PNC Bank 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

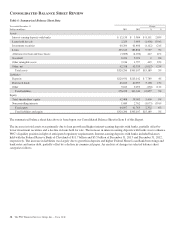

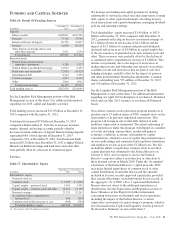

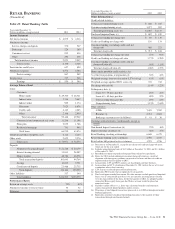

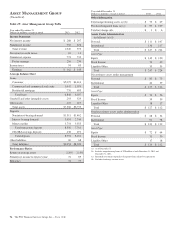

Table 20: Pro forma Transitional Basel III Tier 1 Common

Capital Ratio

Dollars in millions

December 31

2013

Basel I Tier 1 common capital $ 28,484

Less phased-in regulatory capital adjustments:

Basel III quantitative limits (228)

Accumulated other comprehensive income (a) 39

Other intangibles 381

All other adjustments 210

Estimated Basel III Transitional Tier 1 common

capital (with 2014 phase-ins) $ 28,886

Basel I risk-weighted assets calculated as applicable

for 2014 272,321

Pro forma Basel III Transitional Tier 1 common

capital ratio (with 2014 phase-ins) 10.6%

(a) Represents net adjustments related to accumulated other comprehensive income for

available for sale securities and pension and other postretirement benefit plans.

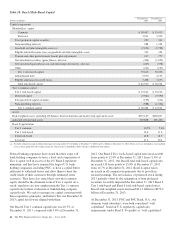

PNC utilizes these fully implemented and transitional Basel

III capital ratios to assess its capital position, including

comparison to similar estimates made by other financial

institutions. These Basel III capital estimates are likely to be

impacted by any additional regulatory guidance, continued

analysis by PNC as to the application of the rules to PNC, and

in the case of ratios calculated using the advanced approaches,

the ongoing evolution, validation and regulatory approval of

PNC’s models integral to the calculation of advanced

approaches risk-weighted assets.

The access to and cost of funding for new business initiatives,

the ability to undertake new business initiatives including

acquisitions, the ability to engage in expanded business

activities, the ability to pay dividends or repurchase shares or

other capital instruments, the level of deposit insurance costs,

and the level and nature of regulatory oversight depend, in

large part, on a financial institution’s capital strength.

We provide additional information regarding enhanced capital

requirements and some of their potential impacts on PNC in

Item 1 Business – Supervision and Regulation, Item 1A Risk

Factors and Note 22 Regulatory Matters in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

O

FF

-B

ALANCE

S

HEET

A

RRANGEMENTS

AND

V

ARIABLE

I

NTEREST

E

NTITIES

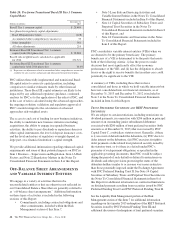

We engage in a variety of activities that involve

unconsolidated entities or that are otherwise not reflected in

our Consolidated Balance Sheet that are generally referred to

as “off-balance sheet arrangements.” Additional information

on these types of activities is included in the following

sections of this Report:

• Commitments, including contractual obligations and

other commitments, included within the Risk

Management section of this Item 7,

• Note 3 Loan Sale and Servicing Activities and

Variable Interest Entities in the Notes To Consolidated

Financial Statements included in Item 8 of this Report,

• Note 14 Capital Securities of Subsidiary Trusts and

Perpetual Trust Securities in the Notes To

Consolidated Financial Statements included in Item 8

of this Report, and

• Note 24 Commitments and Guarantees in the Notes

To Consolidated Financial Statements included in

Item 8 of this Report.

PNC consolidates variable interest entities (VIEs) when we

are deemed to be the primary beneficiary. The primary

beneficiary of a VIE is determined to be the party that meets

both of the following criteria: (i) has the power to make

decisions that most significantly affect the economic

performance of the VIE; and (ii) has the obligation to absorb

losses or the right to receive benefits that in either case could

potentially be significant to the VIE.

A summary of VIEs, including those that we have

consolidated and those in which we hold variable interests but

have not consolidated into our financial statements, as of

December 31, 2013 and December 31, 2012 is included in

Note 3 in the Notes To Consolidated Financial Statements

included in Item 8 of this Report.

T

RUST

P

REFERRED

S

ECURITIES AND

REIT P

REFERRED

S

ECURITIES

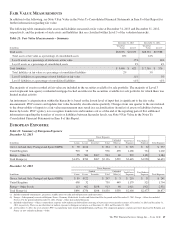

We are subject to certain restrictions, including restrictions on

dividend payments, in connection with $206 million in principal

amount of an outstanding junior subordinated debenture

associated with $200 million of trust preferred securities (both

amounts as of December 31, 2013) that were issued by PNC

Capital Trust C, a subsidiary statutory trust. Generally, if there

is (i) an event of default under the debenture, (ii) PNC elects to

defer interest on the debenture, (iii) PNC exercises its right to

defer payments on the related trust preferred security issued by

the statutory trust, or (iv) there is a default under PNC’s

guarantee of such payment obligations, as specified in the

applicable governing documents, then PNC would be subject

during the period of such default or deferral to restrictions on

dividends and other provisions protecting the status of the

debenture holders similar to or in some ways more restrictive

than those potentially imposed under the Exchange Agreement

with PNC Preferred Funding Trust II. See Note 14 Capital

Securities of Subsidiary Trusts and Perpetual Trust Securities in

the Notes To Consolidated Financial Statements in Item 8 of

this Report for additional information on contractual limitations

on dividend payments resulting from securities issued by PNC

Preferred Funding Trust I and PNC Preferred Funding Trust II.

See the Liquidity Risk Management portion of the Risk

Management section of this Item 7 for additional information

regarding our first quarter 2013 redemption of the REIT Preferred

Securities issued by PNC Preferred Funding Trust III and

additional discussion of redemptions of trust preferred securities.

48 The PNC Financial Services Group, Inc. – Form 10-K