operational risk level, risk management

effectiveness and outlook, grounded in quantitative measures

and qualitative factors. Key enterprise operational risks are

also included in the enterprise risk report. In addition,

operational risk is an integrated part of the quarterly business-

specific risk reports.

M

ODEL

R

ISK

M

ANAGEMENT

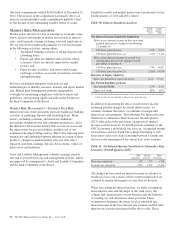

PNC relies on quantitative models to measure risks and to

estimate certain financial values. Models may be used in such

processes as determining the pricing of various products,

grading and granting loans, measuring interest rate risks and

other market risks, predicting losses, and assessing capital

adequacy, as well as to estimate the value of financial

instruments and balance sheet items. There are risks involved

in the use of models as they have the potential to provide

inaccurate output or results, could be used for purposes other

than those for which they have been designed, or may be

operated in an uncontrolled environment where unauthorized

changes can take place and where other control risks exist.

The Model Risk Management Group is responsible for

policies and procedures describing how model risk is

evaluated and managed, and the application of the governance

process to implement these practices throughout the

enterprise. The Model Risk Management Committee, a

subcommittee of the Enterprise Risk Management Committee,

oversees all aspects of model risk, including PNC’s

compliance with regulatory requirements, and approves

exceptions to policy when appropriate.

To better manage our business, our practices around the use of

models, and to comply with regulatory guidance and

requirements, we have policies and procedures in place that

define our governance processes for assessing and controlling

model risk. These processes focus on identifying, reporting

86 The PNC Financial Services Group, Inc. – Form 10-K