PNC Bank 2013 Annual Report Download - page 68

Download and view the complete annual report

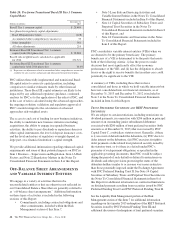

Please find page 68 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.European entities are defined as supranational, sovereign,

financial institutions and non-financial entities within the

countries that comprise the European Union, European Union

candidate countries and other European countries. Foreign

exposure underwriting and approvals are centralized. PNC

currently underwrites new European activities if the credit is

generally associated with activities of its United States

commercial customers, and, in the case of PNC Business

Credit’s United Kingdom operations, loans with acceptable

risk as they are predominantly well secured by short-term

assets or, in limited situations, the borrower’s appraised value

of certain fixed assets. Country exposures are monitored and

reported on a regular basis. We actively monitor sovereign

risk, banking system health, and market conditions and adjust

limits as appropriate. We rely on information from internal

and external sources, including international financial

institutions, economists and analysts, industry trade

organizations, rating agencies, econometric data analytical

service providers and geopolitical news analysis services.

Among the regions and nations that PNC monitors, we have

identified five countries for which we are more closely

monitoring their economic and financial situation. The basis

for the increased monitoring includes, but is not limited to,

sovereign debt burden, near term financing risk, political

instability, GDP trends, balance of payments, market

confidence, banking system distress and/or holdings of

stressed sovereign debt. The countries identified are: Greece,

Ireland, Italy, Portugal and Spain (collectively “GIIPS”).

Direct exposure primarily consists of loans, leases, securities,

derivatives, letters of credit and unfunded contractual

commitments with European entities. Indirect exposure arises

where our clients, primarily U.S. entities, appoint PNC as a

letter of credit issuing bank and we elect to assume the joint

probability of default risk. For PNC to incur a loss in these

indirect exposures, both the obligor and the financial

counterparty participating bank would need to default. PNC

assesses both the corporate customers and the participating

banks for counterparty risk and where PNC has found that a

participating bank exposes PNC to unacceptable risk, PNC

will reject the participating bank as an acceptable counterparty

and will ask the corporate customer to find an acceptable

participating bank.

B

USINESS

S

EGMENTS

R

EVIEW

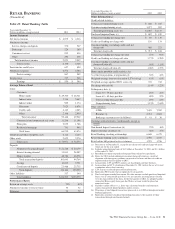

We have six reportable business segments:

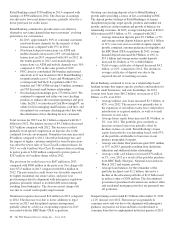

• Retail Banking

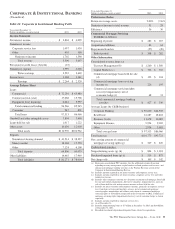

• Corporate & Institutional Banking

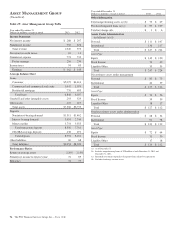

• Asset Management Group

• Residential Mortgage Banking

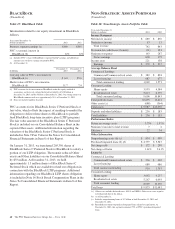

• BlackRock

• Non-Strategic Assets Portfolio

Business segment results, including the basis of presentation

of inter-segment revenues, and a description of each business

are included in Note 26 Segment Reporting included in the

Notes To Consolidated Financial Statements in Item 8 of this

Report. Certain amounts included in this Item 7 and the

Business Segment Highlights in the Executive Summary

section of this Item 7 differ from those amounts shown in

Note 26 primarily due to the presentation in this Financial

Review of business net interest revenue on a taxable-

equivalent basis. Note 26 presents results of businesses for

2013, 2012 and 2011.

50 The PNC Financial Services Group, Inc. – Form 10-K